My prediction for 2023 is that widely ignored fraud will explode spectacularly, amid what will be widely considered an unforeseen Black Swan event. When that happens, all of Wall Street's lethally optimistic predictions for 2023 will be instantly imploded...

My Twitter picture (below) was taken at the Ladner bird sanctuary in 1971. My first encounter with a black swan. I have since migrated south of the border.

Sam Bankman was extradited to the U.S. this week and released on $250 million bail. His partner in crime was released on a mere $250 thousand bail because she threw him under the bus. She admitted they had been knowingly committing rampant fraud, in exchange for a reduced sentence. This is the type of criminal spectacle that keeps this society preoccupied while they are being fleeced by what I call criminality as usual.

The problem with today's markets is the problem with this society - we are dominated by storytellers who ignore all facts. Today's market predictions are science fiction, however this society has an addiction to what I call "soft" fraud.

Which gets us to my 2023 prediction. I predict that the Fed will continue to escalate their campaign of incompetence, and Wall Street will continue to escalate their campaign of fraud until it all explodes with extreme dislocation. Bullish pundits who assert that us skeptics have been wrong this whole time, will be viewed as accomplices to fraud.

Let's recap:

In 2021, exiting the pandemic the Fed made the mistake of staying too loose for too long. In league with global central banks, they inflated the largest bubble in human history. Wall Street took full advantage by "democratizing markets", which meant democratizing fraud. It was exhibited by the Gamestop/ AMC pump and dumps which were conflated as victories for small investors. In addition, a record $1 trillion of junk IPO/SPAC issuance dumped on small investors. Followed by the Ark ETF bonfire of retail money, and mainstream adoption of Crypto Ponzi schemes in 401k retirement plans.

But who knew all of THAT would be small time compared to what was coming in 2022? Not one bullish pundit.

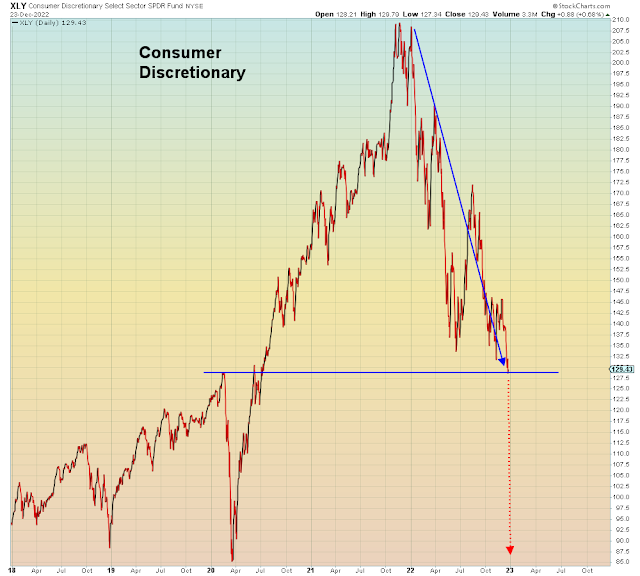

In 2022, the Fed made the mistake of panic raising rates up to a level 3x higher than pre-pandemic while keeping their balance sheet unchanged on the year. Today's bullish pundits STILL have yet to realize that was a colossal mistake, because it has so far only imploded the middle class while leaving the casino class intact. In 2022, Bankman's FTX losses were 1/100th the scale of mega cap Tech losses. Wall Street's consensus 2022 market prediction was off by -30% at the lows of the year and it remains off by a bear market magnitude, as we see in the S&P 500 full year chart below.

I now predict 2023 losses will make 2022 seem like chump change because once again, the Fed and Wall Street have found a way to up the ante:

My prediction for 2023 is that Wall Street's profit and GDP estimates will be off by a minus sign and their market consensus of S&P 4,000 will be catastrophically wrong.

The Fed will be tightening in a bear market/recession. The much anticipated "pivot" will be a total clusterfuck that will accelerate investor risk aversion. I predict the Fed will react very slowly to market meltdown and then they will ultimately panic, causing even more mayhem. Today's bullish pundits just assume that the Fed can easily pivot 180 degrees to rescue markets even though that wasn't the case in 2000 or 2008.

It will be like March 2020 without the central bank bailout. When that happens, the simmering global housing bubble will final explode, rendering all of Wall Street's 2023 predictions instantly buffoonishly optimistic.

In summary, "hard" fraud accounts for a de minimis amount of society's wealth losses. Whereas soft fraud accounts for the overwhelming amount of societal losses. Casually destroying people's financial lives is now the primary business model.

And it's going out of business in 2023.

The SEC will finally be seen for what it is - an enabler of mainstream fraud, while focusing solely on small time spectacle.

As always, the burden of truth is on the minority who believe it exists.