Gamblers are betting the worst is over. Unfortunately, the worst hasn't even started yet...

The only thing that can bring down inflation quickly is a market crash. Hence the Fed has signaled they will keep it up, until their job is done.

"Good news":

The Dow just closed November with the largest two month Dow rally in history (75+ years). Powell was hawkish, but the market didn't care. Nothing could derail this manic melt-up. This impending December rate hike is not a pivot, it's not a pause, it's merely a "step down" from .75% to .5% with ongoing potential rate hikes in 2023. We've entered the Twilight Zone in which a .5% rate hike went from being unthinkable a year ago to good news now. Per Hendry's Iron Law of Disney markets, bad news is constantly conflated as good news. In addition, what bad news obtains has been magically pushed into 2023. Another important concept that has been forgotten is something called "conflict of interest".

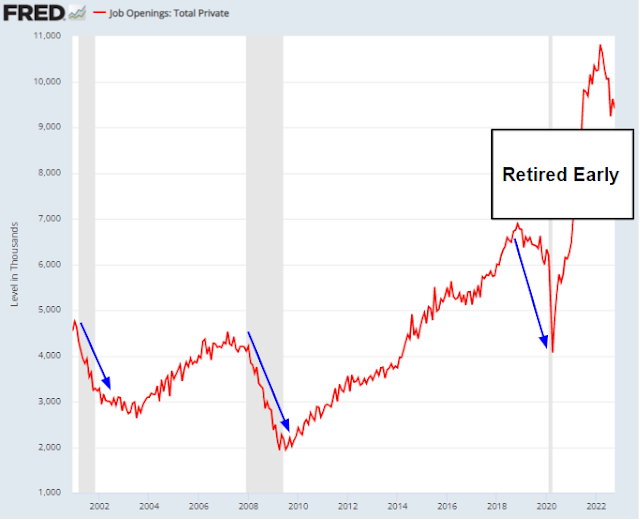

Powell indicated the main source of ongoing inflation is the tight labor market which is not expected to weaken markedly any time soon. The labor market mismatch is primarily due to two million early retirements that occurred during the pandemic. Ironically, due to high stock prices caused by the Fed. Which means that instead of increasing the supply of workers through higher labor participation, the Fed's goal is to reduce the demand for workers. The Fed is of the belief that because job openings are extremely elevated (see below), they can produce a soft landing. However, as we see from the chart, the only way to bring down job openings historically is through recession. Bank of America agrees this is the most likely outcome:

Notably, the Fed never mentioned record corporate profit as a source of inflation. Which I should remind everyone - but mostly the idiots at the Fed - that record corporate profit is AFTER deducting "inflated" employee wages. How could wages be the source of the problem when profits are up 45% in three years?

Here is what BofA has to say about the relationship between jobs, recession, and corporate profits:

"The prospect of negative job growth and a recession probably won’t bode well for the stock market. When the economy contracts, corporate profits usually deteriorate"

Bank of America’s head of U.S. equity and quantitative strategy Savita Subramanian recently said that the S&P 500 is “expensive” and “super crowded.”

Despite all that, BofA sees stocks flat year over year. They predict a mere -10% downside for S&P profits. Below we see how that looks historically. It would be 1/3rd the profit decline of the least worst recessions in 30 years. Despite the fact that the CPI is at the highest level in 40 years. It's all part of the stagflation fantasy now propagated by Wall Street. It's the new permanent plateau of delusion.

Imagine if profits declined a moderate 30% AND stocks declined 30%, that would mean stocks are STILL expensive.

Per the stagflation thesis, stocks are good, bonds are bad, so no surprise we see that retail investor allocation to stocks remains high through November. I am still of the belief that long-term Treasury bonds will substantially outperform stocks on both a relative and absolute basis in 2023.

Per the title of this blog post, I would not be the only unwavering bearish blogger if I did not point out that this will not be a linear process as predicted by Wall Street.

Which is why we must look to the 2015/2018 analogs which were the only two years in the past two decades that featured a December rate hike. And they were both debacles.

I contend that the Santa rally is ALREADY over. It ended a month too soon this year as evidenced by the biggest two month Dow rally in history.

The CNN greed/fear index just flashed its highest reading of 2022. This Dow pattern is similar to last year, except the Dow is peaking a month early. In addition, every spike in the greed/fear index was a rally top in 2022. And of course last December didn't have a rate hike.

Worse yet, we appear to be approaching what Elliott Wave technicians call the "Third wave down". Which means that the decline in the first half of 2022 was the first wave down. The two rallies in the second half were the second wave up. While the waves are not as clear in the S&P 500, the waves are much clearer in this chart of regional banks, which also predicted the 2020 crash. How could banks predict a pandemic? They didn't, the bank chart merely predicted that stocks were about to go down for ANY reason.

In summary, Wall Street doesn't predict black swan events, but they should. Because a market crash is far more likely than stagflation. And when it arrives, the crash will reset all economic and market predictions LOWER for 2023. Which means this market will be STILL over-valued at a lower level and gamblers will be trapped by you know what.

Believe it, or not.