Tuesday, November 30, 2021

Policy Error 2.0 aka. SUPER CRASH

Monday, November 29, 2021

MAXIMUM EXCESS

Fittingly this orgy of consumption is self-destructing due to maximum excess. Far more biblical is the fact that most gamblers don't see it coming. Why? Because they expect infinite return on inequality.

ROI...

For a multitude of reasons, the pandemic took World inequality from asinine to lethal levels. Most pundits today blame central banks for pumping liquidity into bond markets and setting off a global hunt for yield that has bid up every asset class on the planet. They assiduously ignore their own role in embracing this asset bubble and informing us that anything that goes wrong with it is a "policy error", their legal escape clause from culpability. However, we know that these people are addicted to monetary stimulus. Had QE not been used then there would have been a lost decade for stocks post-2008 and there would be a retirement crisis right now. Therefore the ONLY risk that gamblers today worry about is monetary policy. They are now of the belief that the Fed alone controls the stock market. Which is why small increases in inflation set off mass hysteria within the financial community. At the 0% bound, asset prices have a theoretical infinite valuation, and per the textbook discount cash flow (DCF) model the only risk is rising interest rates. The bubble can grow to infinity so long as interest rates never rise again for any reason. The growth of said bubble does not in and of itself pose any risk. All of these investors and pundits are of course assiduously ignoring default risk. They ignore the fact that this so-called model puts all of the burden of deflation on the middle class. These bubbles increase the wealth of the rich while increasing the liabilities for everyone else. So why would the wealthy see default risk if they have been bailed out every single time that markets crash? The belief is that lenders can be bailed out every time while borrowers take on ever larger debts.

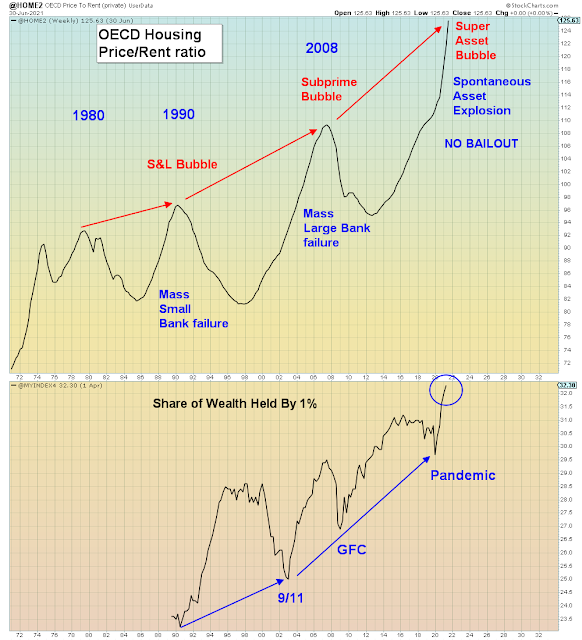

I put my chart on Twitter of the OECD price/rent ratio as a means of showing the RELATIVE increase in the global property bubble over time. One troll said that rents will rise and flatten the curve. That's my point. The landlord receives the asset increase and the renter gets the liability increase. And we are to believe this can continue indefinitely. As I said in my last post, today's pundits are blind to risk. They are pandering to their audience which sees this consumption orgy continuing forever. We learned this past weekend that consumption among the wealthy has DOUBLED since the pandemic began, while consumption among the less well off has been reduced by HALF. Which absolutely proves my hypothesis that the wealth effect is driving consumption, NOT wages as is widely assumed.

"Higher-income households in the U.S. plan to spend five-times that of lower-income households this holiday season"

“While everybody is going through their day-to-day, super excited about this holiday season, we have a whole community of folks who are stressed out,” said Hilliard in a phone interview. “We’re seeing more [charity] demand this year than we’ve ever seen.”

“What starts off as a health crisis turns into a financial crisis if you’re in the lower-income [bracket].”

