The common investment theme for 2021 is rampant fraud. Below I delineate the stocks/ETFs/sectors/assets that are most likely to implode the market. Any one of these alone would not likely be enough to create a meltdown, but if they all roll over at the same time the HFT algos masquerading as market makers will go critical mass. Today's pundits are sanguine because markets are at all time highs and the Dow/S&P in no way convey the risk that lurks beneath the surface. Whenever markets are going up, everything is bullish. But, what's the "catalyst" for meltdown? The catalyst is "Sell"...

First place of course goes to Tesla, EVs, green Energy and the entire auto sector, all of which are hyper overbought.

The melt-up started three weeks ago with Tesla's third quarter results which beat expectations (Oct. 20th). Then it got a boost when Hertz announced they were buying 100k Tesla's for their rental fleet (Oct. 25th). All of that sparked a Reddit-driven options "gamma squeeze", which is a short squeeze using call options. That melt-up in all things EV/Auto continued up until the COP26 conference this past week and the passing of the Clean-Energy infrastructure bill which gets signed tomorrow. In my opinion all of these catalysts are capping off a mega melt-up in Tesla that started two years ago in Fall 2019 and went parabolic during the pandemic.

If Tesla folds back below the blue line then this entire blow-off top is a bull trap that will get fugly. Note that the clean energy ETF is three wave corrective.

On a related subject, as I've shown many times the entire auto sector - including Ford, GM, Auto Nation, Car Max, and of course Avis is ludicrously overbought.

This is all driven by the "car shortage" fraudulent narrative:

Next, the semiconductor sector has also seen a late stage melt-up. The leading stock is Nvidia which is a heavy hitter in terms of market cap and daily dollar trading volume. Nevertheless, the entire sector is now massively overbought.

This sector has been melting up due to the "semiconductor shortage" false narrative. This era has seen record semi demand now conflated as a supply shortage. I also believe this to be the blow-off top phase of a decade long rally:

Also on the topic of Tech stocks, yesterday I showed a chart of "TRINQ" on Twitter indicating that there has been no RISK OFF in Tech for the past decade since the 2011 debt ceiling. Ironically, another debt ceiling debacle is only weeks away. That long-term chart is by no means a precise timing indicator.

Nevertheless, here we see Microsoft the most valuable company in the market right now is the most overbought since the Feb. '20 high:

Transports are also hyper-overbought. Some say it's because of Avis, but Railroads are at new all time highs and below we see the Trucking sector is parabolic. Meanwhile, I showed a chart on Twitter yesterday indicating that this is the largest coincident melt-up between Tech and Trucking since the January 2018 blow-off top.

No discussion of meltdown risk would be complete without a discussion of the $2.8 trillion crypto sector which now equals 2 x 2008 subprime in magnitude. Roughly half of that market cap consists of shitcoins which everyone KNOWS are pump and dump schemes.

The other half is Bitcoin which has now seen widespread adoption, institutional buying, and multiple ETFs. I showed a chart on Twitter yesterday indicating that Bitcoin is highly correlated to the NYSE Composite. And yet, these cryptos are all getting bought with both hands under the fraudulent "inflation hedge" hypothesis. If there is one asinine hypothesis that this society must live with for the rest of time, it's that one. And many other dumbfuck ideas these morons accept without question.

This article in National Affairs magazine argues that Bitcoin is safer than gold and should be considered by the U.S. Treasury. You can't make this shit up. I will not rebut the entire article because he includes some currency history which I happen to agree with, however, I will say that the author has never heard of Japan, their record deficits and record money printing and their currency which 30 years later is STILL viewed as the global safe haven. All due to the power of deflation which is about to get far worse before it gets better.

The main problem with Bitcoin is that it can't scale. It has the carbon footprint of Pakistan. Every Bitcoin transaction consumes $100 in electricity, even just buying a cup off coffee. Yes, you read that right:

For the record, the top performing sector year over year is the fossil fuel Energy sector. Ironically, these stocks languished under Trump who was pro-fossil fuel and then they sky-rocketed under Biden's green energy plan. Mostly of course due to the pandemic unlockdown. Year over year most Energy ETFs are up well over 100%. However, there are few if any Energy stocks at all time highs since they were the worst performing sector in 2020.

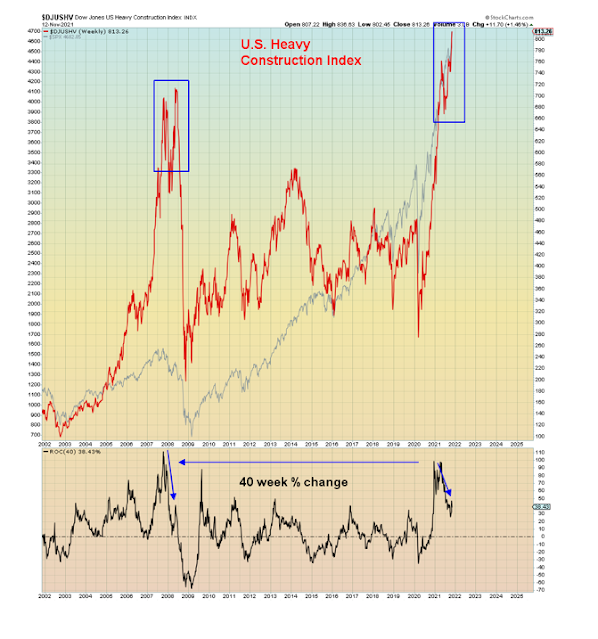

Therefore, instead of showing oil stocks I will show the construction/infrastructure sector which is the most overbought since the Fall of 2008:

In summary, 2021 will forever be known as the year when fraud and criminality were "democratized" amid rampant cynicism, greed, and denial.

Capping off over a decade of non-stop monetary bailouts for the rich.