The biggest risk for gamblers anticipating bailout in 2023 is that we are at the exact opposite end of the Fed policy continuum from bailout...

Rewind to November 10th, 2022:

"There's still a chance we can avoid a hard landing if the Fed pivots in December"

Exactly. But the Fed didn't pivot in December. So now what do bulls expect? They expect a Fed pivot and soft landing to come in 2023 instead. And a pony to go with the horse shit.

Recall that during the first half of 2022, pundits pounded the table saying the Fed was tightening too slowly. Markets had their worst first half since 1970. So then pundits panicked and spent the last six months saying the Fed is tightening too fast.

Which is why the watch word of the year is "Fed Pivot".

What they call "pivot", I call bailout. Have you noticed I'm the only pundit who uses this term? Pivot sounds so official and technical. It's almost like a real economic term. Whereas "bailout" sounds like a trapped bull in desperate need of Fed assistance - the entire market story for the past fourteen years.

This current Fed bailout fantasy has been assiduously cultivated by the financial media desperate to give trapped bulls the illusion of another easy bailout. Just this week, Goldman Sachs put out their latest prediction for 2023 saying it will be an even softer landing than consensus already predicts (re: 4,000 SPX is consensus). Goldman actually sees a soft landing WITHOUT a Fed pivot in 2023, which is on the side of free-basing crack. Bearing in mind that the people writing this were playing Halo in their parents' basement in 2008.

Zerohedge compounds confusion:

"We agree that a divided Congress will be unable to respond to a recession (which will occur), which means that the only support possible in 2023 and 2024 will be from the Fed, and yes: the firehose is coming"

Of course the firehose is coming. But at what level is the question. Will Zerohedge join the NBER in declaring recession with the SPX down -50% as they did so well in 2001 and 2008?

It appears they will.

In early 2023 we will find out what would have happened if the Fed hadn't pivoted in 2018 because the Fed won't pivot until they see market panic and by that time it will be too late. Moral hazard has caused too much underlying technical damage, as we see in the lower pane below.

Recall that in 2008 the Fed didn't have to (1) pause (2) pivot (3) stop QT (4) start QE. We are currently at the exact opposite side of the bailout continuum from 2008 AND from March 2020.

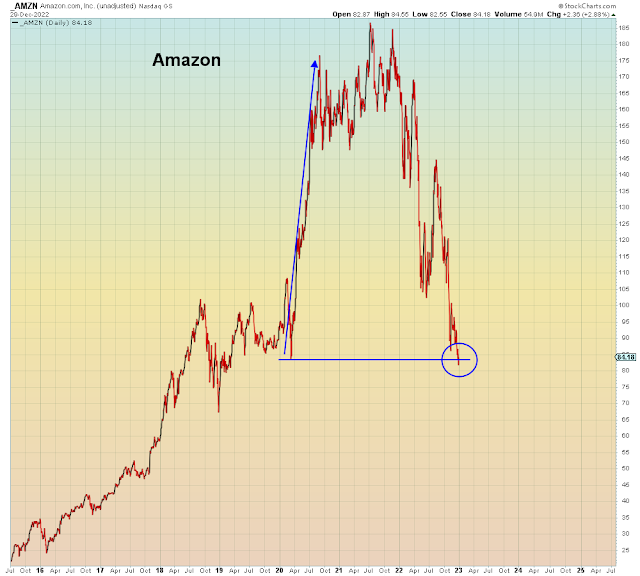

Unlike March 2020, Tech won't support the market this time around.

Recall that it was the "work from home" Tech stocks that supported the market in 2020. Now most of those stocks are already below their March 2020 lows.

2022 has done all of the pre-crash preparation. The ensuing global RISK OFF will leave the casino bidless with nowhere to hide.

The Fed's Volcker gambit of shock interest rate hikes will fail catastrophically because global central banks don't have enough rate hike dry powder to prevent mass deleveraging. And as Zerohedge admits, this Congress will be deflationary. When I say deflationary I mean that supply will exceed demand at the macro level. Leaving a glut of EVERYTHING at the same time.

Contrary to popular belief, already-collapsed consumer sentiment will not improve in 2023 when global asset markets explode.

This is nothing like 2018 in terms of consumer sentiment:

In summary, right now 90% of investors and pundits are bullish and 10% are bearish. I mean really bearish not Wall Street bearish.

This bear market doesn't end until it's the other way around. When that happens, we will STILL be in the minority camp, battling the same morons every step of the way.

And on the right side of the trade.