Now that the rent moratorium is gone, folks are freaking out.”

There are two sides to the price/rent ratio. One side is partying like it's 1929 and the other side is skipping the holidays this year.

And of course what is taking place within the U.S. is also taking place across the entire planet. Developed world nations are enjoying a massive recovery while Emerging Markets are imploding in broad daylight.

Saturday, November 27, 2021

The Edge Of The Abyss

My euphemism for market crash is "Policy error". Meaning forty years of failed Supply Side economics, ending in rampant denial with NO WAY OUT...

I don't normally seek affirmation for my point of view, because I am usually disappointed at what I find. However, from time to time in a moment of weakness I will head over to John Hussman's site for validation. This past week his post was called "The Motherlode".

"Across four decades of work in the financial markets, and over a century of historical data, I’ve never observed as many historical indications of a market peak occurring simultaneously"

Emphatically – and this is important – my intent here is not to “call the top” of this bubble"

So let me get this straight, we have the most concurrent indications of a market top in decades, but you are NOT calling the top. Why? Because to do so would risk credibility if the melt-up continues, that's why.

To be fair, Hussman has been consistent in his view that this is the most overvalued market in history and hence the least investable long-term. However as we see, he is far too circumspect with respect to describing the current level of market risk. His viewpoint is almost entirely directed at market valuation and technical indicators. He scant mentions the economy, nothing on China, nothing on global currencies, nothing about crypto, nothing on the housing market, nothing on corporate debt and where we are in the cycle, nothing about consumer sentiment and no mention of inflation hysteria.

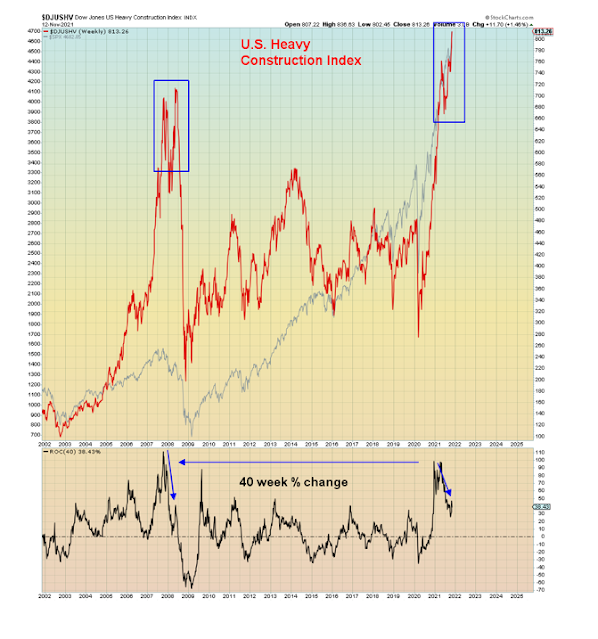

He is not alone. Most of today's stock market pundits are blogging in a vacuum. Without considering these other factors one would conclude this is a stand-alone stock market bubble, not so risky after all. When the Dotcom bubble burst, recession began a full year later. On the other hand when the housing bubble burst, recession began immediately. This time we have both - a stock bubble and a housing bubble. However this time the Fed is ALREADY AT 0% on the Fed funds rate. So they have no dry powder to resuscitate the economy.

Worse yet, he gets defensive about being a “perma-bear”. He apologizes for not taking part in this festival of idiots. Make no mistake, I may be a perma-bear now, but I will gladly use the buy order when valuations return to earth. I call it buy low and sell high. It’s an old fashioned concept that today’s speculators have never heard about. What it comes down to is that no money manager would ever say “sell”, because as they always say if you get out you don’t know when to get back in. Hussman asserts that a universal sell order is not possible since all shares must be owned by someone. Every seller has a buyer. I suggest that is not true. Most share issuance over the past decades was corporate issued stock to cover options dilution. So no, the sheeple didn’t need to plow their life savings into human history’s largest pump and dump scheme. Of course everyone can’t sell in the middle of a meltdown.

