Trump's Disneytopian bonfire of the sanities is reaching new heights of incendiary combustion. The old age home is trapped and there is no way out...

Let's see, my 2020 predictions were for mega crash and rioting. So far, so bad.

Cutting through the CNN and Faux News 24 hour bullshit cycle, this protest-turned-riot exposes America's profound wealth inequality. According to the CIA factbook, the U.S. has a gini (inequality) coefficient between Mozambique and Cameroon. Essentially a DEEP Third World level of inequality.

And the right Banana Republican dictator for the job.

Trump was all set to level sanctions on China and Hong Kong when these weekend riots blew up his plans. Let's see, Cuba, Russia, Iran, Turkey, North Korea, now China and Hong Kong. Those countries that are NOT on the sanctions list have either been invaded already or are America's vassal states - I am referring of course to Europe, UK, and Canada. Fully complicit in enabling America's arsenal of hypocrisy. Unfortunately, just when America was about to "fix" the wayward factory slaves with sanctions and starvation, all of HER lies were exposed for the entire world to see. No amount of lamestream bullshit could hide the ugly reality of it all.

Globally, the U.S. and her puppet allies have done far more damage than ALL other countries combined, in the name of "improving" the corporate bottom line.

I'm just saying what history will say about this biblical debauchery that we have the privilege of experiencing in real-time.

AND, the MAGA Kingdom of course is the Disneytopian fantasy to end this entire era. Believed by a brainwashed Twitter Borg stoned on the glue fumes of ancient mythology and total fucking bullshit. Now culminating in a Potemkin economy and a world of false promises foisted on future generations. What to do? Blame the youth for protesting against their inherited fate. Ungrateful bastards.

History will call the Baby Boomers the Disney generation. Full stop. If I had to start my blog all over again by way of defining this MAGA era, I would call it the "steaming pile of dog shit". Because that is exactly what this farce is turning into.

Remember, had this generation not squandered everything including their own health, then this COVID hoax would have passed unnoticed. Much as the Hong Kong flu did in 1968.

But they panicked. Because Mother Nature had them between a rock and a hard place.

But here is where it gets interesting. Imagine a situation in which the anarchists who are infiltrating the protests are EXPECTED to wear a mask covering their face. Because if they didn't they would be deemed "irresponsible". Do you see a problem with that?

In other words, if you go down the street wearing the skull and cross bones on a mask on your way to full scale anarchy, you will attract less attention than walking down the street with your face fully uncovered.

What could go wrong? Bank robbers can stand in line at the bank along with everyone else.

Again, this is not Idiocracy, this is Super Idiocracy.

Getting back to Trump Casino, the S&P futures are now trending higher in direct relation to meltdown. The more the economy implodes, the more gamblers anticipate further dramatic expansion of monetary euthanasia. Which is why the P/E ratio is now infinity.

Whoa, step back. I was told the P/E ratio is 21.50. How do you get infinity?

The P/E ratio is merely Wall Street's magic 8 ball derived metric for deciding whether or not stocks are overvalued. As it turns out, stocks are NEVER overvalued, interestingly. The ratio is current price divided by imaginary forward earnings. Which means in today's terms it's central bank Kool-aid divided by 1930s depression. Which gets us precisely to 21.50. That, and a frontal lobotomy.

Anytime anyone throws out a P/E ratio under these circumstances, it's because they are a confirmed psychopath. At best , there is right now only fantasy and fiction behind these "fundamentals". At worst, there is conflict of interest.

As I write Sunday night, Hong Kong is LEADING the entire world higher as Trump's promise to revoke their all-important special status on Friday was fortunately overshadowed by rioting and looting and end times prophecy coming true in real-time.

Meaning, Donny's gaze has shifted from "CHINA" to his own fucked up backyard. Who to blame now? Joe Biden's son? In Trump's world if you're white and plead guilty (Mike Flynn), you receive a get out of jail free card. If you're black, you're convicted when you leave your house.

This is all making perfect sense in the context of a late stage global empire collapsing like a cheap tent. Clearing the way for reality to once again fill the void of fear.

What will happen in Disney markets this week? No idea. Just realize that when Wall Street's fantasy P/E ratio reaches its maximum extreme divergence between central bank fantasy and economic reality, the crash back to reality will be the most extreme financial event of our lifetimes. Making March look like a picnic.

When Bernankenstein applied MAXIMUM monetary stimulus in October 2008 he figured he had put a bottom in the market. However, when his rally stalled and imploded, he was only off by 5 months and -40% (S&P). I've noticed that Jay Powell put in a call to his mentor in March and it appears that neither one of them have a very good memory.

Sunday, May 31, 2020

Thursday, May 28, 2020

DENIAL IS LETHAL

For the past decade, being an idiot has paid handsomely. The insanity continued just long enough to convince everyone that ignorance is bliss. Now, unfortunately, being a denialistic fool is no longer an asset, it is mass burial. Because hard to believe but in an Idiocracy there is no strength in numbers. Still, it was a good run with an inevitable ending...

Last week, Mitch McConnell was adamant that there would be no more stimulus, because the GOP views stimulus programs to be hindering the re-opening of the economy. However, this week McConnell said more stimulus is likely. Blogging under these conditions of continuous bullshit is challenging at best. The GOP is now in a very difficult situation ahead of the election. More stimulus will only slow the economic re-opening and reduce the economic multiplier. If people are fat and happy at home ordering everything on Amazon they are less likely to go back to work. Whereas a large reduction in stimulus at this point will leave many families exposed to a collapse in incomes. So policy-makers can either pay people to stay at home or they can motivate them to scrounge for jobs that may no longer exist. Either way the economy implodes. However, the stimulus at least gives people a fake sense of security, which is all the Republicans need between now and November. This being an existential election on all sides.

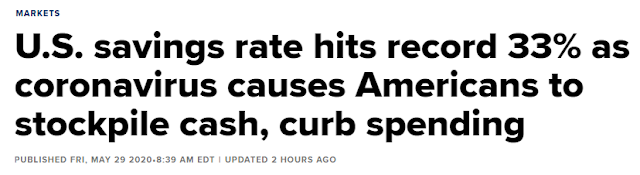

“The paradox of thrift is a negative feedback loop. The more people save, the less they spend; the less they spend, the worse the recession gets; the worse the recession gets the more they save.”

