Now that our trusted psychopaths have created the largest combined fiscal and monetary thermonuclear bomb in history, it's time to take it for a spin:

At some point in all of this madness, there will be a real buying opportunity for a decent bounce lasting more than a few days, however, I am not of the mind that this bailout was the missed chance. What is missing from a tradeable bottom is capitulation and panic. So far the decline has been very orderly, albeit on heavy volume. It was more of a machine selloff, while humans bought the dip. The VIX only spiked because hedgers reached for S&P put protection, however, the TRIN (sell pressure) never spiked. Meanwhile, as we know, the heavy selling never reached Tech.

In this next phase down, I predict panic emanating overnight from Emerging Markets, which received no bailout. Throughout this first leg down, the S&P futures were limit down at least five times overnight. More times limit down in three weeks than in thirty years.

Now, the casino is nine months overbought compliments of the largest sugar rally since 1931. Which by the way was near the beginning of the Great Depression. The way they write these headlines, you would think that was something to celebrate. The Dow didn't final bottom until March 1932, down -90% from the top.

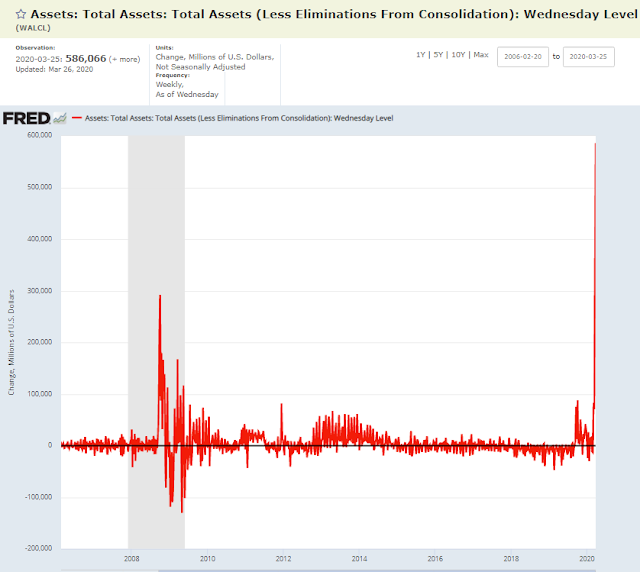

Leaving the fiscal package aside, which just got signed and will take weeks and months to take effect, THIS was the real stimulus behind this week's sugar rally:

$1 trillion of monetary stimulus in two weeks:

One thing we know is that the economic data will continue to worsen week by the week. Gamblers will be told to look across the Grand Canyon and look forward to the light at the end of the tunnel - the freight train of deflation coming straight at them. From an economic data standpoint, the waters will be murky enough to give plausible deniability to today's perpetual denialists. For the majority who have staked their future on studied ignorance, their final implosion will merely be business as usual.

Retail Closures Set To Explode

Retail Closures Set To Explode

Short-term the market could bounce around at these levels, however a "re-test" of the recent low is inevitable.

Here we see the NYSE Composite vis-a-vis 2008:

Here is where it gets interesting.

Semiconductors are rolling over deja vu of the last big stimulus bounce three weeks ago:

We are looking for an NYSE breadth thrust of the likes that occurred at other major trading lows:

I don't trust the bond market right now. The Fed started buying investment grade bonds this week, but they are only taking up to 20% of the market. Which means that bond prices will trade based upon ubiquitous downgrades, which will be coming hard and heavy in the coming weeks. Much of what is considered investment grade will very soon be downgraded to junk and hence outside of Fed purview.

This week, Ford Motor and Delta Airlines among many others were downgraded to junk. Which means that the companies that need help the most, are SOL:

"The Fed’s measures don’t extend help to those companies with credit ratings below investment-grade, leaving a $1 trillion market of highly leveraged issuers without aid"

WTI crude oil is on the verge of cracking $20 this coming week:

Social mood is turning down, and the key support for stocks just disappeared:

NYT: The Stock Buyback Binge Is Over

"Over the weekend, as Congress worked to fashion a $1.8 trillion stimulus package for the economy, President Trump lent his support to provisions in the bill meant to block companies that receive federal money from using it to buy back shares."

Buyback activity will slow dramatically, both for political and practical reasons,” Goldman Sachs stock market analysts wrote in a research note published on Monday."

In summary, this "bailout" is 100% bullshit short-covering sugar rally.

The new TARP was just signed.

Any questions?