All of 2022 risks have been kicked down the road into the end of the year. From Wall Street's perspective, it's money in their bank...

Looking back at the past year we now know that Wall Street's predictions a year ago were total science fiction. Their Fed rate hike predictions were wrong every quarter of the year, by being continuously over-optimistic. And yet, CNBC and Zerohedge dutifully quoted Wall Street’s used car salesmen every step of the way, never once questioning the bullish bias. A premium service that costs twice - once to get the advice and again when you go to use it like a useful idiot.

So it can come as no surprise that Wall Street predictions for 2023 are "looking across the valley" to the better market that lies ahead in the second half of the upcoming year. Hence the average forecast is unchanged to up 5% on the year.

"The range of forecasts is pretty wide this year: Bloomberg surveyed 17 strategists who had an average forecast of 4,009. Reuters’ poll of 41 strategists revealed a median forecast of 4,200."

In other words, despite a Fed target rate that has risen 500% year over year, Wall Street has only reduced their outlook to neutral. Investors can expect somewhere between 0% to 5% return while taking epic - this time KNOWN risk. We all know that monetary policy operates on a lagged basis, and yet the SAME magnitude of rate hikes that collapsed the housing bubble in 2007 are now met with a shrug.

Meaning that Wall Street's 2023 predictions are the same as their 2022 predictions - buffoonishly optimistic.

That's the bad news. The good news is that Wall Street has already closed the books on this year, giving the impression that 2022 risks have gone into hibernation when in fact they have been merely ignored and punted into next year. But why would any (financial) industry that counts one year of P&L at a time, care about that?

So it falls on us to ask the question what could go wrong?

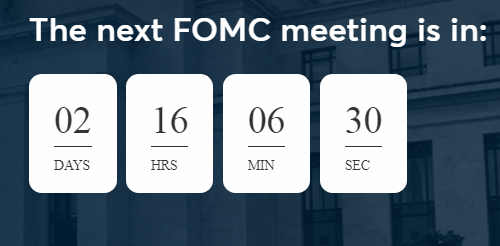

First off, BOTH the Fed and ECB are expected to raise rates by .5% in this coming week.

"The European Central Bank will take its deposit rate up by 50 basis points next week to 2.00%...at its fastest pace on record...despite the euro zone economy almost certainly being in recession"

Europe had already been dealing with the supply shock caused by the pandemic, and now they are struggling with the supply shock caused by the war in Ukraine. So what to do? Raise interest rates on consumers at the fastest rate in history. Consider that the European deposit rate had been negative for the SIX years before the pandemic. And this week it's on the way to 2%. Sound familiar? It's an even bigger policy mistake than the Fed is making. At least the Fed can still pretend the U.S. is not in recession. Not one media stooge has thought to ask the Fed/ECB why they are jacking up rates when rates didn't cause inflation in the first place.

What all of these monetary dunces don't realize is that wages are growing SLOWER than inflation, hence this is NOT demand side inflation. Which is why this policy error will cause the fastest global demand collapse in history. And policy-makers won't be able to resuscitate the middle class when it happens. All because they used their balance sheet to create inflation, and now they're using interest rates to quell inflation. Supply-side idiocy.

Which gets us to the casino. A confluence of factors are coalescing, similar to what happened right before the pandemic meltdown.

For one thing, speculators were very active going into March 2020. One of the risk assets they were bidding up were low quality shipping stocks:

Similarly, in early 2020 Chinese stocks had been shellacked by the early pandemic. However, they suddenly rallied in February due to the excessive amount of stimulus provided by the PBOC.

The same thing is happening now, as we see in the upper pane of the chart below.

Another thing this chart shows is the manic levitation of packaged foods company Campbell Soup company. Which is manifestation of the U.S. recession trade. Another common factor from February 2020.

Another factor many investors seems to forget is that the $USD had a major pullback in February 2020 just before it sky-rocketed. The timing of this dollar pullback lines up with the other risk factors mentioned above. Right before all hell broke loose.

In summary, it's going to be an interesting week.