Fittingly this orgy of consumption is self-destructing due to maximum excess. Far more biblical is the fact that most gamblers don't see it coming. Why? Because they expect infinite return on inequality.

ROI...

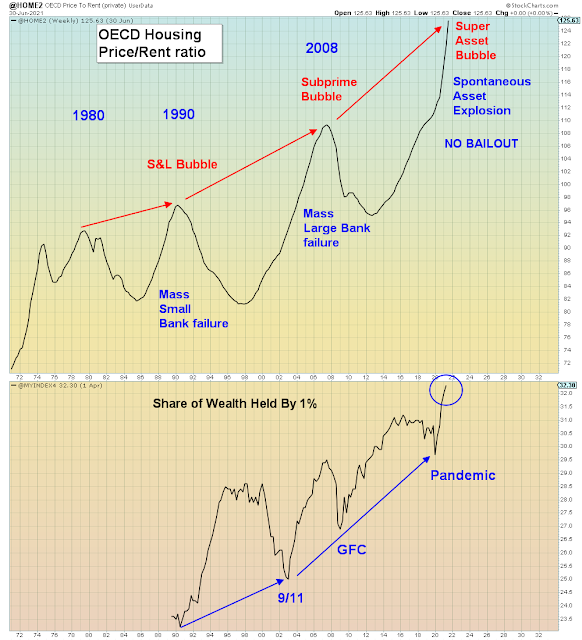

For a multitude of reasons, the pandemic took World inequality from asinine to lethal levels. Most pundits today blame central banks for pumping liquidity into bond markets and setting off a global hunt for yield that has bid up every asset class on the planet. They assiduously ignore their own role in embracing this asset bubble and informing us that anything that goes wrong with it is a "policy error", their legal escape clause from culpability. However, we know that these people are addicted to monetary stimulus. Had QE not been used then there would have been a lost decade for stocks post-2008 and there would be a retirement crisis right now. Therefore the ONLY risk that gamblers today worry about is monetary policy. They are now of the belief that the Fed alone controls the stock market. Which is why small increases in inflation set off mass hysteria within the financial community. At the 0% bound, asset prices have a theoretical infinite valuation, and per the textbook discount cash flow (DCF) model the only risk is rising interest rates. The bubble can grow to infinity so long as interest rates never rise again for any reason. The growth of said bubble does not in and of itself pose any risk. All of these investors and pundits are of course assiduously ignoring default risk. They ignore the fact that this so-called model puts all of the burden of deflation on the middle class. These bubbles increase the wealth of the rich while increasing the liabilities for everyone else. So why would the wealthy see default risk if they have been bailed out every single time that markets crash? The belief is that lenders can be bailed out every time while borrowers take on ever larger debts.

I put my chart on Twitter of the OECD price/rent ratio as a means of showing the RELATIVE increase in the global property bubble over time. One troll said that rents will rise and flatten the curve. That's my point. The landlord receives the asset increase and the renter gets the liability increase. And we are to believe this can continue indefinitely. As I said in my last post, today's pundits are blind to risk. They are pandering to their audience which sees this consumption orgy continuing forever. We learned this past weekend that consumption among the wealthy has DOUBLED since the pandemic began, while consumption among the less well off has been reduced by HALF. Which absolutely proves my hypothesis that the wealth effect is driving consumption, NOT wages as is widely assumed.

"Higher-income households in the U.S. plan to spend five-times that of lower-income households this holiday season"

“While everybody is going through their day-to-day, super excited about this holiday season, we have a whole community of folks who are stressed out,” said Hilliard in a phone interview. “We’re seeing more [charity] demand this year than we’ve ever seen.”

“What starts off as a health crisis turns into a financial crisis if you’re in the lower-income [bracket].”

Now that the rent moratorium is gone, folks are freaking out.”

There are two sides to the price/rent ratio. One side is partying like it's 1929 and the other side is skipping the holidays this year.

And of course what is taking place within the U.S. is also taking place across the entire planet. Developed world nations are enjoying a massive recovery while Emerging Markets are imploding in broad daylight.