This society now believes that printed money is the new El Dorado. Recessions and bear markets have been banished to the dustbin of history, replaced by consumption binges and effortless speculative profit. The only question is why didn't anyone try this sooner? What fools! Pundits are basing their current views of the economy upon recent widespread panic buying encouraged by ubiquitous industry pimps; which will be a swan dive into pavement when panic buying turns into panic selling...

Let's begin with this just ending climate conference COP26. The conference has just barely ended and yet people are already realizing that it was just another load of false promises. Which is more cynical, to NOT believe in man made climate change, or to believe in it but not do nothing about it? This climate conference is an analog for the global economy. It's a massive false promise for the future predicated upon the favoured approach of doing nothing. We have discovered the new El Dorado, printed money. Now featuring consumption orgies and speculative manias where there used to be recessions and bear markets. The only question today's pundits have is why didn't anyone think of this sooner? When the false promises around this consumption orgy explode, then the forced downsizing will do more to reduce carbon footprint than any ten bogus climate conferences.

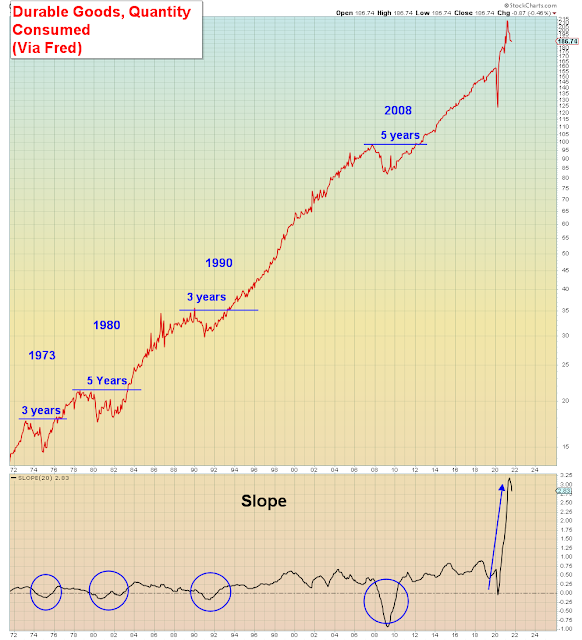

Here we see the pandemic was the first recession in U.S. history in which consumption INCREASED:

But at least we know why the entire $Green energy sector has been on fire lately. Not only was there a climate conference, but also Biden's clean-energy infrastructure bill just passed, and the largest (EV) IPO of the year. ALL in the same week. And the world's richest man rang the cash register several times.

"KA-CHING!!!"

Recapping the economic situation - the pandemic caused a global supply shock which led to higher prices. The initial response was for demand to INCREASE especially for durable goods, cars, and houses. The question is what happens next? Inflationists believe we are in a wage-price spiral that will continue to drive prices higher until the Fed is forced to move or the bond market spontaneously implodes. However, if they are wrong, then we are merely pulling forward consumption from the future and therefore on the verge of the largest and fastest demand shock in U.S. history.

The current "inflationary" view is quite convenient for Wall Street and other industries that are benefiting from panic buying: No one knows when this will end, but it will end badly. Plausible deniability is also the convenient view to ride this year -end melt-up through bonus payout. So, there is tremendous conflict of interest taking place right now.

This article from the former head of India's central bank summarizes the tightrope central banks are walking:

"Former Indian Central Bank Governor Raghuram Rajan highlighted the tightrope that policymakers have to walk with monetary stimulus, warning that one false move may lead to a global “wealth shock” that could scare consumers"

What we notice is that ALL of today's pundits, including Rajan, believe that central banks are STILL in control over global markets. Therefore, they alone decide when this party ends. However, I am not of the belief that they are in control anymore. I believe they have the illusion of control.

In addition, I believe that this recent panic buying has fed into their backward looking data model and is giving them ALL a false sense of economic confidence. In other words, these are misleading indicators for the future. When we see that consumer confidence has now reached a decade low in this most recent reading, understand that these pundits can't afford to be wrong this time.

Case in point, Jim Cramer says he is going to use this week's retail earnings to get a "feel" for the consumer. What he is going to see is that sales and profits are up this past quarter, and therefore he's going to assume that consumer confidence is solid.

Whereas we already know it's collapsing. We also know that wages are not keeping up with prices. Which is very likely why the bond market is not reacting to the latest inflation news.

In summary, this era reminds me a lot of 2007. It's an industry game called "Dance while the music is playing" aka. Musical chairs.