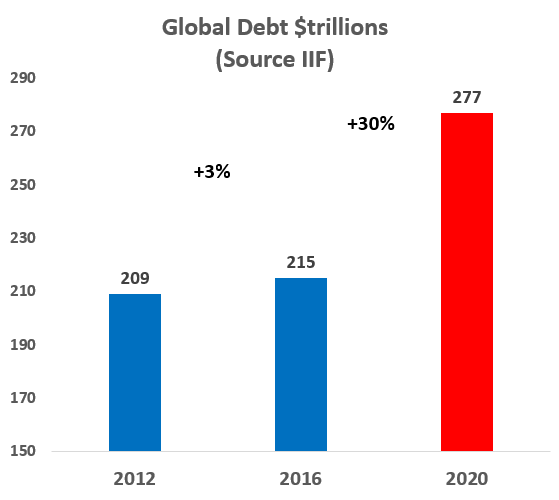

For over a decade straight global central banks held interest rates at record lows to buy time to borrow our way out of the 2008 debt crisis. The net effect of course was a colossal increase in global debt that has accelerated 10x during "MAGA":

"However, the coronavirus pandemic is not the sole factor to blame for the massive level of global debt.

“The pace of global debt accumulation has been unprecedented since 2016"

Economists never question what all of this debt means for the long-term economy. Of course it's deflationary, however, far worse, it portends mass corporate bankruptcy on an epic scale.

This week I am staying at a Doubletree hotel which is part of the Hilton brand of hotels. I've stayed in this particular hotel many times over the years, but I've noticed the hotel has become very dilapidated since COVID began. The hotel is currently half staffed and the large neon DoubleTree sign at the top of the hotel is only half lit. So technically I am staying at the Double Hotel. This hotel is illustrative of what is taking place across the economy. Going into this pandemic, companies had gorged on a decade worth of cheap debt. Which they used to buy back stock and to invest in "growth". This year's emergency borrowings are going solely to keep the lights on until normalcy returns. They are making zero new investment.

Which means that the assets on their balance sheet are rapidly depreciating while their debts are skyrocketing, which is destroying their shareholder equity. These companies are ticking time bombs. For example, Hilton has a negative book value (shareholder equity) of -$4.77.

Since the election there has been a MASSIVE rotation into the cyclical sectors, under the auspice that it's finally time for value to outperform. Investors are looking past the short-term COVID spike to the "return to normal" when COVID subsides. However on the other side of this disaster these companies will be zombie corporations, at the mercy of their debtholders. The travel and leisure sector could take decades to return to 2019 peak activity level. Which means there is a decade worth of over-investment that needs to be rationalized across hotels, airlines, rental cars, mall retail, and of course the fossil fuel sector. Ground zero for over-investment in long-term losses.

Today's economics establishment never considered the long-term deleterious impacts that low interest rates would have on future growth. Essentially these low interest rates pulled forward decades of investment into a low demand environment. Deflation created more deflation. Many people are quick to blame central banks for keeping interest rates low. However, central banks can't hold interest rates low in a truly reflationary environment. Bonds are priced off of forward reflation expectations. The true cause of low interest rates are Third World imports. The U.S. has been mass importing deflation via low priced imports. Which means the U.S. is essentially importing poverty in order to create prosperity. A death spiral of collapsing demand now featuring companies borrowing money to stave off bankrutpcy. Under COVID, the U.S. has achieved a 100% virtual economy. Growing poverty has been well disguised by the global asset bubble. Which is why the "cycle" can never end. This must be the first time in world history wherein the debt accumulation cycle lasts forever. Growing to infinity.

Normally, higher interest rates end the debt accumulation cycle. However, in 2008 it was mass subprime defaults that ended the cycle. The same thing will be true now. Mass corporate defaults will explode the infinity credit bubble. And when that happens there will be a glut of everything: Hotels, jet airliners, homes, cars, boats, expensive colleges, gold bars, and overpaid economists.