First, some perspective:

Emerging Markets are imploding deja vu of VixPlosion 1.0:

The leading (5g) semiconductor stocks are rolling over...

Biotech is imploding, on the right shoulder of the two year market top.

Social mood is done.

Recession stocks are leading

Oil is getting shellacked:

Speculators are ALL IN

Goldman is bullish

Volatility specs are leveraged up:

"A breed of systematic trader acutely sensitive to volatility is charging into U.S. stocks at the kind of pace last seen before “volmageddon” rocked Wall Street almost two years ago."

“If any unpredictable but tiny shock causes a correction in the upward momentum of a U.S. stock price index like the S&P 500, systematic trend-followers are likely to rush into exiting from their current bullish trades simultaneously,”

"It was a tiny yet unpredictable Black Swan event"

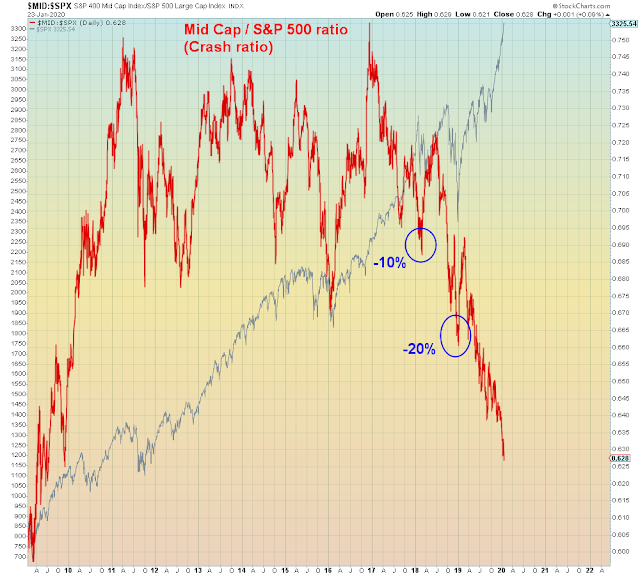

New extreme level in crash ratio:

All systems go