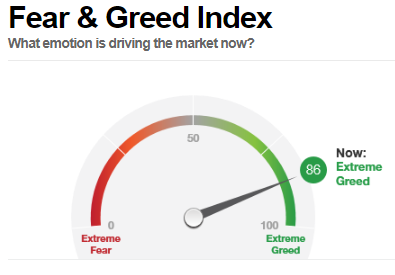

https://money.cnn.com/data/fear-and-greed/

Tuesday, November 24, 2020

A Manic Depression aka. Buyer Beware

https://money.cnn.com/data/fear-and-greed/

Monday, November 23, 2020

MAGA: License To Explode

"Advisers to President-elect Joseph R. Biden Jr. are planning for the increasing likelihood that the United States economy is headed for a “double-dip” recession early next year. They are pushing for Democratic leaders in Congress to reach a quick stimulus deal with Senate Republicans, even if it falls short of the larger package Democrats have been seeking"

Sunday, November 22, 2020

A Ponzi Pandemic

Friday, November 20, 2020

Survival Of The Fittest

The cult of McDonald Trump is reaching a suicidal zenith, as we enter COVID winter. The Kool-Aid is flowing like a river. The GOP will forever be remembered for their infinite ability to exploit their own base of useful idiots. In the fullness of time, COVID will sequester more carbon than any climate conference ever imagined...

As fate would have it, the three biggest superspreader events of 2020 all fall during the last two months of the year. Heading into the darkest depths of winter: The election, Thanksgiving, and Christmas. In Trump country, all of the mitigating steps taken at the beginning of the virus have all been abandoned in favor of conspiracy theories as COVID cases, hospitalizations, and deaths skyrocket. Which can only mean one thing.

RISK ON.

Back in February when the pandemic was just getting started there was a White House task force, a massive Federal stimulus program, a national lockdown order, and widespread concern over the virus. Now, entering the worst part of the pandemic we have none of that. Trump is preoccupied with subverting democracy, and this week Mnuchin rescinded the remaining stimulus money. A petulant political move that will be catastrophic for the economy:

"Treasury Secretary Steven Mnuchin on Thursday said he would not extend most of the emergency lending programs run in tandem with the Federal Reserve, a move the central bank immediately criticized, citing the fragile recovery."

All indications at this juncture suggest that the toxic politics of this era will prevent any major new stimulus bill from getting passed prior to inauguration. We can thank the stock market super bubble for convincing the Casino Class that any further stimulus is unnecessary. Which has been McConnell's stance for months. Clearly it will take a massive stock market crash for GOP criminals to take notice of the collapsed real economy and the imploded middle class.

At this point calling these fiscal programs "stimulus" is entirely inaccurate. That terminology gives the misleading impression that the economy is recovering and just needs a bit of a boost to continue. At this point, given the collapse in employment and skyrocketing pandemic, fiscal spending is now LIFE SUPPORT for the economy. Without new massive fiscal injection, the economy will collapse.

Amid this new pandemic surge, no surprise new jobless claims are rising again. And bond yields are imploding, as expected.

This is the part where bond shorts get annihilated. Again.

This week, compliments of Tesla's addition to the S&P 500, the clean energy trade went late stage parabolic. The clean energy bubble has eclipsed the wholesale collapse in the oil and gas sector:

Also this week, the Rydex Bullish/Bearish asset ratio reached a new all time record high:

Thanksgiving is the biggest travel week of the entire year. The CDC is urging people not to travel during the holidays, so the morons on Fox News today were mocking the CDC warning. Which is why fifty million people are still expected to travel during Thanksgiving. All of which will make this week the biggest superspreader event of the year.

In summary, the medical profession has learned a lot about this virus over the past year. They've clearly figured out how to reduce the fatality rate relative to the number of cases. However, one thing they haven't learned is how to prevent morons from being morons.

Which leaves that job to natural selection.

Thursday, November 19, 2020

Deflationary Value Trap

Wednesday, November 18, 2020

The Free Money Hypothesis

“Our cases are increasing so rapidly here, we literally today are making plans to put refrigerated trucks for morgue space outside of our hospitals and field hospitals,” said Dr. Forman

"Boeing (NYSE:BA) cut gains after Morgan Stanley warned that bullish sentiment on the stock was getting ahead of fundamentals. The aircraft had been up more than 6% intraday after the Federal Aviation Authority ordered the ungrounding of Boeing's 737 Max, which was involved in two deadly crashes"

Tuesday, November 17, 2020

FOMO: Fear Of Missing Obliteration

It was inevitable that a narcissistic psychopath would one day become president. Trump is the Jim Jones of presidents. His legacy will be measured in astronomical body count...

