Panic buying in autos, homes, durable goods, commodities, cryptos, and Tech stonks is the overwhelming cause of today's "inflation". It's called the trickle down fake wealth effect and that premium is going to come out of markets via margin call.

Lower prices are coming, and when they do liabilities will exceed assets and the sheeple will quickly realize they are bankrupt. At that point EVERYONE will understand the difference between inflation and deflation, however that lesson will have arrived 40 years too late...

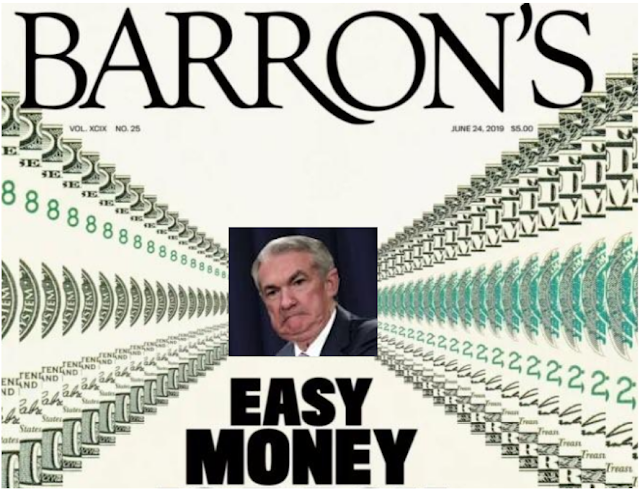

This week the money printing cargo cult is going late stage euphoric on news that their Kool-Aid serving cult leader Jerome Powell has been re-nominated to lead money printing operations. On the one hand they embrace everything he does for them in casino markets, on the other hand they excoriate him constantly for economic inflation. You can't turn on the TV or radio these days without hearing about the "inflation" crisis. These people are plowing their life savings into the most overbought and overvalued asset markets in human history and yet all you hear about is the price of eggs going up 50 cents.

No question, at the bottom of the wage scale, a combination of factors have made even relatively small price increases seem insurmountable. However, maybe it's time to consider the fact that working wages have been suppressed by mass outsourcing and mass immigration for forty years straight. As I showed in my last post, wages are going up the LEAST of all other types of prices. Which in aggregate is deflationary.

Now we learn that Biden is following Trump's (mistaken) lead in releasing oil from the Strategic Petroleum Reserve. Which is ironic, because it's highly likely that oil prices have already peaked. Any blind man can see below that oil is far lower today than it was in 2014, 2011, and 2008, none of which times oil was released from the SPR. Meanwhile, Trump released oil from the SPR in September 2019 which was only a few months before oil crashed the most in history - going negative in April 2020. I predict that will very likely happen again.

More importantly, note that oil demand is STILL only at 2013 levels (lower pane).

EIA data is here:

https://www.eia.gov/petroleum/weekly/