Kind of like this "good and easy to win" trade war, that is now totally out of control. Trump will be seen as the president whose entire administration was based upon false promises, superficial gestures, and incessant bullshit. Supported by a loyal base not having even slightest clue this is all heading for implosion. To say that history won't be kind, is an asinine understatement.

"It's all coming together now"

Speaking of no way out, it appears that gamblers haven't given a lot of thought as to what happens AFTER the fake trade deal is reached. The new "best case scenario" for markets in the China trade war is "no deal"...

"The U.S. and China have tried to salvage a potential “phase one” trade agreement, a deal that would involve Chinese purchases of U.S. agriculture first announced in October. The sides have failed to sign a partial deal."

In other words, this year will most likely be a repeat of last year's December G20 "truce", except at a higher level of tariffs. One year of non-stop bullshit to go nowhere.

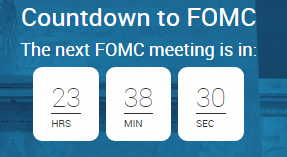

So far, markets are muted during this "FOMC Drift" period aka. the "best 24 hours of the year". However, there is reason to believe that the rally into this all-important "trade deal" has reached its terminus.

The primary U.S. beneficiary of the no new tariffs "none deal" is the technology hardware complex including Apple:

"The Dec. 15 deadline for the U.S. to levy a 15 percent tariff on about $160 billion of Chinese goods, including smartphones, laptops, electronics and clothes, is Sunday. The tariffs would be the first direct blow to the tech industry, which has been relatively insulated from the trade dispute."

One can make the case that the "good news" is priced in. This rally is essentially identically to last year's:

"The good news is, no news. Now buy "stocks""

Chinese stocks, identical to last year's fake truce:

Among the sectors that won't appreciate the good news regarding the endless trade war, are the stocks assuming this would all be over by now:

Industrials

Transports

A full year of Dow Theory non-confirmation:

$USDJPY RISK OFF has preceded every selloff in the past two years:

aka. "Overnight risk"

Then there's this bit of good news waiting on Thursday in the UK:

Somehow, what was limit down news for the pound and S&P futures in 2016 at the Brexit vote, is now "good news".

Again, one can make the argument that all of the "good news" is priced in, since it wasn't good news in the first place.