Which is why on Black Friday yesterday there were blue light specials in aisle 11 of the Dow, but no takers. Cyclicals were bidless as there were concerns over a new mutant virus. Remember COVID-2019? That was two years ago. Two years later and we still can’t find our ass with both hands. At present, the people who are fully vaccinated want everyone to wear masks and lockdown at a moment’s notice. While the people who are unvaccinated don’t believe in masks or social distancing. It’s the full retard approach to pandemic management.

And remind me again the last time the market was melting up into a pandemic lockdown and got monkey hammered? Oh right February 2020.

Deja vu.

You cannot be too bearish right now nor too critical of this festival of idiots. But you can put your capital and credibility at risk by having ANY part in it.

It’s clear that the Fed has fully euthanized this society and now even the bearish are complacent. Ironically what this inflation hysteria has done is to take another Fed bailout off the table. The FOMC minutes this week indicated many Fed members believe QE should be rolled off FASTER. In 2018, the S&P was down -20% before the Fed reversed policy. This time the market will be down a multiple of that amount. Meaning way too late.

And then the REAL acrimony will begin. Record inequality will ensure that policy-makers are highly constrained from implementing a 2008 style bailout.

Another massive risk that is in no way priced in.

The worst approach of course are those pundits who claim we have runaway inflation but caveat every single article with asterisk “policy error”. Meaning this can all end suddenly and abruptly, and hence economic reflation is binary. Which is what we saw on Friday with the Dow down 1,000 points.

What all pundits have in common is that they are ignoring the reverse wealth effect and how it will impact already collapsed consumer sentiment when the air comes out of the bubble. They’ve been ignoring the role of the wealth effect on the way up and its effect on consumption. So no surprise they are ignoring what will happen on the way down.

In summary, today’s market commentary is fucking pathetic. Weak and idiotic. Grade F all around. A festival of idiots with the only concern being left behind.

Tuesday, November 23, 2021

THE CURE FOR HIGHER PRICES IS ON THE WAY

Panic buying in autos, homes, durable goods, commodities, cryptos, and Tech stonks is the overwhelming cause of today's "inflation". It's called the trickle down fake wealth effect and that premium is going to come out of markets via margin call.

Lower prices are coming, and when they do liabilities will exceed assets and the sheeple will quickly realize they are bankrupt. At that point EVERYONE will understand the difference between inflation and deflation, however that lesson will have arrived 40 years too late...

This week the money printing cargo cult is going late stage euphoric on news that their Kool-Aid serving cult leader Jerome Powell has been re-nominated to lead money printing operations. On the one hand they embrace everything he does for them in casino markets, on the other hand they excoriate him constantly for economic inflation. You can't turn on the TV or radio these days without hearing about the "inflation" crisis. These people are plowing their life savings into the most overbought and overvalued asset markets in human history and yet all you hear about is the price of eggs going up 50 cents.

No question, at the bottom of the wage scale, a combination of factors have made even relatively small price increases seem insurmountable. However, maybe it's time to consider the fact that working wages have been suppressed by mass outsourcing and mass immigration for forty years straight. As I showed in my last post, wages are going up the LEAST of all other types of prices. Which in aggregate is deflationary.

Now we learn that Biden is following Trump's (mistaken) lead in releasing oil from the Strategic Petroleum Reserve. Which is ironic, because it's highly likely that oil prices have already peaked. Any blind man can see below that oil is far lower today than it was in 2014, 2011, and 2008, none of which times oil was released from the SPR. Meanwhile, Trump released oil from the SPR in September 2019 which was only a few months before oil crashed the most in history - going negative in April 2020. I predict that will very likely happen again.

More importantly, note that oil demand is STILL only at 2013 levels (lower pane).

EIA data is here:

https://www.eia.gov/petroleum/weekly/