There is an exorbitant price to be paid for this fool's errand, in time and money. The true bagholders will be short of both when it comes to this final reckoning. I predict very few "winners" in this ultimate game of chance. Art is imitating life on the most popular show in Netflix history - "a bit of the old ultra violent" Squid Game, is a South Korean version of the Hunger Games, wherein desperate gamblers from all walks of life are recruited into a deadly series of games for the amusement of the ultra wealthy.

If gambling is a rampant problem, then one can make the case that the situation isn't about to improve as the Kospi backtests the 200 dma ready to go bidless:

These Global Chaebols however are far from merely a South Korean problem. China is taking its oligarchs to task in a serious way, whereas the U.S. is sitting back and doing nothing. More content to criticize China for interfering in what is clearly exceptional capitalism.

"...None of those U.S. shows capture the rage and despair of our broken capitalistic system, in which young people are crushed by debt, social mobility feels like a joke, power and capital are hoarded by unreachable oligarchs and elected officials are too impotent or indifferent to help"

Indeed.

U.S. policy-makers are captured by the system. From an economic standpoint, the "center" has silently moved to the right over the past forty years, meaning the old center is now to the left of Nancy Pelosi and her gambling husband. Ron Paul can take pride that he consistently voted for the destruction of the middle class, while pretending to be a man of the people. It's the fruit of forty years of "Shock Doctrine". In the words of Milton Friedman, never let a good crisis go to waste. Now what we have is a Third World economy papered over with continual stimulus.

And it was all going so well...

My predictions for a deflationary collapse in 2021 have been continually pushed back into the end of the year, bonus season. The stakes have never been higher. Unfortunately, none of today's pundits acknowledge the binary risk inherent to these manipulated markets. They are all content to extrapolate Ponzified "stagflation" into the indefinite future. Not one of them acknowledges the role of speculation in fueling this illusion of reflation. Capital is now front-running the economy and inventing false narratives on the way. Whereas the economy used to drive markets, now it's the other way around.

Returning to the 2018 analog, all of the Trump tax cut stimulus was spent in the first half of the year. By the fourth quarter, the fiscal drag was well underway while the Fed was hell bent on tightening. Sound familiar?

I can't explain why these serial fools keep believing the same fairy tales each time expecting a different result, but they do, every single time. Here we see via Financials that this week the reflation delusion went full crack up boom mode, however NYSE new highs are right back to where they were a year ago when the massive post-election reflation rally got started.

The whole stimulus-driven illusion is turning back into a pumpkin.

Just in time for Halloween.

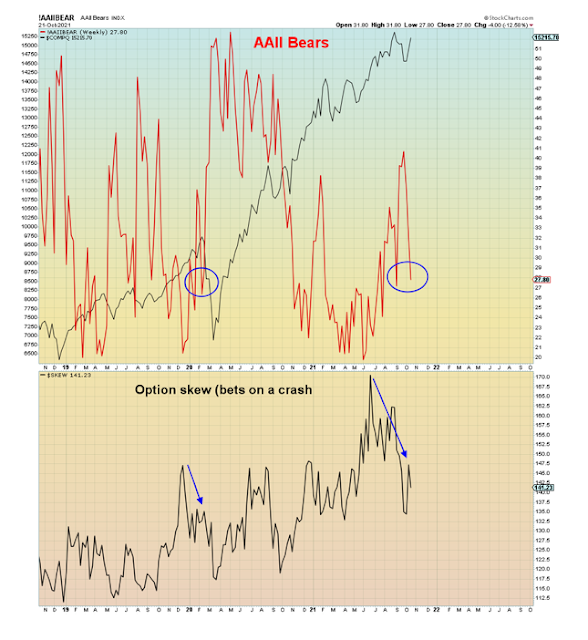

Here we see weak bears are capitulating deja vu of last year at the top. Meanwhile, skew is also coming down.

All it takes for delusion to become rampant is time and misallocation of capital.

It's been a long time since we saw both cyclicals and growth stocks implode at the same time...

Global markets have seen this fake reflation movie over and over again since 2008.

This secular recovery fantasy is a Made In America export.

In summary, at the beginning of this longest cycle in U.S. history, Millennials were protesting Wall Street. Now they are massively levered to the world's largest Ponzi scheme, the S&P 500. Bitcoin/crypto is the fission trigger for thermonuclear detonation of the Weapon of Millennial Destruction (WMD).

They have now officially become Generation Gambler. And when they implode, they will take down everything.