Carbon has collapsed, wealth inequality is next...

Speculation is running rampant as to what's next? Gamblers are using money printed stimulus checks to bid up the virtual economy bubble while the real economy explodes in broad daylight. The mainstream economists now sniffing monetary glue are today's "experts" while those of us who question this insanity are locked in a padded cell while the inmates run the asylum...

Is it immoral to monetize idiots? I don't know, but I'm taking my chances.

I'm having great difficulty blogging these days, because my rage collapsed in line with the carbon reduction. I've never experienced writer's block previously, and no amount of alcohol is helping this time, whereas previously it was jet fuel on the bonfire. I'm becoming fat and happy - everything I hate about this world. I now regard blogging as an affront to the Creator for having delivered everything I/we asked for - A generational paradigm shift in real time. The biggest shift in 100 years. All paid for in carbon.

Granted, we all have skin in this game now. We all know too many friends and family who are card carrying members of the Corporate Borg. The groupthink circle jerk of idiots now in manic overdrive.

Picture a scenario in which no matter how ludicrous the economic divide becomes, today's EconoDunces STILL evince full faith in money printing. Imagine stay-at-home gamblers using stimulus money to bid up their own portfolios. And imagine central banksters vowing to "do whatever it takes" to drive a ever-larger gap between asset valuations and the real economy. What more can they do other than to administer MORE monetary euthanasia? The American Dream has now morphed into the American glue sniffing contest.

This past week, I vowed to stay off Zerohedge - what I consider financial crack cocaine. I was doing so well until this weekend, and then I caved and became my usual unhinged when I came across this article predicting hyperinflation.

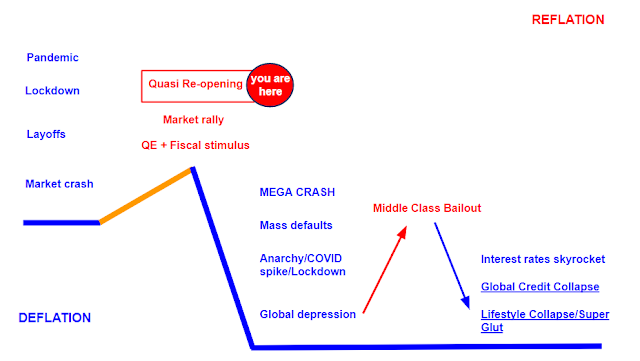

This article follows the typical fake news formula - a handful of loss leader facts to lure the reader in, a specious narrative, and a pre-ordained conclusion. I can't rebut all of it, however, it was so specious that it inadvertently made me realize that my hyper-bearish prediction is not bearish enough. I came to realize that these money printing morons at global central banks can't create anything approaching reflation any time soon. Therefore I created a new economic model to indicate why any expectation of reflation has been pushed back by months, if not years. My new hyper-bearishness comes down to the fact that asset crash will bring about a collapse in investment AND a collapse in household leverage. The highest income households that are far above the median income will fall the hardest, in a total reverse of what has happened over the past decades, the wealthy elite will implode.

The middle class bailout will collapse lifestyles down to the median income. There will be a glut of everything, but mostly cars and McMansions.

The article draws a straight line between central bank money printing and hyperinflation. Not even ONE mention of COVID, and no mention of the socially distanced economic multiplier. No mention of Japan and their 30 year experiment with printed money, all leading to extreme deflation.

Sophomoric garbage at best.

A casual glance at reflation and the Fed balance sheet indicates that there is no straight line between monetary expansion and reflation.

This past week, the NYSE delisted JC Penney.

It's time for the casino class to realize that the stock market is NOT more important than the 'Conomy.

Make no mistake, this is the biggest dumbfuck money bubble in human history, without any comparison.