The sheeple at large have lethally conflated an asset hyperinflation bubble for a traditional wage price spiral. They've had ample assistance from those who are more than happy to offload over-valued assets at asinine prices...

This current paradigm is nothing like true inflation as defined by a cost of living wage price spiral. In order to have a wage price spiral, one must have wages increasing at an accelerating rate. Not depressed by mass unemployment. In addition, under true inflation financial assets - stocks and bonds - get destroyed by the reduced discounted value of future payments. Does that sound like this type of inflation? Of course not. This is a lethal asset hyperinflation bubble rotating from one asset class to the next. And the dominoes are falling.

Most articles on Zerohedge are worthless these days, because not unlike the mainstream media, the quality of their content has declined inversely with the growth of their lowest common denominator subscriber base. Nevertheless, this one by The Burning Platform cut through some of the monetary haze surrounding this lethal hyperinflation bubble. The author describes how a condo that languished below 2004 prices for 14 years, suddenly gained 60% in the past two years. Then he talks about the baseball card craze and how small pieces of cardboard are suddenly gaining tens of thousands in "value". Does anyone actually believe there is a shortage of basecall cards? Apparently, the site that values these sports collectibles stopped taking new customers because they've been inundated with new clients eager to value (aka. "sell") their old baseball cards.

Remember a year ago when there was a toilet paper shortage at the beginning of the lockdown period?

The article below is a reminder from March of last year. Several reasons for the shortage are given, but the one that resonates is that panic buying creates more panic buying. In other words, what they are describing is the hoarding mentality that accompanies a TRUE hyperinflationary environment - one in which prices are higher week after week. There is only one problem, the shortage was temporary. If there was true hyperinflation, the cost of toilet paper would be skyrocketing not due to a lack of supply but because the dollar would be collapsing in value.

"Images of empty shelves and shopping carts piled high with supplies have inundated news reports and social feeds. People see images of panic buyers, assume there's a reason to panic and buy up supplies, too"

Of course there was no actual shortage of toilet paper. Manufacturers quickly figured out how to make more of it. In fact, last year's shortage has turned into this year's glut:

One year later:

"Kimberly-Clark Corp. reported a sharp drop in toilet paper sales and warned the coronavirus pandemic-fueled surge in demand for its products was slowing."

The number of assholes keeps growing at an exponential rate, and yet toilet paper demand is slowing. A modern paradox.

Where was I...

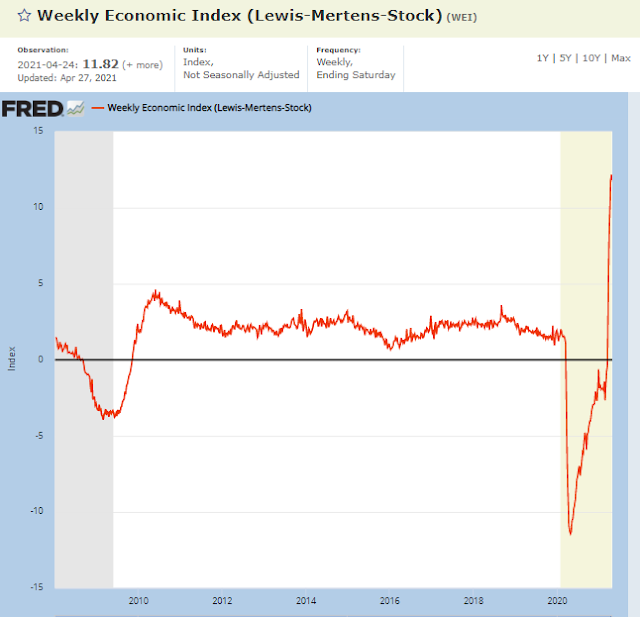

Unlike general price inflation, an asset hyperinflation bubble can implode overnight, destroying asset values. Central banks didn't have to do a thing for Gamestop to implode. Next went Biotechs, Ark ETFs, EV SPACs, Fintechs, Cloud computing etc. Central banks didn't raise interest rates nor change their QE policies in the least.

The toilet paper scenario is a warning of what's coming when this hyperinflation asset bubble fully unwinds - a glut of everything.

Gold, which is the true protection from inflation, is warning that there is no sustainable inflation. Gold started rallying in 2019 when the Fed was cutting rates, but then it ran out of gas last summer. One of the first asset bubbles to roll over. In my opinion it has substantial downside from these levels.

All of these bubbles are predicated on the basis that the dollar is losing its value. Permanently. Which is the fundamental basis behind true hyperinflation.

However, the dollar is merely lurking behind the scenes of the massive margin expansion.

What people forget from last year, is that one of the first order effects of the pandemic crash was that the dollar ripped higher.

We are seeing a very similar headfake pattern play out this year:

When the dollar rips higher, today's assets will become liabilities. At that point, low interest rates won't matter. Only return of principal will matter. There will be a global liquidity crisis unlike anything we've seen in our lifetimes.

Those who are predicting the death of the dollar will get their heads ripped off. Again.