Somehow these amnesiacs STILL haven't learned that the good times are only for the ultra-wealthy. When the economy booms, the party is over...

The deflation trade is getting obliterated while the fake reflation trade goes late stage parabolic, corralling bulls into the riskiest stocks at the end of the cycle. A necessary and sufficient event for full explosion.

They are about to get a boom, just not the kind they are expecting:

New York Times, Feb. 22nd, 2021:

Indeed.

Below, this is the Wall Street consensus now: Excessive stimulus and skyrocketing interest rates are good for value stocks and hence good for the overall market. The Y2K Tech bubble will now explode without any consequence:

"As reflation occurs with excessive fiscal stimulus, rising money supply lifts commodities, a positive for value versus growth"

Recall that Tesla now has a greater market cap than the entire energy sector, so how is a rotation to commodity stocks that leaves the largest cap stocks bidless, going to forestall casino explosion?

It won't.

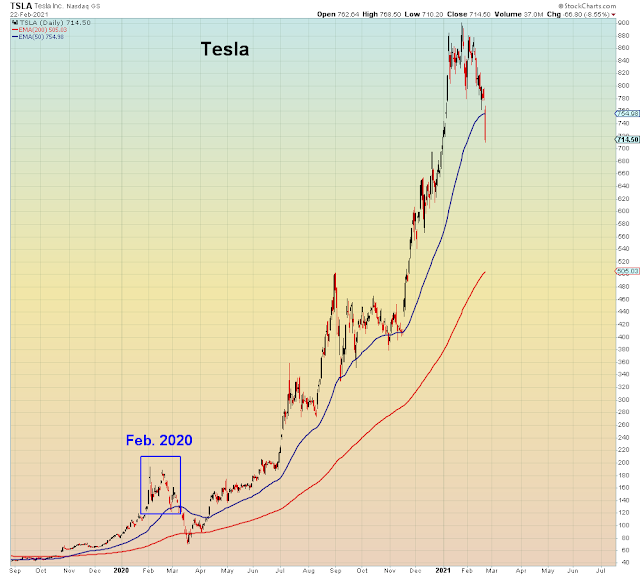

Tesla just closed below the 50 day moving average for the first time since the March meltdown. Another bubble bursting:

In addition, commodity and energy stocks always rally late in the cycle, which should be a warning to today's over-stimulated risk junkies. There is no such thing as "value" in this market. Traditional value stocks e.g. energy, financials, retailers, airlines, hotels, etc. have zero earnings visibility and are trading based upon Magic 8 ball derived forward earnings estimates. These stocks also have far too much debt and weak balance sheets. They are not value companies, they are value traps, and as I showed in my prior post most are already in a bear market.

Below we see the CPI relative to 2008 - the last time we saw a late cycle headfake commodity rally. In that event, oil crashed 70% in a matter of weeks. Quite painful for those who bought into the asinine idea that inflation was coming in August of 2008. They believed this exact same fairy tale nine months into a recession on the eve of Lehman, so why wouldn't they believe it now?

All they have to believe now is that amid the worst unemployment in 90 years, a locked down economy, and a deficit at WWII levels, reflation is imminent. Clearly, reflation expectations have been ratcheted down over the past decade to Japanified levels of non-existent growth, and oil demand at a decade low.

What will it take to create real inflation? It will take a paradigm shift away from bailing out the rich to bailing out the middle class. So far these "stimmy" packages have been too little too late. At best they are merely stopgaps to fill in the chasmic hole left by mass unemployment and a locked down economy.

In any event, the reflation argument is already self-destructing. Higher inflation portends higher interest rates which are lethal in the largest credit bubble in human history. As I've said before, interest rates will rise just long enough to explode the debt bubble at which point headfake reflation will be monkey hammered by a deflationary credit crisis:

Bonds and bond-like product are already imploding:

The safest stocks have left the building:

Tech stocks are going bidless.

Today was another record day for down volume in the world's most popular Tech ETF:

On my Twitter feed I made note of the fact that this current overbought bailout rally is literally almost identical to the 2019 Fed bailout.

Then as now, running on glue fumes and rampant bullshit.