So many fools today are worried what happens if yields keep rising, that they are ignoring the real risk - what if they don't keep rising? While copious dullards are on the lookout for inflation, they are about to get trucked by deflation. Starting with asset deflation which will bring about uncontrolled economic deflation. Central banks will be powerless to stop it...

I wrote this article in response to this Zerohedge post:

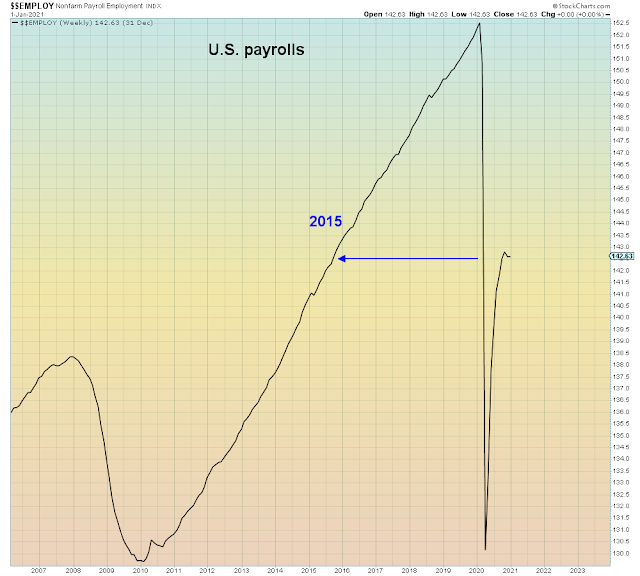

Most pundits today believe that all it takes to create inflation is Fed balance sheet expansion. If that were true then Japan would have extreme hyperinflation by now. The Yen would be worthless. However, despite having the most aggressive QE program in history Japan has been mired in deflation for over thirty years. In addition, the BOJ is Japan's largest stockholder. And yet, the Yen is STILL viewed as the ultimate safe haven, safer than the U.S. dollar. Globalization is inherently deflationary. It's not meant to create middle class wealth, it's intended to monetize the middle class to mint new billionaires. A dubious "capability" that reached record wealth inequality over the past year, in what can only be called the biggest billionaire bailout in history. And yet they STILL don't see the inherent deflation risk in this "system". Nothwithstanding this deflationary track record for forty years straight, deflation remains the least expected outcome on Wall Street.

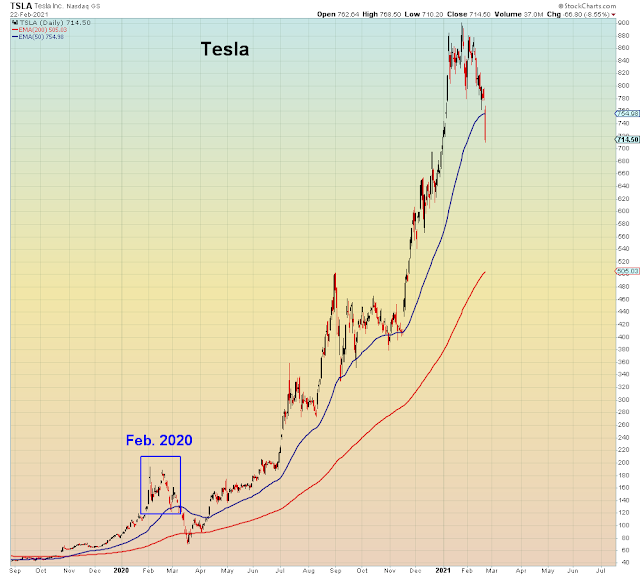

Once again, the reflation trade is the most crowded trade on Wall Street right now. As we see via the graphic above, the consensus belief currently is that the vaccine rollout is leading to inevitable recovery which will accelerate in Q2. In the meantime, the ongoing stimulus is "building a bridge" to full recovery. The reflation narrative assumes that the record asset bubble continues growing unchecked, to infinity. However, in my view the asset bubble is the biggest risk to this fairy tale. When the Dotcom bubble exploded in March 2000, the Fed had 6% of interest rate buffer to cut to offset recession. They used 4.5% of it. This time, the Fed has zero % interest rate buffer. Which means that "stimulus" is entirely dependent upon a fractured Congress who can't agree on anything. Even within the Democrat party, fault lines are now appearing between fiscal moderates and the radical left.

