Full disclosure, I just re-loaded my short gold via put options through April 17th, until I cash out, or until they close the casino. Whichever comes first. We heard the exact same arguments in favor of owning gold two weeks ago but I ignored them in favour of a 10x profit. Now gold has round tripped back to the recent highs. Offering another fat pitch. The only concern I have is that they will shutdown Trump Casino.

Zerohedge: Gold Is Like Toilet Paper. If You Don't Have Any, You Will Be Very Unhappy

Where to begin. First off, physical gold IS like toilet paper - there is a short-term shortage, however in the longer-term there is a glut hanging over the market in the form of jewelry. A mere trickle of what is soon to come.

February 29th, 2020:

"Over the last few weeks, gold buyers have seen a frantic push by individuals racing to sell their little-used jewelry in the U.S. and Europe amid worries that the extraordinary price rally fueled by the coronavirus since the start of the year may soon run its course."

For those who own physical gold for the long-term, this will be the fantastic buying opportunity of a lifetime. A chance to keep averaging down lower and lower. I view gold to be the ULTIMATE belief in central bank alchemy. And of course I have absolutely ZERO faith in central banks' ability to solve this crisis. To understand my prediction for gold is to understand my entire economic hypothesis of impending extreme deflation.

It's ironic that this last stage gold rally is occurring amid the backdrop of a severe dollar shortage worldwide. One that has been well documented on Zerohedge. It's a known fact that gold trades inverse to the dollar and that very same negative correlation has been intact for the past several weeks. In other words, a bet on gold here is a bet that the Fed has the dollar liquidity crisis under control. They don't. It's about to get 10x worse, as Emerging Market currencies explode in every direction.

But, it's the gold technicals where things get really interesting:

Here we see gold on a weekly basis. The chart shows that gold is three wave corrective off of the 2011 all time high. We also see that gold volatility is extreme right now. A trip back to these key support levels will give physical gold buyers plenty of opportunity to average down. Which according to Zerohedge is what they want:

Zerohedge: Gold Is Like Toilet Paper. If You Don't Have Any, You Will Be Very Unhappy

Where to begin. First off, physical gold IS like toilet paper - there is a short-term shortage, however in the longer-term there is a glut hanging over the market in the form of jewelry. A mere trickle of what is soon to come.

February 29th, 2020:

"Over the last few weeks, gold buyers have seen a frantic push by individuals racing to sell their little-used jewelry in the U.S. and Europe amid worries that the extraordinary price rally fueled by the coronavirus since the start of the year may soon run its course."

For those who own physical gold for the long-term, this will be the fantastic buying opportunity of a lifetime. A chance to keep averaging down lower and lower. I view gold to be the ULTIMATE belief in central bank alchemy. And of course I have absolutely ZERO faith in central banks' ability to solve this crisis. To understand my prediction for gold is to understand my entire economic hypothesis of impending extreme deflation.

It's ironic that this last stage gold rally is occurring amid the backdrop of a severe dollar shortage worldwide. One that has been well documented on Zerohedge. It's a known fact that gold trades inverse to the dollar and that very same negative correlation has been intact for the past several weeks. In other words, a bet on gold here is a bet that the Fed has the dollar liquidity crisis under control. They don't. It's about to get 10x worse, as Emerging Market currencies explode in every direction.

But, it's the gold technicals where things get really interesting:

Gold tanked in early March and then found a bottom last Monday (March 16th) following the Fed's QE announcement. Just as I said three weeks ago, it's a supremely crowded trade based on futures net specs, record ETF inflows, and of course non-top Zerohedge bullshit. Recall that the selloff two weeks ago was attributed to over-leveraged gamblers forced to sell gold to meet Tesla margin calls. A mere hint at what is about to come.

Here we see gold on a weekly basis. The chart shows that gold is three wave corrective off of the 2011 all time high. We also see that gold volatility is extreme right now. A trip back to these key support levels will give physical gold buyers plenty of opportunity to average down. Which according to Zerohedge is what they want:

I have three criteria before I will be a buyer of gold:

1) All of the highly leveraged weak hands get margined out. Zerohedge stops spamming me with gold ads

2) The credit markets final explode under the weight of crushing defaults, bringing about extreme deflation

3) Policy-makers stop bailing out corporations and begin to consider serious middle class heli money. Something only Bernie Sanders has suggested to date.

Getting back to Trump Casino, having predicted Super Crash in real-time, nevertheless, for the first time in a very long time, I am becoming neutral on my market opinion. I still believe it will go much lower, however, my trademark hyper-bearishness has abated for some reason. I think it has something to do with the collapsed carbon levels.

That said, the raw facts point to an impending super explosion lower in Emerging Markets which are sans bailout and evidencing greater dollar financing strains by the minute. In my opinion this latest S&P rally lasted just long enough to get more dolts onboard for the ride lower.

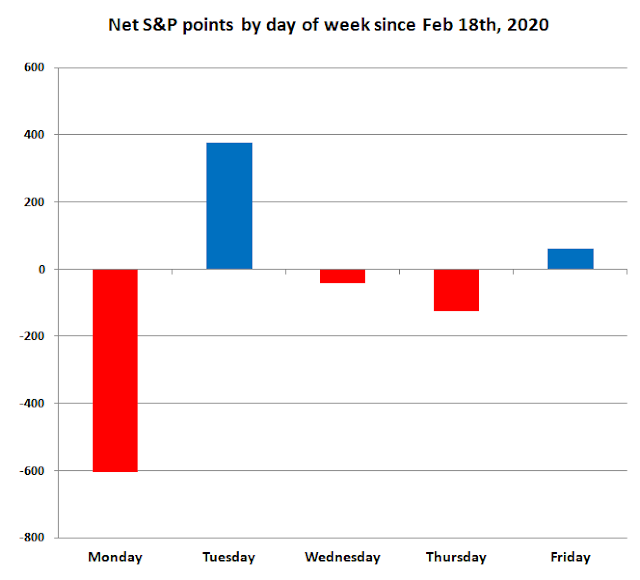

On the topic of today's Super Tuesday rally, I would note that the peak Casino high water mark of every week since this Super Crash began was Tuesday. This is not a prediction, merely an observation:

In summary, I hope everyone has enough toilet paper for what comes next. Because you never want to wipe your ass with a gold bar.