I thought I was well stocked up on toilet paper going into this debacle until my daughter came home from college and usage spiked 5,000%. Now I'm starting to panic. I'm not above hoarding from my own family.

It's sad what this society will believe out of sheer desperation. They have been well-conditioned to believe the official narratives and never think for themselves. Now we are seeing the perilous downsides of a society overrun by marketing-driven sociopaths. The U.S. political system has been systematically dumbed down to a popularity contest, now collapsed down to the lowest intellectual denominator called "Trump". We live in a groupthink Borg of obedient corporate zombies seeking affirmation from like-minded fools.

Speaking of leap of fantasy, the new "CARES" act for small business - passed on Friday - is turning into a monumental clusterfuck right now. The goal of the program is to carry small businesses through the virus shutdown. The way it works is that a small business takes a loan to pay their rent and payroll through the crisis and if they retain 90% of their employees, the loan is forgiven at the end. If they don't retain 90% of their employees because the business fails in the meantime, they are saddled with a large debt and a non-existent business. It's Supply Side economics taken to its logical conclusion - unlimited debt for businesses amid non-existent demand.

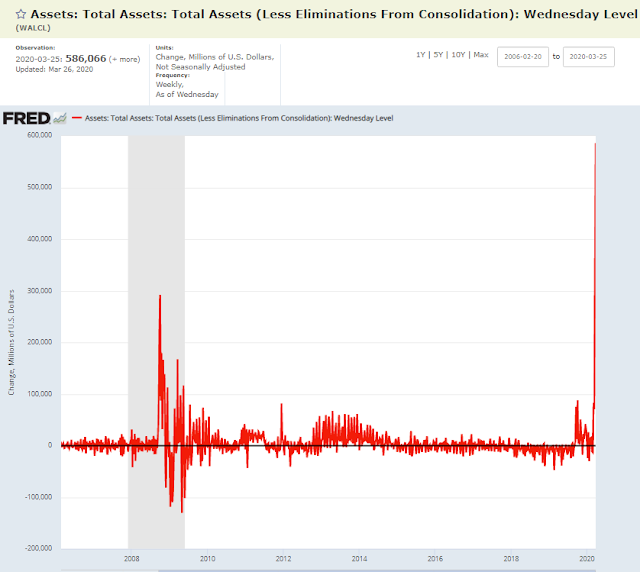

Moving along in bailout utopia, the most lethal delusion now being believed is that the Fed can keep asset prices elevated across the board in every market. While their intrinsic valuations (aka. earnings) collapse to zero:

"The Federal Reserve has unleashed what’s frequently been called a bazooka in its efforts to calm markets. Its next step could be to go nuclear"

Dipping into one of the riskiest parts of the capital markets would have seen like fantasy only a few months ago. But a lot has changed."

I've often used the analogy of bricks - just because someone pays a million dollars for a brick doesn't make every brick in the world worth a million dollars. In order to corner a market and control prices, the central banks would need to buy ALL of the assets not just a part of them. Otherwise, price discovery will continue to be driven by the underlying fundamentals. The rush back into corporate bonds and munis this past week is guided by the delusion that the Fed will now control those markets with small scale liquidity programs.

This path of desperation is well worn - the Bank of Japan owns over HALF of all Japanese ETFs and has expanded their balance sheet more than any other central bank.

Any questions?

The delusion of central banks attempting to corner all markets at the same time brought up a painful memory for me this past week:

In March 1980, forty years ago, at the age of 12 I made the first investing mistake of my lifetime. The Hunt Brothers from Texas were attempting to corner the silver market, and in the event drove the price up several hundred percent. There was a widespread belief in a silver shortage so the public was panic buying silver. I told my Dad I wanted to put ALL of my savings into silver, so he went with me to buy physical silver. The price collapsed one week later.

"On Thursday, March 27, 1980, following the attempt by brothers Nelson Bunker Hunt, William Herbert Hunt and Lamar Hunt to corner the silver market. A subsequent steep fall in silver prices led to panic on commodity and futures exchanges."

Which gets us to now:

“Sales are going through the roof,” Jason Cozens, founder and CEO of Glint told MarketWatch in a telephone interview. “We are breaking records everyday.”

What we are seeing in the gold market is the exact same thing we are seeing with toilet paper - panic buying and virus-related supply chain bottlenecks, fueling more panic buying:

"The current disruption to gold production is tiny (around 1%); more importantly, there are ample above-ground stocks that could be enticed out at a (higher) price."

It's the delusions surrounding gold and every other asset class that are far more lethal. It's this ubiquitous belief that central banks can create "reflation" out of thin air.

"Going forward, gold is bound to benefit from the massive monetary and fiscal stimulus that is extremely inflationary.

"Overall, as day follows night, so inflation follows deflation, and Gold is not waiting around"

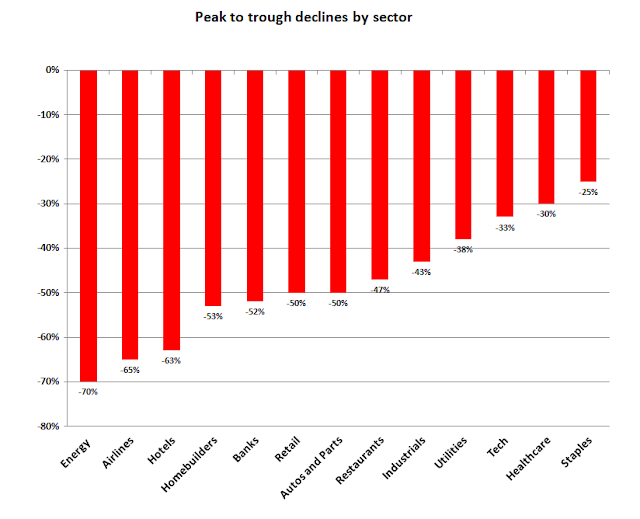

Indeed. Gold gamblers have been front-running central banks for over a year now. You would think that they would eventually clue in to the fact that it's not coming. The roadmap that EVERYONE is using, including the analyst in the above article, is the one vis-a-vis 2008. However, what we saw back then was a -30% drawdown in gold and a very quick retracement in bond yields. Something that isn't going to happen this time with an entire global economy offline at the same time.

Something that has NEVER happened before.

It's all just a leap of fantasy, wholly disconnected from the fundamentals of reality. The economy is shutdown, there is no transmission mechanism for reflation to occur. And yet these fools believe in it anyways.

They are all of the same mind that if enough idiots believe something, then it must be true.

"There's strength in numbers"