No surprise, war is now a consensus trade:

"Bombing Iran will keep GDP bid through the election"

Where to continue...

Begin with the fact that outside of Tech stocks, global markets have been in a bear market since the January 2018 melt-up, two years ago. As we see below, that melt-up coincided with the high point for S&P 500 new highs.

2018 was roughly a one year bear market, and 2019 was a one year three wave retracement to a lower high. And yet we hear all the time that "global stocks" are at an all time high. It's a load of bullshit. U.S. Tech stocks are at all time highs.

NOTE Nasdaq new highs lower pane. The lower high in lower highs lines up perfectly with the market tops in 2000 and 2007:

Who is ready for currency crisis?

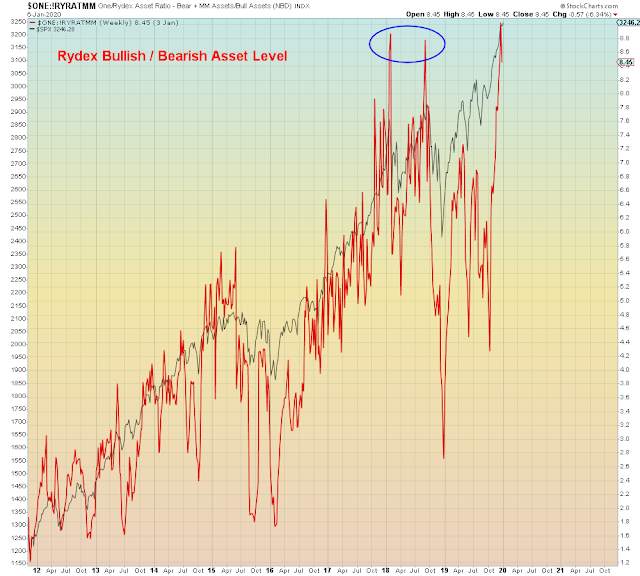

Which of course, is why the crash ratio is so extreme right now:

NOTE Nasdaq new highs lower pane. The lower high in lower highs lines up perfectly with the market tops in 2000 and 2007:

Emerging Markets are rolling over, and the overnight selloffs are getting bought with both hands in the U.S.

Small cap value stocks have gone nowhere for two years straight - these are mostly regional banks and small energy companies. The right shoulder is looking a lot like the left shoulder two years ago:

Bulls should never want to see fracking stocks "leading" the rally as they were today. Because that means it's ending.

The average stock NEVER confirmed the bull market:

A reminder on sentiment AND positioning:

Pharma confirms - the Cheech and Chong high is wearing off, on the right shoulder:

Who is ready for currency crisis?

Bueller?