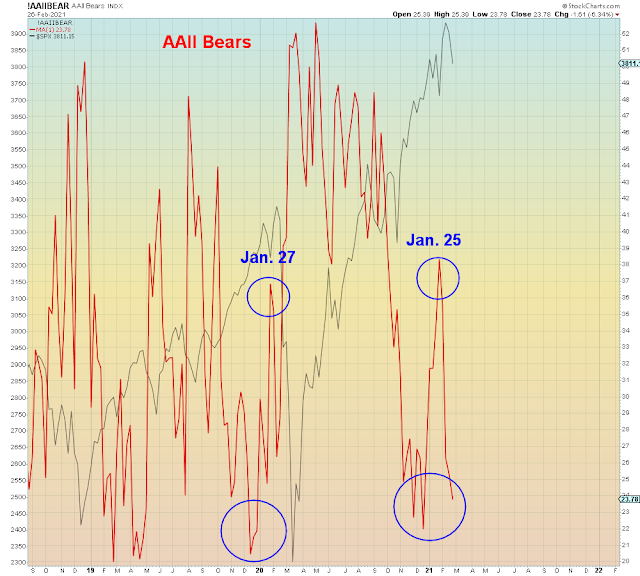

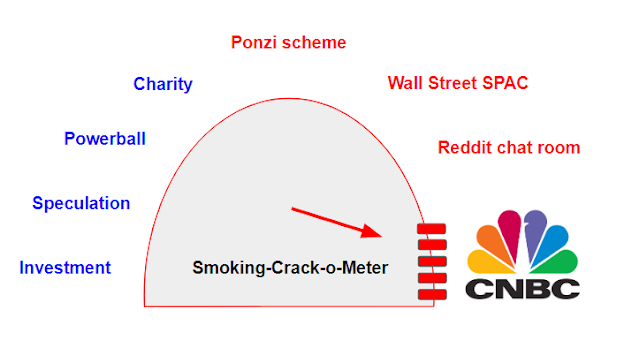

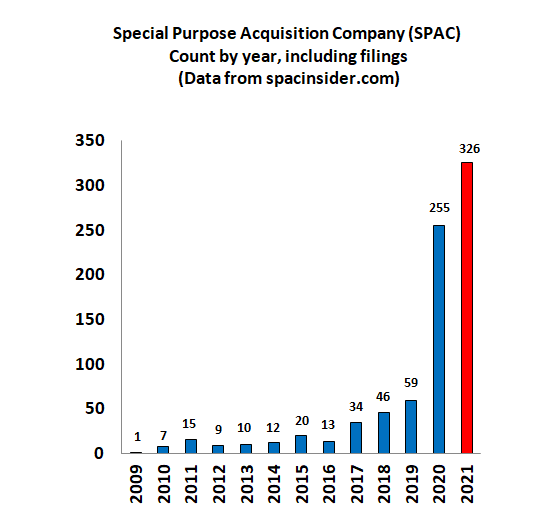

The pandemic has made economic reflation far less possible than it was one year ago before the crash. Post-pandemic, we now face too much unemployment, too much debt, too much corporate insolvency and of course far too much asset speculation. Central banks have ALREADY lost control of risk asset markets, which have been levitating vertically towards a lethally overbought condition. A correlation of "1" in which all unhedged speculators are on the same side of the ultra crowded reflation trade - across stocks, bonds, and currencies. Fittingly, by pushing asset valuations to unprecedented levels, speculators have made their expected outcome far less likely to occur.

Today's pundits who make the least sense are the ones who acknowledge the insane asset bubble AND who predict imminent hyperinflation. Do they not understand what inflation does to interest rates and bond markets? It explodes them. It ends the economic cycle as it has every other time in U.S. history. As it's doing now - reflation continues just long enough to create a credit crisis:

Of course the current back up in yields is minor compared to what we have seen in the past. Only now, yields are back to December 2019 levels, after $7 trillion of combined monetary and fiscal stimulus aka. 30% of the economy.

Here we see the oil market as a proxy for global recovery aka. lack thereof.

The fact that central banks no longer have control over risk markets will soon be evident to even the most stoned of gamblers. They have been fully willing to ignore the risk as long as overall markets were marching higher. When it all explodes lower, they will not be quite as complacent. What took five weeks one year ago to get markets under control will likely take even longer this time. However, the real problem will be economic, as policy-makers won't have the ability to adequately stimulate the over-leveraged economy.

Given all of these risk factors, I currently don't see any serious prospect for sustained reflation on the horizon at this time.

Gold is confirming what I see right now - stoned gamblers chasing risk in the biggest bubble in human history while making up stories about economic reflation to justify asinine valuations. They are reaching for maximum leverage going into an economic depression.

A lot of hot air, just waiting to explode.