Over on Twitter I'm getting overrun by morally challenged trolls who have fallen prey to a society of Bernie Madoff acolytes running amok. All it takes is time for people to believe ANYTHING. Except the truth, that belief never comes willingly. Now featuring a generation adamant that printed money is the secret to effortless wealth. The biblical fates are conspiring to make epic fools out of epic fools, betrayed by their consensus belief in Ponzi markets...

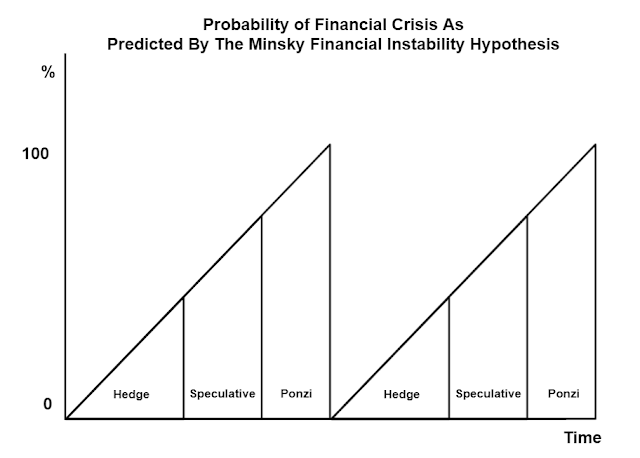

Depending upon how you look at it, this gambit has been going on for a year and a half, a short time, or thirteen years since 2008. From the former view, it's clear that today's attention deficit trolls have never experienced the downside of a popped asset bubble and bear market. For if they had, they would not be tempting fate by telling me that this can go on forever. From the correct latter view, this has lasted far longer than either the Dotcom bubble and the Housing bubble lasted and therefore the consequences will be far more lethal. These days, elapsed time is widely viewed as a buffer against risk. Like a thief that gets away with his crimes over and over again, the view is that this super asset bubble is now a risk free venture. Unfortunately, that happens to be the opposite of the truth. Per the Minsky Financial Instability Hypothesis, debt profligacy grows with time. People become desensitized to risk and start adding greater leverage as time passes. Nevertheless, people always want to know the exact date of "inevitable", because they want to stay in the casino as long as possible. After all, ours is not a "noble and kingly wisdom", hence one must not grow insolent upon their present enjoyments lest they miss out on the latest pump and dump scheme.

In the Minsky model, the inflationary stage is the most lethal stage. First off because the inflationary mindset convinces people that debts will be reduced over time by the effects of inflation. Secondly, because this stage leads to a melt-up in asset values as all manner of assets are panic bought and hoarded.

"Over a protracted period of good times, capitalist economies tend to move from a financial structure dominated by hedge finance units to a structure in which there is large weight to units engaged in speculative and Ponzi finance. Furthermore, if an economy with a sizeable body of speculative financial units is in an inflationary state, and the authorities attempt to exorcise inflation by monetary constraint, then speculative units will become Ponzi units and the net worth of previously Ponzi units will quickly evaporate"

https://www.levyinstitute.org/pubs/wp74.pdf

In this cycle, the temptation to add risk is far worse than any other time in modern history because central banks have succeeded in convincing people that the business cycle has been eliminated. Therefore debts can continue to grow forever. There will never be a deleveraging again. As of this writing these risks are now generational in magnitude. Instead of being worried about their badly timed option bets, today's trolls should understand that the lethal consequences of being WRONG are now totally unaffordable to those who are fully wedded to this epic disaster.

As I showed on Twitter, this past year's pattern of margin debt acceleration is the same as it was at the END of the two prior cycles. After the March 2020 lockdown it took a mere 8 months for margin debt to explode to a new all time high. Whereas at the beginning of the past two cycles, it took FOUR YEARS.

History will say that the Millennials were lured into the end of the cycle by gamified trading apps, Wall Street con men, crypto Ponzi schemes, a global pandemic, and social media organized pump and dump schemes.

In other words, a morally collapsed society of Bernie Madoff acolytes running amok...