This is the savings rate going back 60 years:

Those who follow Trump to his logical denouement, won't make the return trip. Trump is the past and the past is failure. MAGA is legacy empire recycled for nostalgia sake one more time. But they say: "Trump ran on a platform of neo-isolationism". No he didn't, he is a demagogue who ran on a platform of opportunism and mob mind control. He demanded MORE power than any prior president in U.S. history so he could command and control the entire world on Twitter. Trump is everything that failed about the past - ignorance, arrogance, greed, gluttony, and desecration. Desecrationism is over. And now Mother Nature demands the pound of flesh that is owed, and she will get it, in size. Trump's aged base are between a rock and a hard place: Health versus wealth. However in their minds they are entitled to both.

Which fully explains why the stock market is now held aloft by the stay at home virtual economy bubble, while the real economy implodes in real time. It's the "we can have our cake and eat it too" obligatory delusion. In addition they can surely implode the Chinese while China's imported goods continue to flow to shelves at Walmart uninterrupted.

This week we learned that the "Payroll Protection Program" was a bust.

"...Data from the Small Business Administration shows net weekly PPP lending has actually been negative since mid-May, as fewer firms applied for loans, and some borrowers returned funds"

The money left unborrowed and unspent under the program - represents a lost opportunity. Businesses were supposed to use it to retain workers, but may have been laying them off instead of tapping the money.

Some 38.6 million people have filed for unemployment insurance since the crisis began, and the unemployment rate is expected to near or surpass the 25% record reached in the Great Depression."

Some 38.6 million people have filed for unemployment insurance since the crisis began, and the unemployment rate is expected to near or surpass the 25% record reached in the Great Depression."

From an economic standpoint, the additional stimulus will merely give a false sense of comfort while allowing wholesale carnage to take place in the background. One by one companies are now going bankrupt quietly but steadily. The government can't bailout everyone at the same time and no amount of Fed loans are going to make a difference. As we see above, the PPP small business loan money was not even fully deployed. There is too much risk and economic uncertainty to be taking on more debt under these perilous conditions. Even debt that came with an escape clause was deemed too risky:

For their part, many large companies have already drawn down their credit lines and are now downsizing in order to survive. The dead money sectors of the economy are (mall) retail, autos, travel, entertainment, financials, energy and real estate. Which from an investment standpoint leaves Utilities, toilet paper stocks, big pharma/biotech, Lockheed Martin & Co, and of course the Super Tech bubble. All of which are overvalued.

For their part, many large companies have already drawn down their credit lines and are now downsizing in order to survive. The dead money sectors of the economy are (mall) retail, autos, travel, entertainment, financials, energy and real estate. Which from an investment standpoint leaves Utilities, toilet paper stocks, big pharma/biotech, Lockheed Martin & Co, and of course the Super Tech bubble. All of which are overvalued.

This combined fiscal and monetary election rigging voodoo is lethal to anyone who places their full faith and credit in it. Coronavirus has brought full Japanification to the entire planet. Whereas previously printed money was used to simulate stock market prosperity, now printed money is being used as a proxy for jobs and incomes. When GDP hits zero, economists will be shocked at what they have fabricated. A 100% virtual economy, existing in denialistic fantasy alone.

Today marked another 2 million plus initial unemployment claims, meaning new layoffs, however economists highlighted the reduction in continuing unemployment claims as evidence of economic recovery. Picture the entire U.S. economy having been shutdown for two months and then re-opening last week ahead of Memorial Day. How many people would you predict were called back to work?

Three quarters? Half?

Wrong: 16%: This is the best indicator we have for current period REAL GDP or lack thereof:

Today marked another 2 million plus initial unemployment claims, meaning new layoffs, however economists highlighted the reduction in continuing unemployment claims as evidence of economic recovery. Picture the entire U.S. economy having been shutdown for two months and then re-opening last week ahead of Memorial Day. How many people would you predict were called back to work?

Three quarters? Half?

Wrong: 16%: This is the best indicator we have for current period REAL GDP or lack thereof:

“The paradox of thrift is a negative feedback loop. The more people save, the less they spend; the less they spend, the worse the recession gets; the worse the recession gets the more they save.”

This is the savings rate going back 60 years:

As I've said, when the middle class bailout arrives, everyone is going to be forced to fit their lifestyle inside an average income plus whatever savings they have left and whatever income they can eke out of the obliterated economy. Everything else is on the table now.

I for one am not worried about the future. We've finally turned the corner to start worrying about this planet and people rather than corporate profit. It's been a long time in coming and an exorbitant cost. However, the final tally is far from over. Those who can't make the adjustment from being loyal corporate drone to human being, will find this next phase difficult to say the least.

Eventually the debts will get inflated away and a new currency paradigm will evolve. The dollar's exploding liabilities are far too onerous to ever be repaid. The same is true for most other global fiat currencies. However, in the deflationary phase, currency destruction can take a long time. Just ask the Japanese who now have debt at 238% of GDP. More than double the U.S. figure.

Facing the future is not easy, but this decrepit society has been avoiding reality for too long already. Why can't we all be Japan for the next 30 years? Because Japan was in deflation when the rest of the world was in expansion. Japan benefited from exports to the U.S. and China. The entire world can't all export their way to prosperity in a global depression. Quite the contrary.

Denial and delusion got us this far, but it will be excess baggage for the rest of the journey. Under the new paradigm, less is more. From now on being a denialistic idiot is no longer an asset, it is now a colossal liability.

On Wednesday this week, the Trump Administration warned that passing the proposed Hong Kong Security law would bring hard consequences. Today (Thursday), China passed the new law by a 100% majority. When 2.1 new layoffs were announced, the Dow gapped up 200 points at today's open. Which has been the exact same pattern for six weeks - a Dow rally every time jobless claims rise. Now featuring 40 million souls unemployed.

Trump announced that consequences will be unleashed sometime Friday. Overnight, China announced that once Trump does whatever he is going to do, they are going to retaliate. Which I take as meaning this weekend.

