"It seems like asset bubble warnings are emerging everywhere you look these days...a growing legion of retail investors are challenging Wall Street orthodoxy and sending shares of previously unheralded stocks into the stratosphere...Trendy bets are all over the place, with cash pouring into assets from solar power and cloud computing, to exotic new investment vehicles like special purpose acquisition companies (SPACs)"

So what’s behind all the speculation? In a nutshell, the global pandemic. Policy makers have rolled out trillions of dollars in stimulus to cushion the economic blow, money that could well end up pumping asset bubbles

With even the riskiest debt now paying less than ever, investors are chasing every catchy extreme in search of the next big payoff"

"As the craze for SPACs, special purpose acquisition companies, on Wall Street continues to play out, the “Mad Money” host turned cynical, saying the market has been “flooded with cash to the point of absurdity.”

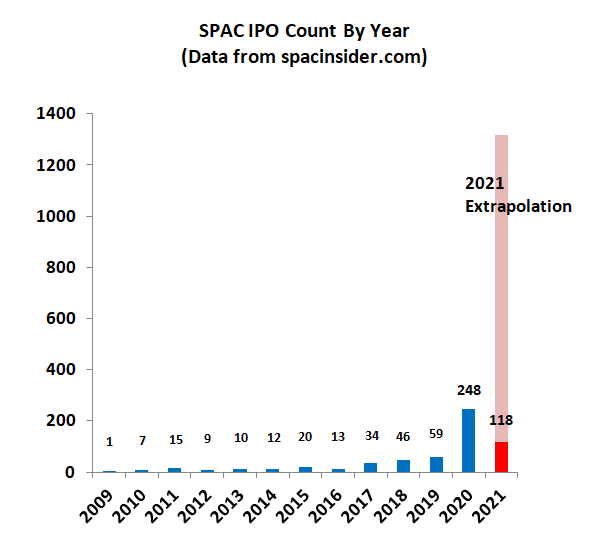

SPACs are similar to IPOs, except the money is raised up front and then the acquisition target is selected. The theoretical benefit of a SPAC is that it lets public investors get in on the ground floor of investment. Think of it as public venture capital. However, the private companies that are the targets of acquisition are usually extremely speculative and often have no revenue or earnings. This shows SPAC issuance by year. So far 2021 (bright red line) has double the issuance of 2019. The light red line is an extrapolation based upon current issuance.

In hindsight today's sleeping regulators will realize that junk SPAC issuance was a key contributor to collapse, as it sucked liquidity out of the market.

Of course this all ends badly, but this time policy-makers won't have the tools to repair the economic damage. What we are already witnessing is the convergence of fiscal and monetary policy, with oversight by a fractured Congress. The consequences of a bubble explosion now could not be more extreme. Collapse of wealth and income is inevitable especially for those high income households who do not see this coming. Those who are lower income and/or have minimal market exposure will be less impacted by impending asset deflation.

It seems like ages ago but recall that last week was a total gong show - every major broker had multiple outages during the week. Last Friday, the casino ended at the lows of the week camped at the 50 day moving average. However, in retrospect it was a bear trap, because the market vaulted back up to all time highs this week. Fast forward one week later and all concerns over last week's dislocations have been forgotten. Never mind that the set-up is the exact same as last February - a bear trap bounce at the 50 day followed by a whiplash bull trap all time high:

And what caused this massive ramp to new all time highs amid mass trading outages? As I reported earlier this week, Robinhood saw record app downloads last week, peaking on Friday at 600,000 in one day. For the week, 2.1 million new downloads

"The platform "experienced record growth during some of the most challenging days operationally this past week as Robinhood continued to lead the industry in app downloads last week by a wide margin"

But the story gets even crazier because it wasn't just Robinhood that saw major trading app downloads last week:

Week over week, Fidelity app downloads increased 900%, E*trade was up 720%, Ameritrade 575%, Schwab 339%.

Across all platforms combined, broker app downloads increased 300% last week over the prior week.

So we need not wonder why the market was bid this week. All it took to garner a mad dash into risk was RECORD Nasdaq down volume on a mere 4% decline in the S&P 500. Higher down volume than Lehman.

A minor preview of what is coming:

Meanwhile, bulls will be happy to know that Yellen completed her inquiry into last week's gong show and she concluded that Disney markets are "resilient". Mind you, resilient and frenzy are not normally words that make sense in the same sentence:

Gamestop is a reminder of what happens in EVERY pump and dump and Ponzi scheme. The early stage "investors" make a lot of money and get interviewed on CNBC, while the vast majority of people get left holding the bag.

Our middle son made another $250k last week in Gamestop and then he put it all into SPACs. I almost shit a brick. But I've been informed the old man doesn't know what he's talking about.

FINRA just posted margin balances through December. What we see is that gamblers were deleveraging into the top one year ago in February 2020. However, since the pandemic, they have been loading up on risk. These margin figures are lagged of course, however, one would be delusional to believe that the spike in trading accounts we saw last week did not further increase leverage.

Who knew that all it took for rampant speculation was a global mass death toll and shutdown of the economy?

In summary, there are rampant bubbles, ignored warnings and market glitches. The response from policy-makers is "all clear" and the reaction from traders has been record trading app downloads and record leverage.

No, they don't see it coming.

And no, the old man is not wrong.