Whenever things go pear shaped for this Idiocracy, dedicated amnesiacs look around for the proximate cause of the problem and who to blame. Because, otherwise it was all going so well. Unfortunately, what these people are assiduously ignoring is 40 YEARS of policy error...

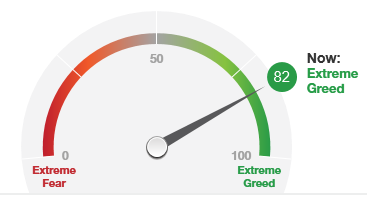

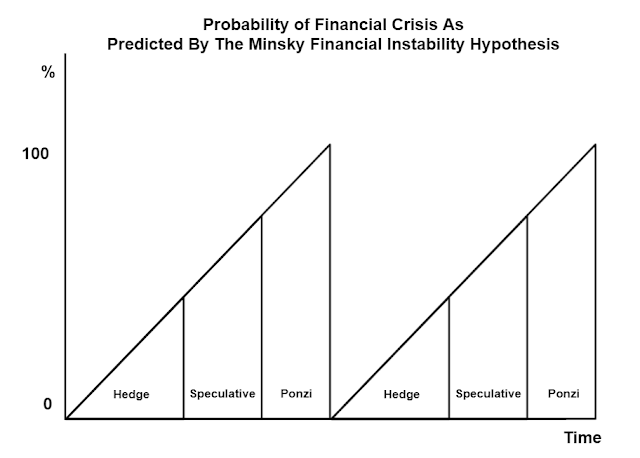

Forty years of Supply Side Voodoo Economics later and we are now mainlining monetary heroin into crypto Ponzi markets to cover up the imploding economy. The policy error began decades ago when greed was conflated as a national ideology. What began as a business imperative to maximize corporate profit somewhere along the line jumped the Maslow hierarchy of needs to become the meaning of life.

There are so many open frauds taking place right now that it's impossible to keep track of them all. Congress is now instructing the SEC to make a spot Bitcoin ETF a priority.

You can't make this shit up.

"Bitcoin spot ETFs are based directly on the asset, which inherently provides more protection for investors"

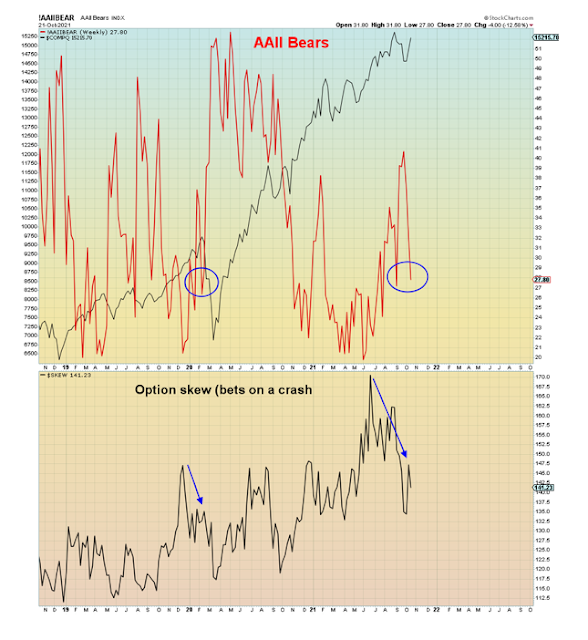

What we see below is that crypto fraud usually peaks after the bubble implodes. This time, it's reaching new highs BEFORE the bubble explodes. Think about what's coming next with respect to fraud discovery.

This gas station owner is trying to prevent fraud on a micro scale by warning senior citizens away from his station's Bitcoin machine.

"Amarjit Singh says since the machine was placed in his store three months ago, he's noticed 12 seniors coming in to buy bitcoin because they thought they had to pay a [falsified] fine to the RCMP"

It's true that Wall Street is the ultimate scam machine. Nevertheless, joining them in their criminal gambit is not the best way forward. This year we've seen record crypto scams, SPAC scams, IPO scams, and every other type of scam.

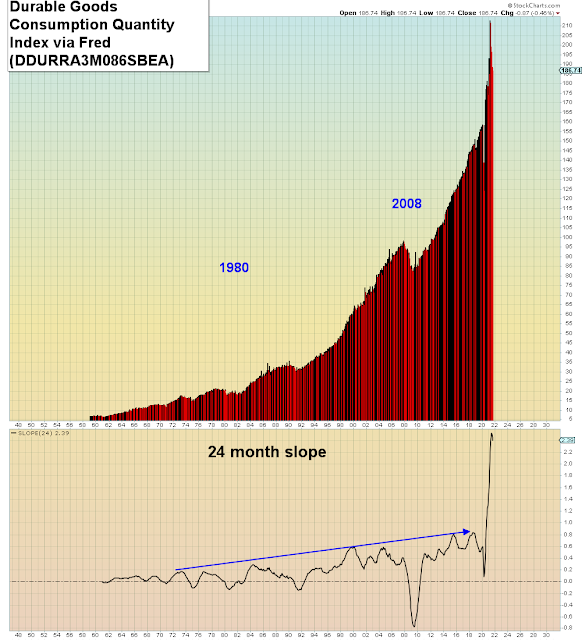

When this all explodes with biblical dislocation we know this Idiocracy will look around for who to blame, never once thinking to look themselves in the mirror. According to these lifelong aspirational morons, we are now to believe that a global pandemic has improved the global economy hence justifying record valuations in everything. You have to be brain dead to believe it, hence it goes largely unquestioned.