We have now achieved Super Idiocracy. Implode at your own risk.

On Wednesday this week, the Trump Administration warned that passing the proposed Hong Kong Security law would bring hard consequences. Today (Thursday), China passed the new law by a 100% majority. When 2.1 new layoffs were announced, the Dow gapped up 200 points at today's open. Which has been the exact same pattern for six weeks - a Dow rally every time jobless claims rise. Now featuring 40 million souls unemployed.

Trump announced that consequences will be unleashed sometime Friday. Overnight, China announced that once Trump does whatever he is going to do, they are going to retaliate. Which I take as meaning this weekend.

We have now achieved Super Idiocracy. Implode at your own risk.

Wednesday, May 27, 2020

The MAGA Staycation From Reality Is Ending

What comes next is called "Shanghai Surprise". What happens when gamblers bid up their own stocks while pretending to be wealthy...

The confluence of risks that attended the Corona top led to the fastest and most violent crash from all time highs. This one will make that one look like a picnic. Having led the market since the 2016 election, The MAGA stocks are finally imploding...

Overnight tonight (Thursday in Hong Kong), the Chinese congress is widely expected to pass the new controversial Hong Kong security bill essentially eliminating Hong Kong's special status from a civil rights perspective. A move that will very likely prompt the U.S. to do the same, from a trade perspective.

Which would be the "nuclear" option:

"The Trump administration is considering imposing the same tariffs on exports from Hong Kong that it puts on goods from mainland China, according to officials with knowledge of the discussions. That could happen soon after the Chinese government approves the national security law on Thursday."

As usual, my view of this situation is not quite the same as the pablum served on U.S. lamestream news. Some of us may recall the 1997 handover of Hong Kong from Britain to China and the tremendous nationalistic pride in Hong Kong emanating from the liberation from Britain. Fast forward 23 years and the British rule is now the good old days. Hong Kong's "special rights" under the China reunification were supposed to last 50 years, however, only an arrogant fool would believe that Beijing would allow the free-wheeling former colony to retain privileged status for that long. It's amazing it lasted as long as it did. In the meantime, half of Vancouver and Sydney real estate was bought up on the prospect that this day was inevitable. At least now all of those empty condos will have someone actually living in them, instead of being safety deposit boxes in the sky.

If the U.S pulls the trigger on revoking Hong Kong's special trading status, it will very likely trigger global meltdown. Why? Because China's currency has been weakening into the event, and once again global gamblers have been partying like it's 1929. Overlay that with the Chinese stock exodus risk hanging like a Damocles Sword over the Nasdaq which could not come at a more lethal time. Picture a global currency crisis and Mega Tech meltdown at the same time. Smash Crash 2015 x 10.

There is no ETF for the mega cap "MAGA" stocks (Microsoft, Amazon, Google, Apple), however this ETF "O'Shares Giants" does a decent job, brought to us by Mr. Wonderful himself.

Here we see the weekly reversal of fortune:

Short-covering in cyclicals is leading this last gasp rally.

Why shorts are covering ahead of this all important overnight event is not for me to say.

Nevertheless, it's a necessary and sufficient condition to trigger meltdown.

China Tech stocks bounced at the same level as in March:

Now that the economy is "re-opened", the staycation stocks are getting pounded. As of now, there is still no Cramer COVID-19 index, so we can use video game stocks as a proxy:

"China’s offshore yuan tested the weakest level on record on speculation the government would be willing to permit a weaker currency in response to fresh punitive measures from the U.S."

The last time we saw this much short-covering was the last time everyone believed the Fed B.S. had saved the day:

The confluence of risks that attended the Corona top led to the fastest and most violent crash from all time highs. This one will make that one look like a picnic. Having led the market since the 2016 election, The MAGA stocks are finally imploding...

Overnight tonight (Thursday in Hong Kong), the Chinese congress is widely expected to pass the new controversial Hong Kong security bill essentially eliminating Hong Kong's special status from a civil rights perspective. A move that will very likely prompt the U.S. to do the same, from a trade perspective.

Which would be the "nuclear" option:

"The Trump administration is considering imposing the same tariffs on exports from Hong Kong that it puts on goods from mainland China, according to officials with knowledge of the discussions. That could happen soon after the Chinese government approves the national security law on Thursday."

As usual, my view of this situation is not quite the same as the pablum served on U.S. lamestream news. Some of us may recall the 1997 handover of Hong Kong from Britain to China and the tremendous nationalistic pride in Hong Kong emanating from the liberation from Britain. Fast forward 23 years and the British rule is now the good old days. Hong Kong's "special rights" under the China reunification were supposed to last 50 years, however, only an arrogant fool would believe that Beijing would allow the free-wheeling former colony to retain privileged status for that long. It's amazing it lasted as long as it did. In the meantime, half of Vancouver and Sydney real estate was bought up on the prospect that this day was inevitable. At least now all of those empty condos will have someone actually living in them, instead of being safety deposit boxes in the sky.

If the U.S pulls the trigger on revoking Hong Kong's special trading status, it will very likely trigger global meltdown. Why? Because China's currency has been weakening into the event, and once again global gamblers have been partying like it's 1929. Overlay that with the Chinese stock exodus risk hanging like a Damocles Sword over the Nasdaq which could not come at a more lethal time. Picture a global currency crisis and Mega Tech meltdown at the same time. Smash Crash 2015 x 10.

There is no ETF for the mega cap "MAGA" stocks (Microsoft, Amazon, Google, Apple), however this ETF "O'Shares Giants" does a decent job, brought to us by Mr. Wonderful himself.

Here we see the weekly reversal of fortune:

Short-covering in cyclicals is leading this last gasp rally.

Why shorts are covering ahead of this all important overnight event is not for me to say.

Nevertheless, it's a necessary and sufficient condition to trigger meltdown.

China Tech stocks bounced at the same level as in March:

Now that the economy is "re-opened", the staycation stocks are getting pounded. As of now, there is still no Cramer COVID-19 index, so we can use video game stocks as a proxy:

"China’s offshore yuan tested the weakest level on record on speculation the government would be willing to permit a weaker currency in response to fresh punitive measures from the U.S."

