Over the past 12 years stoned gamblers became addicted to monetary heroin. Over that time, the dumbest money enjoyed the biggest (unrealized) gains, until there was no smart money left to find. COVID ended that paradigm; unfortunately there's no one left to get the memo. Now there is universal belief that printed money is the secret to effortless wealth. Because everyone knows that 7 billion morons can't be wrong...

What was astonishing on election eve via the futures market was the MASSIVE rotation to the monetary heroin (QE) trade and the simultaneous dumping of the reflation trade, as the blue wave got priced out. The Nasdaq 100 and the Russell 2000 were polar opposites of green and red. It was the exact reverse of four years ago when Trump got elected and the reflation bid was put on in size.

Below we see via the Nasdaq futures that the election rally came at the mid-point of the three wave rally:

This week, the Nasdaq 100 returned to the same level from two weeks ago at the blue wave high.

Year to date, the Nasdaq 100 has seen the largest inflows in two decades:

What happened that night of course was the story of the week, and the year:

"A strange thing happened on the way to the biggest post-election surge in modern stock-market history. On Wednesday, while the S&P 500 was tacking on $600 billion of fresh value, most of its members fell.

How the index still managed to gain so much altitude is the story of the week and of the year: a reigning oligarchy of market behemoths, soaring past everything else"

...it was the first time in at least six decades that the S&P 500 jumped more than 2% as more volume flowed into declining securities than advancing ones on the New York Stock Exchange"

Here on a weekly chart we see that the virtual economy was down for the two weeks prior to the election. And then enjoyed the largest up volume EVER this past week. And yet the index (ETF) never made a new high:

Rotation into an imploding Tech bubble is only part of the bull trap that took place this week.

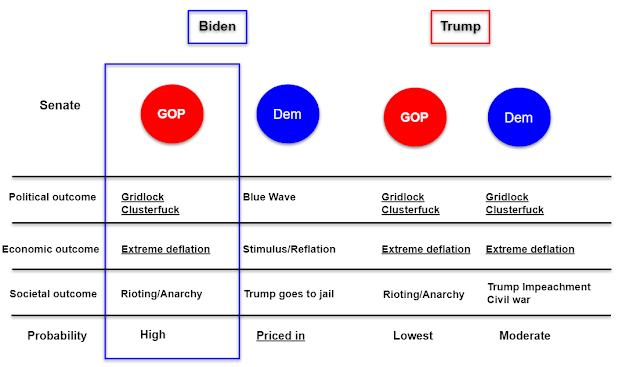

Prior to the election, along with every other pundit, I posited the various election scenarios. Going in, the blue wave was priced in. However, I gave this current gridlock SNAFU a probability of "high". I said the outcome would be deflationary and rioting would be pending the end of stimulus.

Nevertheless, Wall Street being what it is - an asset allocation machine with a bedtime story to follow, has rotated to the QE asset reflation narrative in size. Zerohedge does a great job of explaining the new narrative, while questioning absolutely none of it. How could something that worked so well for over a decade, fail now? Won't the stock market diverge from the economy forever?

When the usual people go under the bus, that's "Goldilocks" in Wall Street parlance. Because the only people who get bailed out in this economy are the criminals who collapse the financial system.

Gold exhibits everything that is wrong with the policy of monetary euthanasia - we have an imploding economy and ubiquitous belief in free money. Gold ETFs have seen record inflows during 2020. The abiding belief is that as long as the monetary spigots are open, gold can't go down. Here we see that from 2009 to August 2011 gold rose along with Treasury reflation expectations. However, when Treasury yields rolled over, gold followed. The QE in 2013 had no effect on reversing gold's downtrend. Fast forward to now and we see that gold gamblers have been front-running reflation for two years now, going back to October 2018.

It's a very crowded asset allocation rally aka. a greater fool's rally.

It should come as no surprise that gold peaked when the stimulus ended in July. Since that time, amid record inflows it has trended lower, until this week:

Meanwhile we already got news that the stimulus impasse we've enjoyed since the end of July is already set to continue:

Those who are wed to their trades and to groupthink narratives will never make it through this impending gauntlet. First they will hide out in mega bubbles that are perceived safe havens, then when those implode they will rotate to cash just when the real money printing gets started. Applying the standard lessons of the past decade will be lethal.

This generation is way overdue a good hard lesson in basic economics. The cost of this deflationary oppression has been falling on the working class every day since 2008, while the Casino class has been enjoying non-stop asset reflation. There is only one way to fix the problem.

Return to the origin, sans bailout.

Base case scenario.