Central banks have done a FANTASIC job of ensuring no one sees it coming. With considerable assistance from other well known psychopaths. Just ask Herbert Hoover...

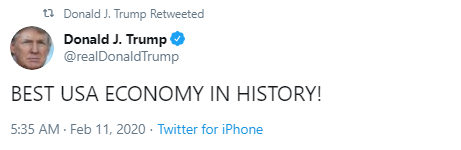

History will say that as the global economy went into final meltdown mode, stocks went parabolic. Gamblers were well-conditioned to believe that global economic disintegration was a buying opportunity. Central banks squandered ALL of their dry powder creating a feel good super bubble ahead of the recession, leaving nothing left for when it was really needed.

Recall, according to Zerohedge, imploding China was the "genius" behind Trump's 2020 election strategy. Now we will find out just how genius it is:

"Maybe Trump is a genius, after all. What if he finally gets the steep Fed rate cuts he has been demanding? [He did]

After that, he ends the trade wars, tariffs go to zero [Or just stay in place], and the stock market surges to new highs -- just in time for the 2020 election!"

"Maybe Trump is a genius, after all. What if he finally gets the steep Fed rate cuts he has been demanding? [He did]

After that, he ends the trade wars, tariffs go to zero [Or just stay in place], and the stock market surges to new highs -- just in time for the 2020 election!"

On the topic of MAGA and Y2K melt-up, it appears that Jeff Bezos remembers Y2K rather well:

"That’s the largest seven-day selldown by any executive tracked by the Bloomberg Billionaires Index, which began in 2012"

"The Trump administration and tech have had an often tense relationship and Trump pinned the name on the companies just hours after the FTC said it would investigate their past acquisitions."

Very soon, all of these mega cap Tech stocks will be dead money for years more likely decades, and Jeff Bezos clearly knows it. Why? Because these are mature companies whose current bubble valuations far exceed their growth rates. The four horsemen of Tech in 2000 were Microsoft, Cisco, Dell, and Intel. Of those four stocks, only Microsoft has reached new all time highs, but it took fifteen years for Microsoft to take out the Y2K high (2015). Similarly, the "Nifty Fifty" stocks circa 1972 languished for decades. Most having reached peak earnings growth in that era.

As we see, Cisco is right now selling off deja vu of of 2007. It peaked last summer:

This final bubble is a mix of 5g wireless stocks and cloud internets. All four MAGA Tech stocks (Microsoft, Apple, Google, Amazon) are in an arms race to dominate cloud market share.

Not only are these mega caps leaving behind economic cyclicals, they are now leaving behind the rest of the Nasdaq. Two new Hindenburg Omens yesterday (NYSE, Nasdaq).

Which is why the crash ratio keeps becoming more extreme.

ANYTHING could tip this market over now.

VIXPlosion is waiting to happen, as volatility is not confirming this new all time high:

In addition to printed money, the current fairy tale is that these handful of overbought Tech stocks are safe havens from global implosion. The entire world is now crowded into MAGA Tech.

All of which is the long way of saying that today's gamblers are massively leveraged to a Tech bubble going into global recession without a safety net.

"There have probably never been as many characteristics of a top as we are experiencing today"

“Exponentially rapidly rising or falling markets usually go further than you think but they do not correct by going sideways.”

In summary, central banks have done a FANTASTIC job of ensuring that no one sees this coming. With considerable assistance from other well known psychopaths.

“Something is happening out there to the economy and while we can’t be quite sure what it is, this collapse in the need for labor on the part of companies is not a positive development,”

Federal Reserve Chairman Jerome Powell on Tuesday struck an upbeat note on the economy and labor market, telling the U.S. House of Representatives Financial Services Committee that the economy was “in a very good place, performing well.”

No one believes central bank bullshit more than central banks.

After all, they have a flawless record of NEVER seeing recession coming ahead of time. And yet the morons at large never stop asking for their opinion of the economy.

In 2008, the Fed was still flying blind NINE months after recession had started AND after the collapse of the U.S. banking sector.

"On the morning after Lehman Brothers filed for bankruptcy in 2008, most Federal Reserve officials still believed that the American economy would keep growing despite the metastasizing financial crisis."

The Fed’s understanding of the crisis, however, was clouded by its reliance on indicators that tend to miss sharp changes in conditions"

"This is a mid-cycle adjustment"

"There have probably never been as many characteristics of a top as we are experiencing today"

“Exponentially rapidly rising or falling markets usually go further than you think but they do not correct by going sideways.”

In summary, central banks have done a FANTASTIC job of ensuring that no one sees this coming. With considerable assistance from other well known psychopaths.

“Something is happening out there to the economy and while we can’t be quite sure what it is, this collapse in the need for labor on the part of companies is not a positive development,”

Federal Reserve Chairman Jerome Powell on Tuesday struck an upbeat note on the economy and labor market, telling the U.S. House of Representatives Financial Services Committee that the economy was “in a very good place, performing well.”

No one believes central bank bullshit more than central banks.

After all, they have a flawless record of NEVER seeing recession coming ahead of time. And yet the morons at large never stop asking for their opinion of the economy.

In 2008, the Fed was still flying blind NINE months after recession had started AND after the collapse of the U.S. banking sector.

"On the morning after Lehman Brothers filed for bankruptcy in 2008, most Federal Reserve officials still believed that the American economy would keep growing despite the metastasizing financial crisis."

The Fed’s understanding of the crisis, however, was clouded by its reliance on indicators that tend to miss sharp changes in conditions"

"This is a mid-cycle adjustment"