The last time we saw this much short-covering was the last time everyone believed the Fed B.S. had saved the day:

Tuesday, May 26, 2020

Insanity Is The "New Normal"

Don't try to fit in...

To successfully navigate these Disney markets we will have to think like an idiot without becoming one. Beware the Stockholm Syndrome. When today's two main investing strategies - dumpster diving and Ponzi scheming both implode at the same time, that is when you get the "big moves" as we saw in March.

In the meantime, just remember one thing - economic meltdown is a hoax. Party on Garth. Party on Wayne.

This COVID shutdown is merely the worst idea coming at the end of decades' worth of ever-worse ideas. An old age home painted into the corner by a life time of bad decisions choosing wealth over health until they had a near death experience and shit a brick. Trump will forever regret his decision to shutdown the U.S. economy. After all, it was merely another indulgent executive order to delight his decrepit Twitter mob. It was a kneejerk reaction that he regretted immediately. And one that will forever be seen as the death knell for American Ponzi capitalism. Too late. Nature pulled a punch and the Idiocracy blinked. I don't care what CNN says, if they had the slightest clue that their Amazon-indulged virtual way of life is already over, they would be panicking right now too. Those on the alt-right warning of economic meltdown are not wrong, they just have ZERO credibility. Too many fake conspiracy theories has rendered this impending meltdown just another hoax to be ignored as the "system" collapses in real-time. For their part, today's EconoDunces, years hence can brag that paying people to borrow money (negative interest rates) was the best idea they had at the time, having systematically exhausted every other dumbfuck idea. First they consigned the developing world to poverty and then they failed the entire developed world as well.

Getting back to Trump Casino, as I've said many times before, insanity is the "new normal". The Great Depression saw 10 bear market rallies - on average one per year. Each time, gamblers believed it was the light at the end of the tunnel, when it was really a freight train screaming towards them. This however, is the most denialistic rally in human history. Not only is the virus still en fuego, but the economy is nowhere near rock bottom. Meanwhile momentum junk is making new highs.

I've also said many times that the stock market exists solely for insider share dumping and IPO moonshots, - which happens to be insider share dumping as well. This past week, the crap-laden IPO index made a new all time high, as the virtual economy bubble went manic. And, what to do but start launching new IPOs again. Yes, you read that right, Wall Street launched a new IPO, and it was a moonshoot at that:

"Inari Medical posted pricing terms on May 18th for its IPO: 7.3 million shares at $14 to $16 each...The deal was [final] priced after the close on Thursday: 8.2 million shares at $19 each. That’s right. Bankers upsized the deal and priced it above the high end of its new price range. The IPO started trading Friday at $41.30 and closed at $42.51, up 123.7 percent from its IPO price."

To be more accurate, the stock closed 200% above the original $14 term sheet price.

Here we see the overall IPO index as of mid-day Monday. Making a key reversal of fortune on the daily:

As I was saying, each rally will look more specious than the last which means that bearish sentiment will rise over time from today's still-denialistic levels. However, central banks will do their best to ensure that valuations remain fully disconnected from reality. Which means that the market will remain uninvestable from a long-term perspective. In the meantime, the bearish consensus will grow and the bear market rallies will become more brutal with each leg lower. Something we have to expect going forward. When we ride the rallies higher, we have to make sure they reach full glue sniffing mode before we bail. Otherwise we will get out far too early. On the downside, when the neighbours are bearish, then it's time to rent stocks again. Rinse and repeat.

It appears as of Monday, that we are watching a major capitulation rally as weak handed bears got mowed down with a 600 Dow point open after the long weekend. However, the Nasdaq is starting to roll over.

Which means that the 1930 trade war rally is reaching its apex.

Zooming out on the S&P 500 we see a very familiar pattern emerging. A bear rinse at the 200 day and then re-test of the two month low.

The rest of the world took the Memorial Day holiday as a chance to catch up with U.S. delusion. Kindly delaying overnight risk until U.S. stay-at-home gamblers were back on line. So they could watch their self-implosion in real-time.

Speaking of stay-at-home gamblers, this site RobinTrack tracks the stock positions of gamblers using the Robinhood app. Many of whom are newbies to online trading. As you can see from the leaderboard, the largest among neophyte gamblers is Ford.

The people using this app and most people in general get their investment ideas from chat rooms and other like-minded neophytes. Essentially, it's a circle jerk of like-minded dunces, not unlike MAGA itself.

Of all the bellwether stocks I track on my most bearish list, Ford happens to be at the top of the list. Because it's tracing out a three wave correction at the EXACT same level as post-Lehman. Which means that a lot of people on Robinhood are about to explode:

In summary, the market is a value trap. Meaning that there is no value in this market and therefore bottom fishing collapsing sectors amid rampant denialistic bullshit is a great way to self-implode. What is keeping this economy from rebounding any time soon is lingering COVID fear, social distancing, and a byzantine clusterfuck of re-opening by-laws and rules that vary from locality to locality. Ironically the much heralded vaccine won't help much because the faster it's developed, the less it will be trusted. The "anti-vax" movement is about to go mainstream. Geezers are between a rock and a hard place, and young people are already breaking the rules, still not sure why they were in forced celibacy mode in the first place. Clearly a conspiracy of parents.

All of which is why from a casino standpoint, the only asset class left is "Momentum" - which operates per the greater theory of investing: Everyone expecting a greater fool to come along, until they inevitably realize the greatest fool is the one in the mirror.

When these two strategies - dumpster diving and Ponzi scheming - both implode at the same time, that is when you get the BIG index moves to the downside. As we saw in March and as we will see again now.

Gamble at your own risk.

To successfully navigate these Disney markets we will have to think like an idiot without becoming one. Beware the Stockholm Syndrome. When today's two main investing strategies - dumpster diving and Ponzi scheming both implode at the same time, that is when you get the "big moves" as we saw in March.

In the meantime, just remember one thing - economic meltdown is a hoax. Party on Garth. Party on Wayne.

This COVID shutdown is merely the worst idea coming at the end of decades' worth of ever-worse ideas. An old age home painted into the corner by a life time of bad decisions choosing wealth over health until they had a near death experience and shit a brick. Trump will forever regret his decision to shutdown the U.S. economy. After all, it was merely another indulgent executive order to delight his decrepit Twitter mob. It was a kneejerk reaction that he regretted immediately. And one that will forever be seen as the death knell for American Ponzi capitalism. Too late. Nature pulled a punch and the Idiocracy blinked. I don't care what CNN says, if they had the slightest clue that their Amazon-indulged virtual way of life is already over, they would be panicking right now too. Those on the alt-right warning of economic meltdown are not wrong, they just have ZERO credibility. Too many fake conspiracy theories has rendered this impending meltdown just another hoax to be ignored as the "system" collapses in real-time. For their part, today's EconoDunces, years hence can brag that paying people to borrow money (negative interest rates) was the best idea they had at the time, having systematically exhausted every other dumbfuck idea. First they consigned the developing world to poverty and then they failed the entire developed world as well.

Getting back to Trump Casino, as I've said many times before, insanity is the "new normal". The Great Depression saw 10 bear market rallies - on average one per year. Each time, gamblers believed it was the light at the end of the tunnel, when it was really a freight train screaming towards them. This however, is the most denialistic rally in human history. Not only is the virus still en fuego, but the economy is nowhere near rock bottom. Meanwhile momentum junk is making new highs.

I've also said many times that the stock market exists solely for insider share dumping and IPO moonshots, - which happens to be insider share dumping as well. This past week, the crap-laden IPO index made a new all time high, as the virtual economy bubble went manic. And, what to do but start launching new IPOs again. Yes, you read that right, Wall Street launched a new IPO, and it was a moonshoot at that:

"Inari Medical posted pricing terms on May 18th for its IPO: 7.3 million shares at $14 to $16 each...The deal was [final] priced after the close on Thursday: 8.2 million shares at $19 each. That’s right. Bankers upsized the deal and priced it above the high end of its new price range. The IPO started trading Friday at $41.30 and closed at $42.51, up 123.7 percent from its IPO price."

To be more accurate, the stock closed 200% above the original $14 term sheet price.

Here we see the overall IPO index as of mid-day Monday. Making a key reversal of fortune on the daily:

As I was saying, each rally will look more specious than the last which means that bearish sentiment will rise over time from today's still-denialistic levels. However, central banks will do their best to ensure that valuations remain fully disconnected from reality. Which means that the market will remain uninvestable from a long-term perspective. In the meantime, the bearish consensus will grow and the bear market rallies will become more brutal with each leg lower. Something we have to expect going forward. When we ride the rallies higher, we have to make sure they reach full glue sniffing mode before we bail. Otherwise we will get out far too early. On the downside, when the neighbours are bearish, then it's time to rent stocks again. Rinse and repeat.

It appears as of Monday, that we are watching a major capitulation rally as weak handed bears got mowed down with a 600 Dow point open after the long weekend. However, the Nasdaq is starting to roll over.

Which means that the 1930 trade war rally is reaching its apex.

Zooming out on the S&P 500 we see a very familiar pattern emerging. A bear rinse at the 200 day and then re-test of the two month low.

The rest of the world took the Memorial Day holiday as a chance to catch up with U.S. delusion. Kindly delaying overnight risk until U.S. stay-at-home gamblers were back on line. So they could watch their self-implosion in real-time.

The people using this app and most people in general get their investment ideas from chat rooms and other like-minded neophytes. Essentially, it's a circle jerk of like-minded dunces, not unlike MAGA itself.

Of all the bellwether stocks I track on my most bearish list, Ford happens to be at the top of the list. Because it's tracing out a three wave correction at the EXACT same level as post-Lehman. Which means that a lot of people on Robinhood are about to explode:

In summary, the market is a value trap. Meaning that there is no value in this market and therefore bottom fishing collapsing sectors amid rampant denialistic bullshit is a great way to self-implode. What is keeping this economy from rebounding any time soon is lingering COVID fear, social distancing, and a byzantine clusterfuck of re-opening by-laws and rules that vary from locality to locality. Ironically the much heralded vaccine won't help much because the faster it's developed, the less it will be trusted. The "anti-vax" movement is about to go mainstream. Geezers are between a rock and a hard place, and young people are already breaking the rules, still not sure why they were in forced celibacy mode in the first place. Clearly a conspiracy of parents.

All of which is why from a casino standpoint, the only asset class left is "Momentum" - which operates per the greater theory of investing: Everyone expecting a greater fool to come along, until they inevitably realize the greatest fool is the one in the mirror.

When these two strategies - dumpster diving and Ponzi scheming - both implode at the same time, that is when you get the BIG index moves to the downside. As we saw in March and as we will see again now.

Gamble at your own risk.

Saturday, May 23, 2020

The Dumbfuck Money Bubble. See It, Or Be It.

Carbon has collapsed, wealth inequality is next...

Speculation is running rampant as to what's next? Gamblers are using money printed stimulus checks to bid up the virtual economy bubble while the real economy explodes in broad daylight. The mainstream economists now sniffing monetary glue are today's "experts" while those of us who question this insanity are locked in a padded cell while the inmates run the asylum...

Is it immoral to monetize idiots? I don't know, but I'm taking my chances.

I'm having great difficulty blogging these days, because my rage collapsed in line with the carbon reduction. I've never experienced writer's block previously, and no amount of alcohol is helping this time, whereas previously it was jet fuel on the bonfire. I'm becoming fat and happy - everything I hate about this world. I now regard blogging as an affront to the Creator for having delivered everything I/we asked for - A generational paradigm shift in real time. The biggest shift in 100 years. All paid for in carbon.

Granted, we all have skin in this game now. We all know too many friends and family who are card carrying members of the Corporate Borg. The groupthink circle jerk of idiots now in manic overdrive.

Picture a scenario in which no matter how ludicrous the economic divide becomes, today's EconoDunces STILL evince full faith in money printing. Imagine stay-at-home gamblers using stimulus money to bid up their own portfolios. And imagine central banksters vowing to "do whatever it takes" to drive a ever-larger gap between asset valuations and the real economy. What more can they do other than to administer MORE monetary euthanasia? The American Dream has now morphed into the American glue sniffing contest.

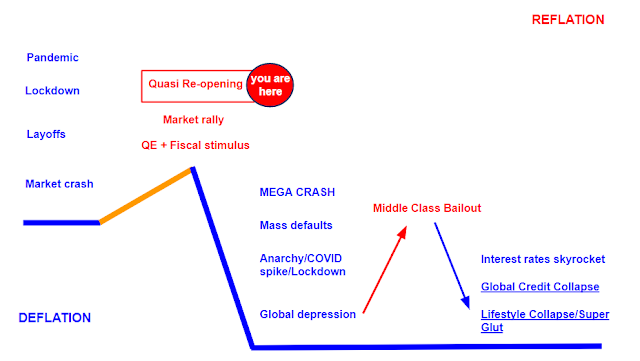

This past week, I vowed to stay off Zerohedge - what I consider financial crack cocaine. I was doing so well until this weekend, and then I caved and became my usual unhinged when I came across this article predicting hyperinflation.

This article follows the typical fake news formula - a handful of loss leader facts to lure the reader in, a specious narrative, and a pre-ordained conclusion. I can't rebut all of it, however, it was so specious that it inadvertently made me realize that my hyper-bearish prediction is not bearish enough. I came to realize that these money printing morons at global central banks can't create anything approaching reflation any time soon. Therefore I created a new economic model to indicate why any expectation of reflation has been pushed back by months, if not years. My new hyper-bearishness comes down to the fact that asset crash will bring about a collapse in investment AND a collapse in household leverage. The highest income households that are far above the median income will fall the hardest, in a total reverse of what has happened over the past decades, the wealthy elite will implode.

The middle class bailout will collapse lifestyles down to the median income. There will be a glut of everything, but mostly cars and McMansions.

The article draws a straight line between central bank money printing and hyperinflation. Not even ONE mention of COVID, and no mention of the socially distanced economic multiplier. No mention of Japan and their 30 year experiment with printed money, all leading to extreme deflation.

Sophomoric garbage at best.

A casual glance at reflation and the Fed balance sheet indicates that there is no straight line between monetary expansion and reflation.

This past week, the NYSE delisted JC Penney.

It's time for the casino class to realize that the stock market is NOT more important than the 'Conomy.

Make no mistake, this is the biggest dumbfuck money bubble in human history, without any comparison.

Speculation is running rampant as to what's next? Gamblers are using money printed stimulus checks to bid up the virtual economy bubble while the real economy explodes in broad daylight. The mainstream economists now sniffing monetary glue are today's "experts" while those of us who question this insanity are locked in a padded cell while the inmates run the asylum...

Is it immoral to monetize idiots? I don't know, but I'm taking my chances.

I'm having great difficulty blogging these days, because my rage collapsed in line with the carbon reduction. I've never experienced writer's block previously, and no amount of alcohol is helping this time, whereas previously it was jet fuel on the bonfire. I'm becoming fat and happy - everything I hate about this world. I now regard blogging as an affront to the Creator for having delivered everything I/we asked for - A generational paradigm shift in real time. The biggest shift in 100 years. All paid for in carbon.

Granted, we all have skin in this game now. We all know too many friends and family who are card carrying members of the Corporate Borg. The groupthink circle jerk of idiots now in manic overdrive.

Picture a scenario in which no matter how ludicrous the economic divide becomes, today's EconoDunces STILL evince full faith in money printing. Imagine stay-at-home gamblers using stimulus money to bid up their own portfolios. And imagine central banksters vowing to "do whatever it takes" to drive a ever-larger gap between asset valuations and the real economy. What more can they do other than to administer MORE monetary euthanasia? The American Dream has now morphed into the American glue sniffing contest.

This past week, I vowed to stay off Zerohedge - what I consider financial crack cocaine. I was doing so well until this weekend, and then I caved and became my usual unhinged when I came across this article predicting hyperinflation.

This article follows the typical fake news formula - a handful of loss leader facts to lure the reader in, a specious narrative, and a pre-ordained conclusion. I can't rebut all of it, however, it was so specious that it inadvertently made me realize that my hyper-bearish prediction is not bearish enough. I came to realize that these money printing morons at global central banks can't create anything approaching reflation any time soon. Therefore I created a new economic model to indicate why any expectation of reflation has been pushed back by months, if not years. My new hyper-bearishness comes down to the fact that asset crash will bring about a collapse in investment AND a collapse in household leverage. The highest income households that are far above the median income will fall the hardest, in a total reverse of what has happened over the past decades, the wealthy elite will implode.

The middle class bailout will collapse lifestyles down to the median income. There will be a glut of everything, but mostly cars and McMansions.

The article draws a straight line between central bank money printing and hyperinflation. Not even ONE mention of COVID, and no mention of the socially distanced economic multiplier. No mention of Japan and their 30 year experiment with printed money, all leading to extreme deflation.

Sophomoric garbage at best.

A casual glance at reflation and the Fed balance sheet indicates that there is no straight line between monetary expansion and reflation.

This past week, the NYSE delisted JC Penney.

It's time for the casino class to realize that the stock market is NOT more important than the 'Conomy.

Make no mistake, this is the biggest dumbfuck money bubble in human history, without any comparison.

Friday, May 22, 2020

Now For The REAL Meltdown

Central bank actions gave gamblers a last chance to get out, before the REAL crash...

The bailout for the wealthy is complete. Implosion may now resume.

"Let them eat stocks"

It portends ominously ahead of a three day long weekend in the U.S. that the S&P is once again camped on the 200 day moving average. As we see at the February top, the first wave down (i) exploded through both the 50 day and the 200 day moving average. Now of course, the moving averages are reversed due to the death cross that took place back in March.

After the close Friday:

U.S. Gamblers have been chasing risk all week ahead of the long weekend.

Complacency is extreme:

"Securities trading was among the most common uses for the government stimulus checks in nearly every income bracket"

The coronavirus rout brought a copious amount of new accounts to online brokers in the first quarter"

“The rush of retail investors into U.S. equities is at least partly a function of a world with no casinos, no sports betting to speak of, and little to do outside the home,” DataTrek co-founder Nick Colas said. “The dopamine rush of a full house is the same as holding a hat-sized stock into an up 3% open on the S&P.”

Now we know where the stimulus went - guns and stocks. Where else?

Outside is America

Treasury issuance:

Tech is in a rising wedge and when it breaks volatility will explode. Stop losses will be hit.

ETFs will implode.

Amazon had a massive key reversal late this week:

Retail cash balances have now reached a new record low

Dual-listed Chinese Tech stocks are getting obliterated in multiple time zones ahead of the impending trade war escalation AND potential MASS U.S. exchange delistings. Baidu is the first major Chinese company to consider delisting in the U.S.

"According to ChinaLawBlog.com, a service of law firm Harris Bricken, "the likelihood that the Chinese government will comply with this demand is at most two percent." And assuming China does not comply, that means that "all Chinese companies currently listed on the U.S. markets will be delisted and no future listings from Chinese companies will be permitted on the U.S. markets."

The Wall Street Journal, which calls HFCA a "nuclear option," notes that passage of the law "would require the SEC to prohibit trading in any shares" that fail to meet the law's requirements -- which is to say, potentially all Chinese stocks. Nasdaq says passage could "torch" the value of "around $1.8 trillion" worth of Chinese stock, which would no longer be nearly as easy to trade in the U.S. "

CNBC: Bill That Could Delist Chinese Companies Is Moving At Warp Speed Through Congress

The equal weight S&P peaked three weeks ago:

This virtual "rally" is 100% virtual economy

Gasoline demand remains our best real-time proxy for the REAL economy; however, demand fell week over week and is currently down -28% year over year. Which is interesting because this is the first week when every state took steps towards re-opening.

https://www.eia.gov/petroleum/weekly/index.php

Somewhere along the road to reopening:

The central bank Jedi Mind trick is wearing off:

This next leg down will not test liquidity, it will test solvency.

"On the first day of China’s biggest political event of the year, Xi Jinping sent a clear message to Donald Trump: We’re going to do what we want in Hong Kong, and we’re not scared of the consequences."

China refrained from setting an economic growth target for the first time in decades, triggered immediate calls for fresh protests and sent the MSCI Hong Kong index to its worst loss since 2008."

Trump Administration Warns New Security Law Will End Hong Kong's Special Trading Status

The bailout for the wealthy is complete. Implosion may now resume.

"Let them eat stocks"

It portends ominously ahead of a three day long weekend in the U.S. that the S&P is once again camped on the 200 day moving average. As we see at the February top, the first wave down (i) exploded through both the 50 day and the 200 day moving average. Now of course, the moving averages are reversed due to the death cross that took place back in March.

After the close Friday:

U.S. Gamblers have been chasing risk all week ahead of the long weekend.

Complacency is extreme:

"Securities trading was among the most common uses for the government stimulus checks in nearly every income bracket"

The coronavirus rout brought a copious amount of new accounts to online brokers in the first quarter"

“The rush of retail investors into U.S. equities is at least partly a function of a world with no casinos, no sports betting to speak of, and little to do outside the home,” DataTrek co-founder Nick Colas said. “The dopamine rush of a full house is the same as holding a hat-sized stock into an up 3% open on the S&P.”

Now we know where the stimulus went - guns and stocks. Where else?

Outside is America

Treasury issuance:

Tech is in a rising wedge and when it breaks volatility will explode. Stop losses will be hit.

ETFs will implode.

Amazon had a massive key reversal late this week:

Retail cash balances have now reached a new record low

Dual-listed Chinese Tech stocks are getting obliterated in multiple time zones ahead of the impending trade war escalation AND potential MASS U.S. exchange delistings. Baidu is the first major Chinese company to consider delisting in the U.S.

"According to ChinaLawBlog.com, a service of law firm Harris Bricken, "the likelihood that the Chinese government will comply with this demand is at most two percent." And assuming China does not comply, that means that "all Chinese companies currently listed on the U.S. markets will be delisted and no future listings from Chinese companies will be permitted on the U.S. markets."

The Wall Street Journal, which calls HFCA a "nuclear option," notes that passage of the law "would require the SEC to prohibit trading in any shares" that fail to meet the law's requirements -- which is to say, potentially all Chinese stocks. Nasdaq says passage could "torch" the value of "around $1.8 trillion" worth of Chinese stock, which would no longer be nearly as easy to trade in the U.S. "

CNBC: Bill That Could Delist Chinese Companies Is Moving At Warp Speed Through Congress

The equal weight S&P peaked three weeks ago:

This virtual "rally" is 100% virtual economy

Gasoline demand remains our best real-time proxy for the REAL economy; however, demand fell week over week and is currently down -28% year over year. Which is interesting because this is the first week when every state took steps towards re-opening.

https://www.eia.gov/petroleum/weekly/index.php

Somewhere along the road to reopening:

The central bank Jedi Mind trick is wearing off:

This next leg down will not test liquidity, it will test solvency.

"On the first day of China’s biggest political event of the year, Xi Jinping sent a clear message to Donald Trump: We’re going to do what we want in Hong Kong, and we’re not scared of the consequences."

China refrained from setting an economic growth target for the first time in decades, triggered immediate calls for fresh protests and sent the MSCI Hong Kong index to its worst loss since 2008."

Trump Administration Warns New Security Law Will End Hong Kong's Special Trading Status

Thursday, May 21, 2020

You Can't Warn Zombies. I've Tried.

Have you ever tried to save someone who didn't want to be saved? Of course you have...

Corporations spend $250 billion per year brainwashing sheeple. For that sum, they expect a substantial return on investment. And they get one. The Lonely Crowd long ago anticipated the rise of a mindless corporate Borg wholly incapable of thinking for themselves. Competitive consumption addicts drifting unmoored in a sea of nihilism, evaluating right and wrong based upon what every other competitive moron is doing. A school of minnows, easy prey for sociopathic sharks.

My futile goal while in the grocery store is to avoid being monetized by a multinational food processor for fun and profit. Have you ever noticed that the healthy items in the store are never on sale, and the boxed crap always gives a discount at checkout? We live in a country that incentivizes unhealthy lifestyles while at the same time making healthcare less and less affordable to the people who can't afford healthy food.

Think about it. Those who do the back breaking work in this country have the least healthy diets and the least access to healthcare. Hiding exploitation behind a facade of superficial corporate generosity has become an overriding marketing theme in this country. It's not "virtue signaling" as the alt-right claims, it's far worse, it's token virtue. Token acts of kindness to ignore the chasmic gaps in the safety net, that are swallowing families whole. Charitable spectacle. And it's just as much the modus operandi on the far right, as it is on the far left.

The story of this week was a guy who refused to wear a mask in Costco. He claimed he "woke up in a free country". Woke is an interesting choice of words, because that's what alt-right nutjobs call outraged libtards, "Woke". It's a synonym for virtue signaling, intended to denote someone with a superficial concern for right and wrong. It speaks volumes that the alt-right automatically presumes that everyone is equally debased. The term cynical itself means to assume that everyone is equally debauched. Who has more motive to assume that everyone is equally corrupt than those who are profoundly corrupt?

Nevertheless, this drone in Costco didn't wake up in a free country. He woke up in a country controlled by corporations. Opinions on social media were largely in favour of the store manager who turfed the unmasked bandit from the store. However, plenty of people sympathized with his plight. I see both sides: A man fighting back against de facto mob oppression. And a man who is somehow unaware of the fact that he was long ago assimilated by the corporate Borg. From the machine's perspective this guy was no more interesting than a dying trout flopping around on the dock.

Zooming out to the historical perspective, none of this COVID theater of the absurd is a conspiracy, and none of it is going according to "plan".

The human species has always had a need to play god and thereby to pretend to exert control over the incalculable numbers of variables that affect our lives. It works for a while - if only because ANYTHING can work for a while. And then it all explodes. The greater the illusion of control, the larger the meltdown. Nassim Taleb wrote an entire book about "fragility" and the apparent inability of humans to control universal chaos. He concluded that the end result of ever-encroaching sclerotic control is a society wholly unable to handle adversity, creating a veil of Potemkin fragility that is ultimately pierced and then shattered. Voila.

I can condense Taleb's entire book down to one sentence:

We are not God.

I've said it before, this COVID pandemonium could have been avoided if we had a healthy population, but we don't. Toxic frankenfood has poisoned the human race. Add in vaping, binge drinking, xbox addiction, porn addiction, TV addiction, social media addiction, opioids, and big pharma to round out the myriad of toxic corporate vectors that have made this virus lethal.

We live in a human toxic waste dump.

And we can't save those who are addicted to corporate servitude.

Freedom is a choice.

Wednesday, May 20, 2020

Buy And Explode

This is the second COVIDIOT top in three months. For the second time since the global pandemic began, gamblers are about to learn that printed money is NOT the secret to effortless wealth. But who knew?

The 1930s analog is right on track, as Herbert Hoover is falling back on his signature election-rigging strategy:

There are no long-term investments on the face of this planet. Everything is now a dumb money trade - Look around to figure out where the dumb money is heading, get in first and get out before the stampede. Is this unethical? Only if you are one of the psychopaths counseling buy and explode. As I've said, the casino is going to trade in a wide Japanified range for years to come. Which means buy the dips and sell the rips.

There are several dumb money bubbles taking place right now - some of which I comment on regularly.

The 1930s analog is right on track, as Herbert Hoover is falling back on his signature election-rigging strategy:

There are no long-term investments on the face of this planet. Everything is now a dumb money trade - Look around to figure out where the dumb money is heading, get in first and get out before the stampede. Is this unethical? Only if you are one of the psychopaths counseling buy and explode. As I've said, the casino is going to trade in a wide Japanified range for years to come. Which means buy the dips and sell the rips.

Just like Suze Orman:

Orman in her own account buys the dips and sells the rips while recommending that everyone else dollar cost average into a depression. Warren Buffett gives the same advice - buy and hold index funds for the long-term. However, right now he is sitting on RECORD cash. Both are intrinsically using the same strategy: buy low, sell high. The sheeple who buy and hold just happen to be the bagholders on the other side of their trades. It's the perfect system.

Looking at the S&P 500, we can see that this rally started running out of glue fumes several weeks ago. Recently it's been levitated by fewer and fewer over-crowded bubble stocks.

Having made two unsuccessful attempts to close above the 200 dma, Skynet just rinsed the bears above the 200 day at wave ('2'), the exact same way as at wave (ii):

Here is year-to-date performance by major market sector. As we see, only Tech has been moving higher for the past month:

There are several dumb money bubbles taking place right now - some of which I comment on regularly.

One bubble that has really taken off in the past week is the junk Biotech rally which is predicated upon the theory that every revenueless Biotech stock will invent the first COVID vaccine:

Among the companies going parabolic is Novavax which was at $4 per share at the beginning of this year and hit $61 yesterday:

Of course video games are on fire as a generation of boy-men have figured out they now have a new "career" playing xBox.

I would point out that this mega Tech bubble is now a global rally, led by eCommerce "stay at home" stocks.

Pop goes the bubble:

Pop goes the bubble:

Silver confirms that precious metals are about to get monkey hammered. Gold (futures) peaked April 14th, although the gold stocks have been making new highs.

I would be remiss if I did not show the central bank managed internet index again, chock full of the "big names"

Here we see the VIX back-testing the 200 day with the internet index in the background.

I think we all see where I'm going with this:

One thing you have to have in any pandemic is lots of guns

Now we know where all of the stimulus money went:

Now we know where all of the stimulus money went:

Here we see that options risk exposure is similar on the right shoulder as it was on the left:

In summary, the 1930s analog is right on track. This week, the U.S. made moves to implode Huawei, to increase scrutiny of Chinese-listed companies, and to fan the flames in Taiwan.

All moves to get China to react and therefore invite further trade sanctions.

As it was in May 1930, this rebound rally was just enough to embolden policy-makers to do something really stupid:

All moves to get China to react and therefore invite further trade sanctions.

As it was in May 1930, this rebound rally was just enough to embolden policy-makers to do something really stupid:

Subscribe to:

Posts (Atom)