Fittingly, today's gamblers are now trapped by their own monetary-induced imagined reality, where they are easy prey for a society of used car salesmen running amok. The lesson NOT learned in 2008 about trusting proven con men, is coming home to roost...

What we are witnessing is an infantile regression from fact and reality. Personally, I no longer react to climate change denial. Why? Because you see it as much now at these climate conferences as you do anywhere else. One side actually believes that Exxon is giving everyone beach front property, while the other side attends climate conferences which spew out non-stop empty promises. Really, who is more cynical?

The fact remains that a relatively innocuous pandemic did more to move the needle on climate change than any ten conferences. COVID was a wake up call that the modern consumption lifestyle is over. It was the most deflationary event in world history. So what did the Consumption Borg do? They went ALL IN on a massive consumption binge at the end of the cycle. The outcome of which will be collapsed demand and a glut of everything.

We now have known demand pull forward in housing, autos, technology/semiconductors, and durable goods. Of course there WAS a time during the pandemic when manufacturing stopped and inventories were depleted. However, since the global economic restart, supply chains have been overwhelmed by restocking. The port of Los Angeles is now handling record volumes to play catch-up.

Ironically, the pandemic-driven increase in online shopping has meant unprecedented new warehouses built across the U.S. These new warehouses must all be stocked which is further increasing demand.

"America has long been gobbling up more goods from overseas than we send back, but in the past year, spending has gone bonkers. Stuck at home and unable to buy services like haircuts and massages, and unable to travel and eat out as much as they’d like, Americans bought even more stuff, filling their ever-larger houses. The U.S. imported $238 billion worth of goods in September, up 15% from September 2019"

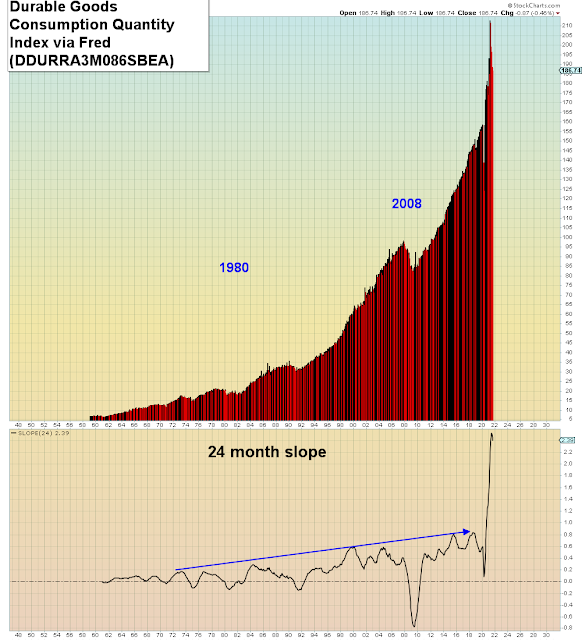

This is a chart of durable goods which I showed on Twitter. We are to believe that this is the "new normal" for demand:

What this surge of demand and restocking clusterfuck has done is it has enabled RECORD profiteering and price gouging, under the auspice of "inflation". Those who have been fanning the flames of inflation hysteria have succeeded in creating human history's largest buying panic in everything.

Here we see the TRUE inflation is in corporate profits which just rose 35% in ONE YEAR. Which is equal to the % gain over the prior 13 years since 2007.

Why is it that these inflationists only complain about rising wages not rising profits? They're assholes, that's why. Here we see that once again mass layoffs are extremely accretive to profit:

Similar to the Y2K date change, Tech stocks just saw a massive ONE TIME increase in computer spending by corporations due to the pandemic. Which is now baselined into corporate earnings. After Y2K it took 18 years for Tech stocks to return to their prior highs. I predict the same will happen now as these mega cap Tech behemoths reach record market cap amid stalling earnings at an unsustainable plateau.

In summary, I predict this will be the fastest and most violent collapse in demand in U.S. history. This buying panic and its lagged indicators of inflation are now concealing a nascent collapse in demand as consumer sentiment hits decade lows. Every company missing revenue estimates this quarter is blaming supply chain problems while ignoring retreating demand. As is their norm, economists will realize the economy has collapsed about a year after it happens.

In the meantime, gamblers continue to make their suicide run in reflation trades. What we are witnessing in real-time is the inevitable death of supply side economics wherein the economy collapses while the misallocation of capital skyrockets amid rampant delusion.

Monetary induced imagined reality propagated by a cabal of used car salesmen running amok.

Don't try this at home.