Ahead of next week's seminal meeting, the FOMC has been signaling they are more than ready to start tapering their asset levitation program aka. welfare for the rich. Ironically, today Congress shot down the concept of a wealth tax on the Fed's welfare recipients, because we all know it would be "unAmerican" to punish monetary transfer payments with taxation. Hard work gets taxed but Elon Musk touting shit coins on Twitter for a 12x gain in wealth that's fair gain under the current "system".

Meanwhile, today's pundits are starting to u-turn away from the fake reflation theme to the Fed-imposed deflation theme. In the process they will leave the majority of their acolytes behind holding the bag of inflated assets.

Hoarding explosion...

Since the pandemic began, Elon Musk's wealth has increased 1200% all due to monetary asset levitation. There is no way to account for that magnitude of gain based upon the "fundamentals" of Tesla. Nevertheless, ALL of that inconvenient fact has been ignored during this most recent debate over a billionaire wealth tax:

"The pandemic has worsened U.S. income disparities, and the wealthiest layer of society is emerging richer than ever before. Between January 2020 and April 2021, America’s billionaires got about $1.2 trillion richer. In dollar terms, Musk was the biggest gainer of them all. Two years ago, Forbes pinned his net worth at $19.9 billion—less than one-tenth of what he’s worth today"

As I have said many times, the politics of today are totally fucking delusional. Those who play the parlor game of assuming these two parties are quibbling over relevant facts, deserve what's coming. Case in point, Joe Manchin sells himself as a centrist Democrat. However, he is clueless as to how weak this economy is right now. Therefore, he is essentially blocking fiscal stimulus that would have cushioned the blow of this impending super recession. He will change his mind quite soon I think, as will his Republican colleagues, when they take down this impending wealth haircut, which will make a 2% wealth tax seem like a great idea by comparison.

Ironically, what we are witnessing AHEAD of the first tightening action by the Fed since the pandemic began, is a wholesale melt-up of the economic reflation trade. Deja vu of 2008, the Fed and its inflationist acolytes are clueless as to the weakness of the economy. Zerohedge keeps making up this Wall Street endorsed story that the policy error is on the front end of the curve - keeping short-term interest rates too low for too long. However, the policy error is ENTIRELY on the back end of the curve - the Fed should have tapered their asset buying a LONG time ago. That is the difference between Bernanke/Yellen vs. Powell - Bernanke always put a set dollar limit on his QE programs. Whereas Powell has been far too profligate with the asset levitation programs that he and his Fed colleagues have been front-running.

History will say THAT was the COLOSSAL error. Notice the magnitude of difference between the post-Global Financial Crisis balance sheet expansion and now (lower pane):

Where was I...

It's clear that human history's largest monetary welfare recipient hasn't read too many books on world history.

"Tesla was built on government cash. For years it used government incentives for people to buy electric vehicles. Much of its current profits are thanks to the sale of government regulatory credits to other, traditional automakers, which allowed them to keep making gas-guzzling pickups and SUVs rather than reduce their emissions...Its founder, the most epically rich billionaire Elon Musk, has also been known to avoid paying personal income taxes, according to ProPublica"

In other words, Elon Musk has massively benefited from monetary AND fiscal welfare for the ultra wealthy.

This chart will be the epitaph for this era:

Here we see that monetary welfare has bid up Tesla to the stratosphere while car buyer sentiment has crashed to a 40 year low. And I should mention the 1980 prior low was in the depths of a recession.

No question, implementing a billionaire tax when the U.S. needs insane amounts of borrowed money from abroad would be impossible to implement. Nevertheless, if they were smart, at this biblical juncture billionaires would not be weighing in on THEIR disincentives for making money. After all, sitting around waiting for weekly FOMC bond buying programs makes them far more money than going to the office.

What it all comes down to at this point in time, is that far too many people have come to believe that rampant stupidity is the new normal. When I tell people that crash is inevitable, they always ask me when is that? Apparently it's not just wasted money that is of no issue, wasted time is of no concern either. I am quite certain they will feel differently when this all explodes.

Speaking of which...

I have been pounding the table on the 2018 deflation paradigm, however, with this impending Fed tightening action, 2015 is starting to loom large. Back then, China's stock bubble was imploding and their economy was weakening. At the same time the Fed was getting set to raise rates for the first time since 2008. The market tanked in late August so the Fed delayed their tightening until December. When they tightened, global markets exploded in early January.

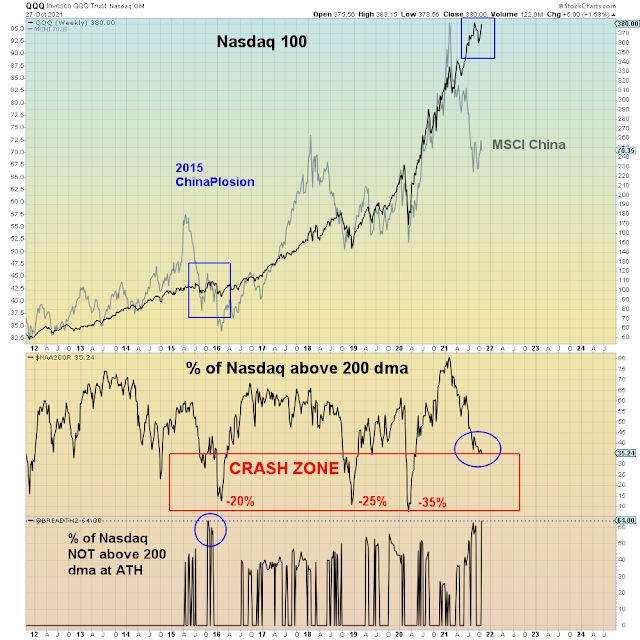

In the chart below, I will highlight the similarities. First off, including Tesla the Tech sector is now 40% of the S&P market cap. The most in market history. Below in the main pane we see the Nasdaq 100 in black and Chinese stocks in gray. 2015 is boxed to the left.

In the second pane we see Nasdaq breadth is camped at the crash zone. In the pane below that we see that breadth divergence is the greatest since October 2015. Both then and now, these readings are records going back 20 years.

In summary, the Fed's policy error was inflating this mega bubble. What they do next will be merely tacit acknowledgement that they have not even the slightest clue how much risk they have created. Unlike Janet Yellen we need not worry that Powell is going to give a damn about China. All of which leaves today's pundits very limited time to u-turn from the runaway inflation theme to the economic deflation theme. Needless to say they will leave the majority of their followers holding the bag of inflated assets.

Hoarding explosion.