FOMO on the left shoulder and FOMO on the right:

A combination of events have coalesced to create a lethal winter interregnum at the behest of an intransigent psychopath.

When the COVID crisis hit, Trump's signature response was denial, blame, and incompetence. He first went to great lengths to obscure the lethality of the virus, as described in Bob Woodward's latest book, Rage. And then Trump went to great lengths to ridicule mitigation measures such as masks and social distancing. Instead he placed all of his efforts on developing a vaccine at "Warp Speed". He bet that a vaccine could be created before the winter of COVID hell. He was right, the vaccine has been created. However, it's not the vaccine that matters, it's vaccinations that matter. Fully half of Americans have already decided they won't be getting vaccinated from COVID. In addition, there are the logistics of distributing the vaccine to millions of people, a process that will take several months.

What to do, as COVID cases skyrocket? Trump is now actively blocking the incoming Biden administration from accessing the transition resources they need to plan an effective COVID strategy. Which means that the Biden administration will be several months behind the curve when they take over. In the meantime, Trump's body count will be piling up to record levels.

Trump has ample assistance from his rabid base of denialists. One must wonder if they really don't believe this virus is real or if they have some sort of death wish. These are the least healthy people on the planet. Many of them have marginal access to healthcare. And yet they continue to play along with the theme that this rising death toll is merely a hoax propagated by Democrats to win the election. Or, a "plandemic" to place more economic control in the hands of Jeff Bezos.

No one can stop Trump. The much feared "Deep State" has been wholly incapable of derailing Trump's subversion of democracy. History informs that nothing is as vicious as a Fascist party that refuses to relinquish power. They will use every trick in the book to hold on to the White House.

Only Covid can stop them, the very thing they deny.

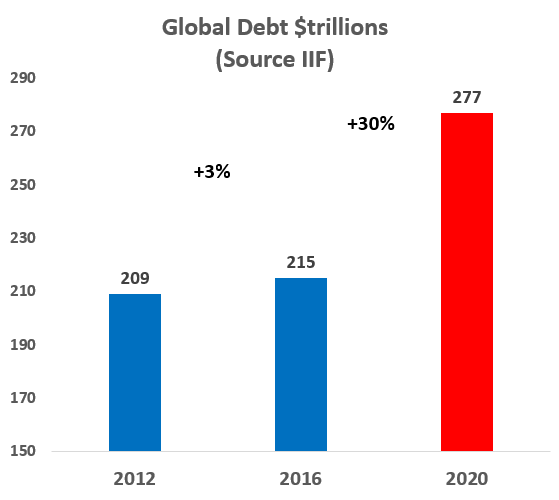

This lethal delusion is driven by manic social mood that attends a monetary asset bubble now reaching new all time highs, while the economy collapses. Global central banks have done their part to administer lethal doses of monetary euthanasia to the Soylent Idiocracy.

This graph below shows that ex-deficit, this is the worst economy since the Great Depression. I call this honest GDP because it adjusts for the ludicrous amounts of borrowing that give this economy the illusion of recovery. Had prior administrations been as profligate as the current one, the U.S. would have been bankrupt decades ago:

The intersection of maximum pain is GOP intransigence on stimulus during a skyrocketing pandemic. States that had ordered lockdowns in the Spring are now reluctant to do so in absence of a Federal safety net of the type offered six months ago:

"Polis said that it’s not fair to impose a stay at home order, especially when the federal government was not offering the same benefits to Americans who would be forced out of work as it had done earlier in the pandemic."

With its uniquely deficient virus response the U.S. is diverging massively from the rest of the world. While Trump focuses his attention on frivolous lawsuits and his election temper tantrum, the U.S. has become the outlier nation with respect to COVID impact.

As the data comes in over the coming weeks showing wholesale economic collapse, Treasury bond yields will collapse. Which will unwind the STILL record Treasury bond short.

And then the Trump Super Bubble will explode.