At the apex of human history's largest asset bubble, social mood has nowhere to go, but down. Central banks have been increasing the wealth divide every day since 2008. Still, the masses will be shocked when monetary welfare for the rich spontaneously explodes. No one told them printed money is NOT the secret to effortless wealth.

Ludwig Von Mises died in 1973 long before Quantitative Easing (aka. monetary welfare for the rich) was invented. His conventional inflationary theories never predicted the massive deflationary impulse that Globalization would soon create. A world of poverty imported by container ship straight to America's shores. Unlike prior mercantilist eras throughout history, Asia's exporters have never cared that the U.S. dollar was no longer backed by gold, hence they have never rejected it as Von Mises predicted. Instead, they took their bounty in factories, jobs, and industries. Now, ironically, they are as wed to this Faustian Bargain trade relationship as we are.

It's clear from the comments on my Twitter feed that most people don't understand the difference between inflation and deflation. That's because at the individual level they feel very similar - a declining standard of living as a paycheck no longer covers expenses. Which explains why most people view this as an inflationary death spiral. At the macro level however, inflation and deflation are nothing alike. Inflation takes place when consumer purchasing power is rising along with wages to fuel the inflationary spiral. It assumes FULL employment. What if no one had a job, would there be inflation? Of course not. The U.S. currently has the lowest EMPLOYMENT rate in modern history. People are leaving the workforce in droves and economists can't figure out why.

There are different reasons why people are leaving the workforce, depending on age, gender, occupation, parenting status etc. For one thing almost all pundits seem to forget that there are 60 million gig workers in the U.S. right now. None of those gig jobs show up in the monthly jobs report. Secondly, many Millennials are quitting their jobs to become full time gamblers in stocks, cryptos and other markets. Thirdly, Boomers were retiring at an average rate of 10,000 per day even BEFORE the pandemic; however, the pandemic moved up their retirement by many years. Why? Peak asset prices.

"About 3 million people retired earlier than they likely had planned as a result of the Covid environment, according to a report by a senior economist at the Federal Reserve Bank of St. Louis"

“Standard theories of household behavior predict that when people get richer, they work less, and there is some evidence that the evolution of asset values influenced labor force participation in previous recessions, especially for those closer to retirement,” the report read. “The large rise in asset valuations during the pandemic suggests that retirement may have become feasible for many people.”

The Fed STILL hasn't figured out that the Fed is the reason why there are so few people looking for work right now. Let's face it, these are not bright people.

"Where did everyone go?"

There are other deflationary factors that were accelerated by the pandemic: One was the overuse of technology. Silicon Valley has a term they use to describe today's rapacious business model: "Blitzscaling". Blitscaling means using "free" capital to subsidize unprofitable business models as they scale up by destroying traditional competitors. Anti-trust regulators used to call this predatory competition. Now, it's the standard business model for untold numbers of "unicorn" billion dollar pre-IPO companies. At 0% interest rates, pretty much any business idea that MAY turn even a minor profit in the very distant future will get funded. And hence now we have the "virtual economy".

And of course global debt exploded during the pandemic.

One chart I posted on Twitter recently showed the collapsed velocity of money. The velocity of money measures the rate of circulation of money throughout the economy. Fed balance sheet expansion is going straight into markets not the economy, like a shot of adrenaline. From there the trickle down effect is making its way into mega yachts, Teslas, and Rolex watches. From there it goes straight back to the banks where it sits as excess reserves.

The banks lend the money back to the Fed via reverse repurchase agreements, and they earn interest on it for doing absolutely nothing.

Here we see the velocity of money (blue line) and the reverse repo $ amount (red line). What inflationists STILL don't understand is that monetary welfare is for the rich, it's not for everyone.

The other shocking chart I showed on Twitter is this one of commodities.

As we see, during the pandemic, commodities lost 50 years of nominal price gains. Subsequently, they have enjoyed the largest rally since 1974. What we also see from this chart is that even before COVID, the trend was already down. 2016 price levels were below 2008 levels. 2008 happened to be peak Chinese growth rate. Now, this year China is set to record its lowest GDP growth in 25 years. Add in a skinnied down Biden infrastructure bill, and there will be no follow-through for this mega rally:

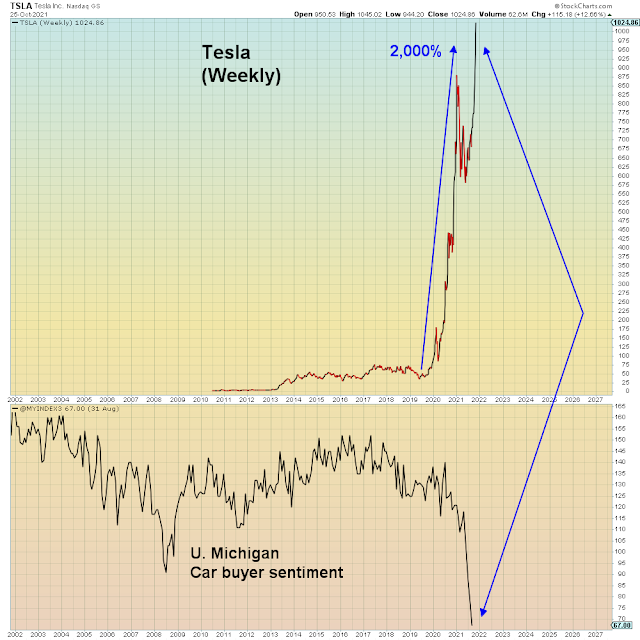

Taking this all together, I am not a deflationist, I am a hyper-deflationist. The only thing standing between us and hard economic reality is human history's largest asset bubble. Consumer confidence has already collapsed and it has taken down housing and auto confidence along with it. This is the consequence of monetary welfare for the rich. It has bid up asset values beyond the reach of normal citizens. As a result, household liabilities have sky-rocketed. The deflationary burden is increasing with each passing day and it will accelerate upon asset bubble collapse.

Since the start of the pandemic, Tesla has gained 2,000%, while Elon Musk's bubble wealth increased 12x in two years.

What we are watching in real-time is peak insanity. The Pyrrhic victory of misallocated capitalism at the EXPENSE of the economy.