“We allege that Sam Bankman-Fried built a house of cards on a foundation of deception" - SEC Chair Gary Gensler

Indeed.

The newly released FOMC outlook for 2023 was super hawkish. Clearly Fed members are getting frustrated at the fact that financial conditions are no longer tightening. The exact same thing happened in the summer, forcing the Fed to pound markets back down.

Today is deja vu, but this society has LETHAL amnesia.

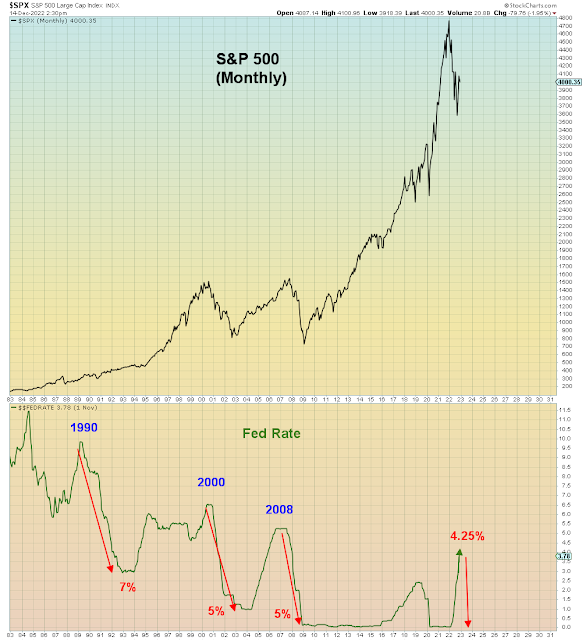

The Fed doesn't understand that they are using the wrong policy tool to tighten financial conditions. They should be reducing their balance sheet at a much faster pace. So in the meantime they keep raising rates, each time expecting a different result. The Fed has now raised rates as much as they did in 2003-2006, but in a third of the time. The consequences of which have yet to be determined.

It's highly likely that this will be the amount of interest rate buffer that the Fed has going into a depression of their own making.

Not enough.

What happened this week with the Sam Bankman-Fried arrest is eerily reminiscent of the Madoff arrest this week in 2008. The Feds are arresting small time grifters while facilitating the much larger scam taking place in the "regulated" markets. It took the Feds WEEKS to arrest Bankman-Fried primarily on charges of illegal overseas wire transfers. Plenty of time to execute more illegal wire transfers. Clearly, this society has not even the slightest clue anymore as to what constitutes fraud. The entire crypto industry is predicated upon the principle of "DeFi" meaning decentralized finance aka. deregulation. The SEC was never SUPPOSED to get involved. But now that people are getting wiped out en masse, grifters are claiming that slack regulators are to blame.

Post-pandemic, there is not one asset class that has been spared the vertical pump and dump treatment, and yet investors continue to buy the dip. What started with Gamestop and other junk stocks spread to Ark ETFs, junk IPOs and SPACs, EVs in 2021.

And onto commodities in 2022. Which are now collapsing like a cheap tent reminiscent of 2008.

The big problem for investors - beyond total incompetence at the Fed - is that policy-makers both on the fiscal and monetary side have stimulus fatigue due to the pandemic. Which means they are taking a hard line on any form of bailouts. The losses are falling where they may.

This is only the beginning. Because as the dominoes continue to fall, the reflex to bailout investors will be muted by societal acrimony. By the time they figure out they made a massive error in not panicking, it will be far too late.

In summary, this is a house of cards built on a foundation of deception.

Position accordingly.