Bulls are now trapped in no man's land praying for a central bank bailout. Sadly, central banks and other known psychopaths got them into the bubble, but they can't get them out of a bubble that is imploding in real-time. All talk to the contrary is purely self-motivated delusion by gamblers who know they are trapped. And whose efforts this past week to buy themselves out of a crash failed miserably. But not for lack of trying.

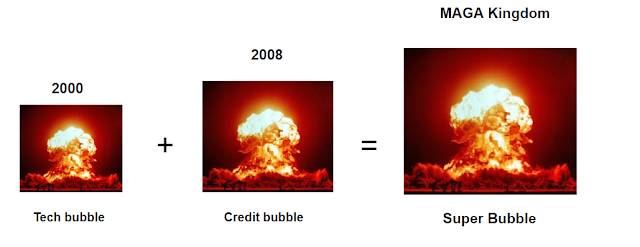

All of which means that the Trump super bubble is running perilously low on dumbfuck capital.

Zerohedge does a decent job of explaining the various factors that drove this epic Coronavirus melt-up and last week's ensuing mini-crash. But then they come to an asinine conclusion that the selloff may be over for now.

First, they lay out the manic reach for risk that culminated in February of all months. An entire month of rabid speculation while the Coronavirus raged in the background. As if anyone couldn't see that ending badly.

Next, they show some charts indicating that the momentum machines have flipped from massively net long to now net short. Why that means that the selling is over, is not for me to say. Is that because these machines only fuel momentum on the upside? Hardly. I predict all of these machine driven momentum strategies will be totally outlawed in the very near future. "CTAs" and all of this other crap.

Then they explain that the Millenials who drove the melt-up via various message boards got pole axed in the past week. As their leveraged bets got margined out. Not hard to believe.

However, that's where I part ways with their conclusion that the selling is over. Because while the factors that drove the melt-up to unsustainable valuations are now gone, the Mom and Pop home gamers went ALL IN during the crash.

Why? Because they were told to.

By Trump, Kudlow, Suze Orman, Jim Cramer, and Barron's this week. And by their own personal financial investment advisors the ones that were used car salesmen before they found their true calling in life.

But it gets far worse, because the market manipulation I described the week before the mini-crash whereby the weekly options are being used to drive the market higher, was confirmed by Bloomberg. In other words, the manipulation of weekly options allowed a virtual boiler room of Millennials to drive the largest Mega Cap Tech stocks to obscene valuations. A super bubble that remains intact, with no catalyst to drive it higher. And now come the Coronavirus-linked earnings downgrades in Microsoft and Apple. The two largest cap stocks on the planet.

But what could go wrong?

"History hasn’t been kind to people claiming to have a magic hand. The latest sell-off, driven by a new wave of coronavirus fears, shows how quickly markets can turn on you. But even veteran traders have trouble dismissing a 900,000-user Reddit forum called r/wallstreetbets, or r/WSB for short, whose tips and tactics have shown an uncanny ability to push prices, at least for the short term."

“There is no denying the fact that in the month of February 2020, the public is back,”

Members of r/WSB believe they’ve discovered a kind of perpetual motion machine in the interplay of stocks with options contracts"

To summarize what I described over a week ago, these morons were renting insane amounts of cheap weekly capital to push Tesla, Amazon, Microsoft, Apple, and other momo stocks higher. Until they exploded.

"At least from the dealers”—the middlemen—“they’ll tell you in big tech names, flows are substantial, and it’s moving things,”

So now that momentum has reversed, these guys are out of the market, and the algos are pointing down now. Which gets us to everyone else in the market. The ones who were buying the dip all week:

“The S&P 500′s drop has improved the risk/reward ratio but we need to see panic readings before stepping up.”

But while the drop in stock prices and bond yields was sharp fast, there still aren’t many signs of outright capitulation in the market after last week’s sell-off, JPMorgan’s Nikolaos Panigirtzoglou said in a note."

Here we see Rydex bull / bear asset now versus prior selloffs.

One of these is not like the others:

Beyond home gamers, it gets far worse.

Amid crude oil annihilation, speculators RAISED their bets this past week:

They are raising their bets into a third wave down:

Amid RECORD low bond yields, somehow speculators remain bearish on Treasuries. This has to be the MAX pain trade of the past year:

S&P futures speculators RAISED their bets this past week:

The entire repo rally evaporated this week. Four and a half months of melt-up gains gone in five trading sessions:

And despite epic realized volatility, vol speculators remained net short this week:

But the most lethal advent of this past week is that the largest bubble never imploded.

As the crash ratio shows, investors migrated further towards the largest cap Tech stocks in the past week. Seeking safe haven in the most overbought and over-owned stocks that were artificially bid up by options speculators:

1. Tesla

2. Amazon

3. Apple

4. Google

5. Microsoft

So for all of the hopium talk about "deleveraging" there was only "BTFD" coupled with removal of the momentum strategies that bid up the bubble in the first place. The net effect of which was to leave Mom and Pop investors holding the bag.

Back in 2015, the Shanghai Composite had a very similar melt-up in the face of worsening economic news, driven by the over-use of monetary stimulus coupled with rampant speculation. When that bubble burst, the PBOC stepped in to do everything possible to stop the crash. They banned short selling, then they shut down the market for days at a time. Finally, they banned institutions from selling. Nevertheless, the market still found its true price -60% lower.

I called it Shanghai Surprise. Which is what I expect to happen this coming week.

Ironically, this headline which could be circa 2015, is circa 4 days ago. As we know, we live in a society that never learns:

"A surge in small-cap Chinese stocks, fueled by government stimulus measures to support the virus-hit economy, is triggering fears of a repeat of the boom that preceded the 2015 market crash."

“This is already a bubble. It’s a game of the greater fool”

“With all the millions and millions of Chinese on lock-down, more people have more time to dabble in the stock markets,”

These are the Chinese stocks that are cross-listed on U.S. markets. The largest of which of course is Alibaba.

In summary, China Tech and the Nasdaq 100 are the last bubbles. Now inextricably tied via excessive speculation.

Feb. 3rd, 2020:

Last week was merely the preview:

I have said all along, there is only one safe place to hide right now.

And there is only one group of people who got it right this past week.

The same people who have been betting against Trump since his election: