Of all of the frauds and Ponzi schemes operating under the hood of this central bank sponsored vacation from reality, all pale in comparison to the economic recovery fraud taking place in broad daylight. Twelve years of post-2008 monetary bailout is now reaching its logical conclusion - a super asset bubble masking economic depression. Pump and dump schemes have been officially normalized...

This week Fed Chairman Jay Powell painted a bleak picture of the economy in his testimony to Congress. He also pledged to keep monetary policy on full throttle until the economy improves. Therein lies the problem, his own policies have created the biggest divergence between fantasy and reality in U.S. history. His stark view of the economy could not be more at odds with the opinion of the markets he has assiduously over-lubricated, which have now priced in a better economy than what abided pre-pandemic.

Cyclicals at the end of the cycle is where money goes to die:

"Fundstrat Global Advisors’ Tom Lee sees a major market shift underway in which Big Tech starts to greatly underperform economically sensitive stocks."

“We’re two months into something that could be playing out over the next 10 to 20 years.”

The market bottomed on March 24th, 2020, which means we are now eleven months into mass delusion on a biblical scale:

The fact remains that today's policy-makers have no clue how to fix the economy. Today's economists are money printing experts and financial alchemists. This generation knows how to outsource an economy but they have not even the slightest clue how to get one back. The engineer CEOs of yesteryear have long been supplanted by overpaid marketing and finance Mad Men. All of which portends ongoing stimulus dependency for the foreseeable future. Each round larger and more dramatic.

However, among the many distortions caused by printed free money, a massive stock market bubble is only one of the deleterious side effects waiting to implode. This week, the bond market is getting annihilated by the prospect of infinite stimulus. The efficient "free money" hypothesis is getting tested in the bond market, and it's failing:

The irony can't be overlooked:

Feb. 24th, 2020:

By not raising short-term rates, the Fed is pushing inflation expectations and long-term rates higher:

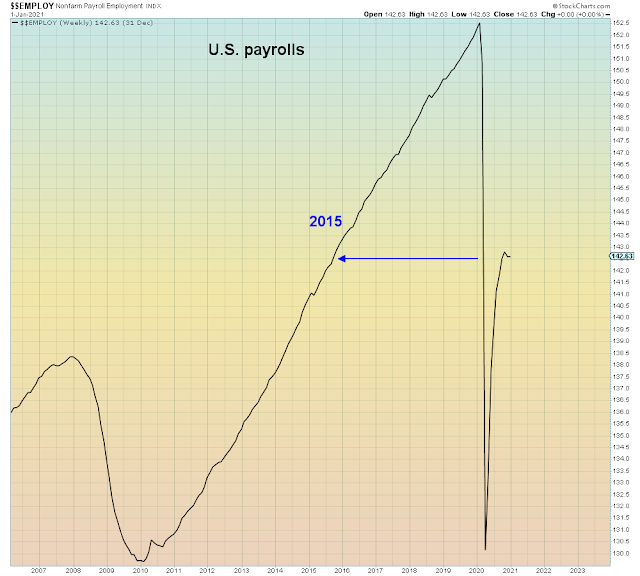

In their infinite bureaucratic wisdom, global central banks have decided that printed money is a proxy for a real recovery. Today's momentum chasing gamblers - themselves economically illiterate - have been easily seduced by the asset sugar high. Fully believing that the stock market actually reflects economic fundamentals, when nothing could be further from the truth.

An intentional delusion that central banks have been cultivating since 2008.

This week laggard Energy stocks are leading the market. Today, the XLE finally filled its open crash gap from last February. As we see manic stimulus expectations peaked in June and are overbought again now:

“The epicenter of the epicenter is the energy sector"

What awaits those who have bought into this entire fraud hook line and sinker is a sudden and very unexpected downsizing in lifestyle. One that will serve to collapse the massive gap between the wealthy and everyone else. In this way policy-makers will be successful in fixing inequality.

Just not in the way that anyone expected.

After all, we are "early" in the cycle of criminality: