"My whole life is a bet on you Donny"

As always, this does not constitute financial advice. Nevertheless, I wouldn't share these opinions to a large following; a problem of no concern right now. And therein lies the opportunity. Because there has never been a better time to monetize the stampeding herd. There has NEVER been such a chasmic gap between fantasy and reality. And for that we can thank the GOP echo chamber of like-minded fools. Human history's biggest circle jerk.

Republican sentiment based on the stock market reached an all time high just as Rydex cash balances reached an all time low. Coincidence? I don't think so. Gamblers buying up their own assets while pretending to be wealthy.

From a contrarian standpoint, this is the perfect set-up:

Now, how to maximize profit.

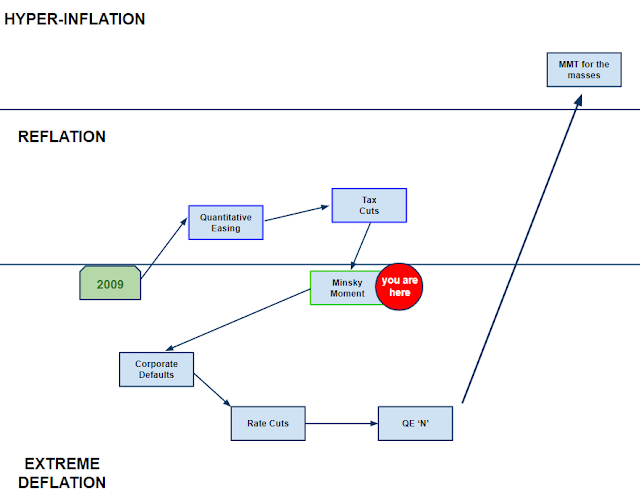

The sole reason valuations haven't mattered for most of the past decade, is because we've been in a central bank sponsored bubble for most of the past decade. All of the various price/earnings multiples, market cap/GDP ratios haven't mattered to date. Those things WILL matter enormously when the bubble bursts and there is no one on the other side of the trade. At that point, the divergence between price and "value" will be closed. The hard way.

I've made no secret that I am always long brick shitting volatility. However, I don't see that as being the best opportunity that this situation presents. Albeit the most imminent one.

There is still very little or no concern for deflation despite a decade of almost non-stop deflation. Central banks have been battling deflation constantly, and yet investors still seem to expect massive inflation. In other words, faith in central banks is complete.

Here we see going back 15 years that interest in the search term "inflation" has far exceeded "deflation".

Which shows how economically challenged this society is right now. Deflation is by far the greatest MACRO threat of our lifetimes - battled for a decade straight with tens of trillions of printed money, still of no mainstream concern.

YET.

The market crash to come will be enormously deflationary. It will "reset" asset values far below the attendant liabilities. We know what that means. Instantaneous insolvency.

Central banks will panic react of course, however, this time the effect on asset prices will be muted. By politics.

This time, there will be no consensus around a bailout for Goldman Sachs. Which will cause even more market panic.

Meanwhile, deficits will explode, soaking up even more liquidity from markets. Making it difficult for central banks to get risk markets under control.

Then the rioting, protests so forth and so on. The term "safe haven" will be put to the ultimate test.

Normally, the ideal set-up for gold.

And yet, we see that gold gamblers have already jumped the gun. Making it another consensus trade which is now exposed to coincident margin calls. Gamblers forced to sell one thing to meet margin on another.

When today's current cabal of groupthink gold lovers get wiped out, I will consider a gold rental.

Here we see the big rally in gold circa 2008-2011 occurred during a reflationary period. Whereas now we see gold is three wave corrective since 2016 and this latest leg up has been assuming imminent reflation.

There will be no reflation until there is a change in "ideology" with respect to who gets access to the free money. Which is going to require some amount of "dislocation" first.

When today's current cabal of groupthink gold lovers get wiped out, I will consider a gold rental.

Here we see the big rally in gold circa 2008-2011 occurred during a reflationary period. Whereas now we see gold is three wave corrective since 2016 and this latest leg up has been assuming imminent reflation.

There will be no reflation until there is a change in "ideology" with respect to who gets access to the free money. Which is going to require some amount of "dislocation" first.