“Money is human happiness in the abstract; and so the man who is no longer capable of enjoying such happiness in the concrete, sets his whole heart on money.”

- Arthur Schopenhauer

One need not wonder why we face a rampant mental and physical health crisis with today's corporate Disney World now entirely at odds with reality. The ad-sponsored false promises propagated by today's corporate Matrix bear inverse correlation to the actual future. But as long as they can keep getting rolled over one quarter at a time, we are told to "believe" in the advertised version of the future.

In no way can this Disney fantasy and its fraudulent assumptions produce inner peace or internal gratification. Quite the opposite, it's intended to create a perpetual desire for "more". A capability this model has fully accomplished. Now featuring a mindless consumption Borg of competitive conformity, with nil chance to find true happiness.

More and more people are turning to Eastern philosophies and practices such as yoga and meditation, in order to fill the black hole of humanity created by the modern lifestyle. This can work at the individual level, but in a disconnected society of narcissistic cyborgs, individual pursuit of zen happiness can only go so far. Islands of inner peace floating in a toxic waste dump of humanity. The full extent of what corporations have destroyed remains well hidden behind the Disney facade of ad-sponsored bullshit and self-medicated fake happiness. The people who propagate this failed way of life themselves scarcely human. Everything is fake now, especially the people.

Which gets us to tomorrow, the busiest day of the year for online dating. Apparently, a lot of single cyborgs make a New Year's resolution to get back out into the Matrix and find a superficially compatible Borg unit:

Which gets us to tomorrow, the busiest day of the year for online dating. Apparently, a lot of single cyborgs make a New Year's resolution to get back out into the Matrix and find a superficially compatible Borg unit:

"If you're single and your New Year's resolution was to rev up the romance, then Sunday, Jan. 5 might be the best day to immerse yourself in dating apps. Dubbed "Dating Sunday" or "Singles Sunday," the superficial holiday is the busiest online dating day of the year...It's the first lonely holiday after the New Year."

I couldn't have said it better myself: A superficial iPhone holiday driven by rampant loneliness in a sea of competitive conformity. No wonder sex robots are flying off the shelves. We have a society that can no longer differentiate between being with a mannequin and being with an iphone zombified human.

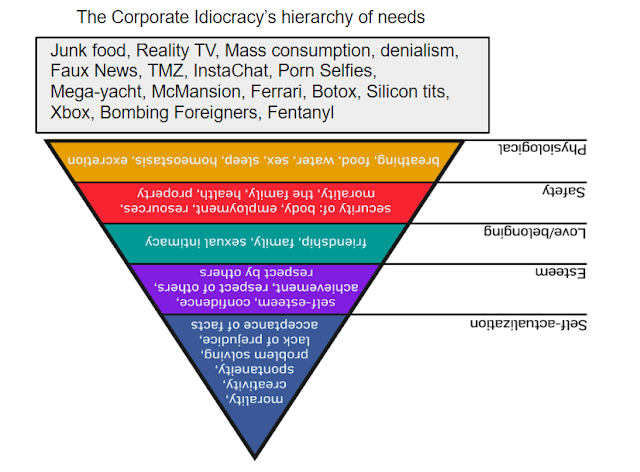

In the Maslow's hierarchy of needs, acceptance of facts is at the top of the pyramid. Whereas today, acceptance of facts and reality doesn't exist. Until these people are capable of facing the truth, nothing will improve.

No surprise, central banks have figured out how to manipulate social mood. Simulated happiness and simulated prosperity are one and the same now. Disney markets are what reassures the Mickey Mouse Club that everything is A-ok.

In the Maslow's hierarchy of needs, acceptance of facts is at the top of the pyramid. Whereas today, acceptance of facts and reality doesn't exist. Until these people are capable of facing the truth, nothing will improve.

No surprise, central banks have figured out how to manipulate social mood. Simulated happiness and simulated prosperity are one and the same now. Disney markets are what reassures the Mickey Mouse Club that everything is A-ok.

Remember back in August when everyone was saying recession is imminent? Google Trends "recession" interest was at a decade high. Well, the Fed fixed that with balance sheet expansion, and the trickle down fake wealth effect:

In August consumer sentiment was at a three year low:

The 10 day call/put options ratio exceeds the left shoulder melt-up and subsequent VixPlosion:

In August consumer sentiment was at a three year low:

The 10 day call/put options ratio exceeds the left shoulder melt-up and subsequent VixPlosion:

Further to the topic of simulated prosperity, recall that the Fed added RECORD amounts of stimulus to calm the overnight repo market into year end. Which is what drove the fourth quarter 2019 melt-up. Stimulus that is now set to roll off in the weeks ahead. Given that these were liquidity operations targeted at short-term assets, they will automatically shrink the Fed balance sheet as they mature, unless the Fed explicitly rolls them over. In other words, deficit-driven quantitative tightening is back, potentially as soon as Monday. Which, corresponds with the first full week of trading in the New Year. Should be interesting to say the least.

Recall on the chart below, January 2016 when Fed tightening blew up global risk markets (S&P -15%), and of course again last December (-20%).

Notice the article doesn't even mention Fed liquidity reduction. The term clueless doesn't begin to describe this society.

Jerome Powell: