After more than a decade of monetary Japanification topped off with four years of Circus Donny, one thing we've learned with certainty is that an aging society can no longer accept the truth...

The World's handling of this pandemic has been all wrong from the start. Trump's handling of it was the worst in the world. I seldom agree with Bill Gates, but he has said from the start that testing was key to keeping the economy open. He was spot on. However, Trump in his infinite denialism put all of his eggs in the vaccine basket. And many people believed it would be a silver bullet panacea. Even now, with Pfizer's most recent 90% efficacy indication, it won't prevent the winter from hell. What it will do however, is allow people to let their guard down and assume the pandemic is ending. Which will increase the spread further.

As Gates has said, if we had focused our efforts on instant testing, most of the economy would be back open by now. However, denialists don't like testing because it "causes" the case load to skyrocket. Which looks bad for Trump. Denialism strikes again.

Which gets us to the casino and the 2008 paradigm.

People forget that there were many false dawns in that fateful Autumn leading into winter. The largest rallies are always in bear markets, which caused a lot of people to assume the worst was over.

The last false dawn was a fake reflation rally that put a massive bid under cyclicals and in particular small cap value stocks which had been beaten down the most. Nevertheless, like all things Wall Street, it was an ephemeral end of cycle blow-off top. Bought and believed by the majority, solely due to the misallocation of capital and short-covering.

Last week starting on election eve, Wall Street put on a massive Tech trade and shorted the Russell 2000 under the auspice of the Goldilocks gridlock trade.

Now all we are seeing is that trade get monkey hammered due to one vaccine headline. In Disney markets consensus trades are lethal.

Zooming in to this year's view, Regional banks are leading this last rally amid a familiar spike in bond yields. June was the mid-point of the rally and this is the end:

Due to mass delusion, most people today are of the brainwashed belief that this economy is stronger than the one in 2008:

"Joe Biden is returning to the White House to lead the United States in the midst of an economic crisis after beating President Donald Trump in Tuesday’s election, a turn of events likely to conjure an eerie sense of deja vu for the Democratic former vice president."

Unlike in 2008, when the country elected Democrat Barack Obama and his running mate Biden as the global economy teetered from the sub-prime mortgage crisis and collapse of the Lehman Brothers investment bank, the worst of the current economic downturn may have passed already, economists and analysts say."

Got that? The worst is over.

There is literally no basis to compare today's imploded economy to the one in 2008. Today, there are millions more unemployed than at the peak in 2009. Today, combined fiscal and monetary stimulus is DOUBLE what it was in 2008.

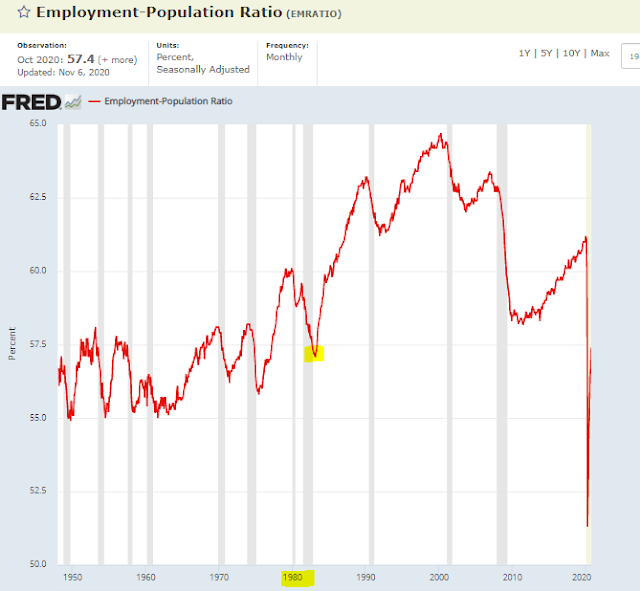

Here we see the employment/population ratio is at the lowest level in four decades. Large companies are crushing small business, and society is ignoring the consequences.

Oil demand is a good proxy for economic activity. This economy just lost three decades of oil demand.

Emerging Markets peaked almost three years ago near the beginning of the MAGA fantasy. Now they are soaring back on the belief that the worst is over.

When in reality, the worst hasn't even started yet.

EMs are a good proxy for global social mood, which is three wave corrective:

In summary, we have a v-shaped recovery in delusion. Wall Street is like every other American Dream factory - Disneyland, Hollywood, Faux News - it's 100% fraudulent. And yet people accept the lies over and over again.

Right now, we are watching the final capitulation to fantasy. A movie some of us remember, and most want to forget.