Even more lethal, is this fake inflation theme which is essentially at this point unquestioned. This pandemic was the most deflationary event in world history. It shut down the global economy. It shut down global travel. It has kept people away from their offices for almost two years now. It blighted small business, restaurants and shopping malls, and it essentially imploded the job market. Economists can't figure out why serial mass layoffs keep leading to lower labor participation each time.

Two of the worst managed and most leveraged multinationals in the world - GE and Boeing - combined laid off tens of thousands of aerospace workers last year. These are some of the most highly skilled workers in the U.S. These are not baristas and burrito assembly line workers.

Now, shockingly aerospace companies have a MASSIVE labor shortage. Why? Because it turns out that intelligent people don't want to work for the same assholes who laid them off.

No pundit saw this coming:

"Against that backdrop, it’s tough to imagine many qualified employees being keen to favor the aerospace manufacturers that dumped them when the going got tough. It doesn’t help the sales pitch that Raytheon prioritized a $2 billion share buyback this year over keeping more workers on the payroll"

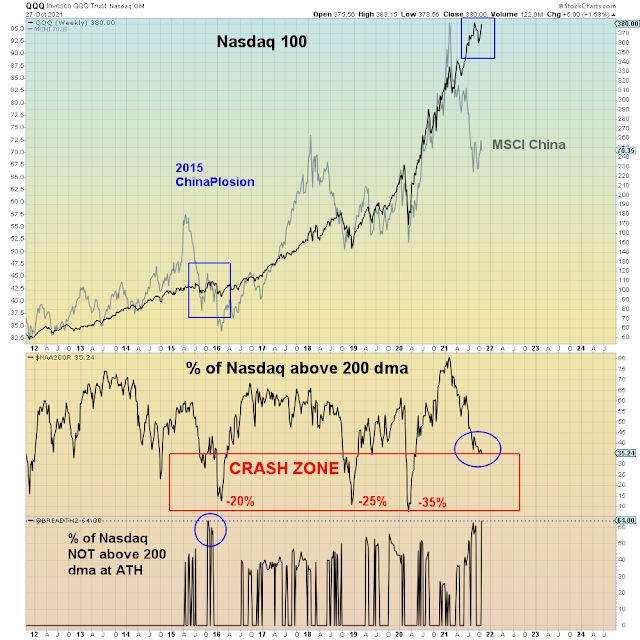

On Friday we just got the first hot payroll number in several months. It appears the termination of Federal pandemic UI finally gave a boost to corporate hiring. Nevertheless, bond yields TANKED on Friday. As I showed on Twitter, bond yields have fallen (t-bonds rallied) EVERY TIME the has Fed tapered QE. And yet STILL pundits are shocked by this occurrence and are therefore now crying policy error. It's either that or admit they've been wrong all along.

Why are bond yields rolling over? Because the Fed is taking liquidity out of markets and hence inflation expectations are falling. And THAT is driving bond prices higher. Unlike the late 1970s when the U.S. middle class was at its apex, now the labor share of the economy and capacity utilization are at all time lows. In addition, we now have MILLIONS of workers missing from this fake recovery.

Late on Friday, the House finally passed the trimmed down Biden infrastructure bill. Too little, too late. Now markets will experience reduced fiscal AND monetary stimulus at the same time. AND a potential debt ceiling/shutdown in just a few weeks deja vu of the 2018 clusterfuck.

In other words, we have very likely witnessed peak reflation.

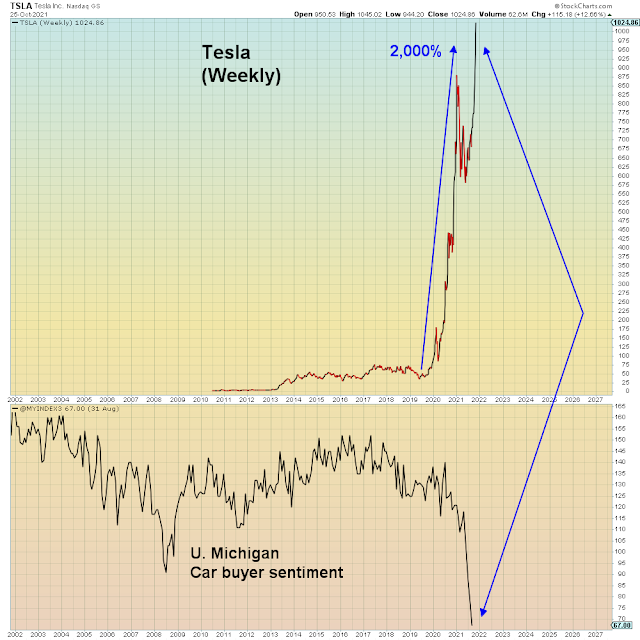

Against this backdrop Transports have "confirmed" this latest all time high, now more than five decades overbought. Trolls inform me it's all due to Avis. No it's not it's due to vertical Tesla and Ford, all things EV, record auto parts companies, Autonation, record railroad companies, and record trucking stocks.

I feel like a high school teacher with the stoners at the back of the class waking up to tell me I'm wrong.

And so it is that here comes the REAL Whack-a-Troll.