It was quite a week in the casino. The S&P 500 ended the week camped at the 50 day Maginot Line. Bulls will need to pull a rabbit out of their ass to prevent wholesale meltdown next week, as the S&P ended at the lows of the week.

Rewind exactly one month to the end of January. The Gamestop debacle had monkey hammered the casino on massive volume. Growth stocks got pounded. On the last trading day of January which also happened to be a Friday, the casino was likewise camped perilously at the 50 day moving average. Here is what I wrote:

"It was quite a week in the Casino. The S&P 500 ended the week camped at the 50 day Maginot Line. Bulls will need to pull a rabbit out of their ass to prevent wholesale meltdown next week, as the S&P ended at the lows of the week"

In other words, this week was literally identical to the last week of January. And of course back then bulls DID pull a rabbit out of their ass.

I know what you are thinking. I must have learned my lesson by now and seen the error in my ways. Based on the above identical technical set-up I must assume the market will ramp higher from this level. No thanks. I will NEVER trust Disney markets. Nevertheless, one must respect the fact that these algos will do everything possible to hold that 50 day moving average.

So now we must look around for what divergences attend this precarious scenario versus one month ago. First off, we should recall that this week is the anniversary of last year's meltdown. Only this time around, the preceding melt-up was far larger.

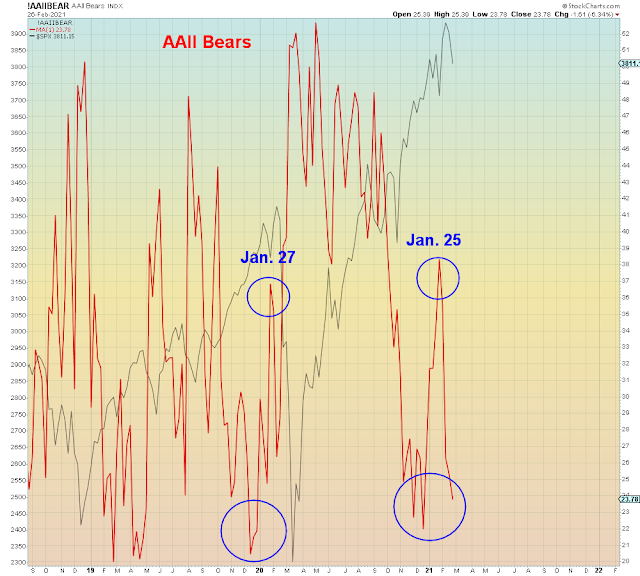

Exhibit B shows individual investor bearishness now versus one year ago. Back then, and this year as well, bears pressed their bets into the first selloff, but then they reversed course during the ensuing melt-up. Looking closer from a month over month perspective notice that last month with the S&P at the 50 dma bears were much higher (Jan. 25th). This week, they let their guard down. Which makes this set-up similar to last year - a bull trap followed by a trap door.

That's the good news for bulls - a set-up deja vu of last month with the possibility of one last bounce to get out through a very narrow and crowded exit.

The bad news is that the smart money already left the building. And now there is massive technical damage on a scale we never saw one month ago:

Here we see the massive (weekly) volume in the World's most popular ETF, the Ark Innovation Fund. Note that in terms of price, the past two weeks erased year to date gains:

Similarly (large cap) Momentum Factor is negative on the year, and broke the trend-line going back to last March.

Tesla - the world's most overbought and overowned Tech stock is below the 50 dma for the first time since last March:

Outside of Tech, safe havens are bidless due to the bond market implosion this week. Stocks can no longer compete with soaring bond yields:

What about cyclicals? Surely the most crowded trade of 2021 must still be working? Glad you asked.

This week, cyclicals rolled over deja vu of June:

Yields have likely peaked for this cycle. And now the dollar is getting set to rip.

In summary, the February rally was a bull trap, and judging by the AAII bears above, it worked fantastic.

Which means buckle up, because this March is very likely going to make last March seem like a picnic.