Slavish adherence to Supply Side Economics made it inevitable they would not see demand collapse. What this mass delusion is leading to is an inevitable super glut and overinvestment in everything. For today's true believers in Fed bailouts, calling this crash a "policy error" will be cold comfort...

If you notice, there isn't one pundit right now saying this is the end of cycle. To even say that is strictly verboten and could cause massive panic. These people all believe that central banks have permanently banished the business cycle. To be sure, the past 13 years of deflationary Japanification have been the longest uninterrupted debt accumulation cycle in U.S. history. Hyman Minsky never predicted the depths of deflation that would allow interest rates to remain pinned at 0% indefinitely.

Be that as it may, the bet right now is that this largest of all debt/speculation cycles continues forever.

It's as simple as that.

Those who are in the "inflation" camp are of the belief that there will be no Minsky Moment to pop this asset bubble and force mass de-leveraging. And yet ironically it's inflation that NORMALLY causes the Minsky Moment to occur. Were it not for the continuous importation of deflation, this runaway fusion reactor would have exploded a long time ago. Way back in late 2014, hedge fund manager Hugh Hendry predicted the day would come when central bank managed Disney markets would explode, but he also predicted that few pundits would see it coming. He believed they would be "drugged by the virtual simulation of prosperity and its acolyte QE".

And he was right.

My opinion and the opinion of very few others is that not only is the Minsky Moment at hand, but that the inflationary bias of today will make the outcome far worse. Why? Because the inflationary instinct is to hoard assets and accumulate debt. Whereas the deflationary mindset is to shed assets and shed debt. This inflation hysteria which is reaching a crescendo right now has the masses panic buying everything. Which is a colossal mistake. They should be raising cash right now. We are on the verge of a super glut. In everything.

Again, this mistake was made in 2008 and few seem to remember the outcome. Back then, the Fed initiated QE for the first time in history. This time they are already pumping liquidity at the highest rate in history. Back then they had 5% interest rate buffer, this time they have 0% interest rate buffer. In addition, this asset bubble has levitated not only the traditional economy, but it has simultaneously inflated the virtual economy Tech bubble.

What we are witnessing is the Pyrrhic victory of the virtual economy which began in the 1990s with the Dotcom bubble and Web 1.0 and went into final overdrive during the pandemic. Which is why I am calling this late stage melt-up the hyper asset bubble. Ironically, technology and automation are highly deflationary factors, because they increase supply without increasing demand.

There are many sub-sectors within Tech that saw a one-time extraordinary burst of demand during the pandemic: Cloud-based systems. Streaming content platforms. Crypto currencies. Electric Vehicles. Video games. And at the center of it all semiconductors. And all of that Tech demand was further super-charged by record amounts of cheap capital to fund all of the various Silicon Valley start-ups predicated upon the "internet of everything". The idea that we could all sit at home and have the world catered to our front doorstep. The only problem is this limitless growth fantasy has a last mile problem. It requires humanoids to physically deliver the merchandise. And unfortunately there are only so many of those to go around.

There is only ONE real supply chain shortage that won't easily be solved by this supply side hyper-growth model, and that is the labor supply. For ALL the reasons - early retirement, inflated 401ks, crypto Ponzi gains, work/life balance - the humanoids are going offline. Which gets us to peak Amazon. That company is now the largest employer in the U.S. and they can only continue to grow by bidding employees away from other Tech companies. Which means that they face slowing growth AND declining profit margins at peak valuation.Which is what they warned about in their most recent quarter two weeks ago.

But no bubble is quite as ludicrous as the electric vehicle bubble. EVERY car maker in the world produces electric cars already or coming to market in the next few months. Car and Driver lists every electric vehicle coming to market. There is nothing new or unique about electric cars anymore, they are commodities now. The only thing that's unique is the ludicrous market premium accorded these electric car companies. Today, the largest IPO of the year Rivian went public at a $100 billion valuation. They have $0 revenues and are running well over $1 billion in annual losses. Compare that to Ford which has $135 billion in revenues and several electric cars ALREADY in the market. And a lower market cap of $80 billion. There will be a massive glut of electric cars on the market a year from now.

And a massive glut of everything else as well.

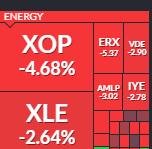

Today we were told that the market tanked because of the 30 year high CPI print. But guess which sector was down the most?

Oil stocks.

Why? Because inflation is always highest at the end of the cycle.