Thursday, November 19, 2020

Deflationary Value Trap

Wednesday, November 18, 2020

The Free Money Hypothesis

“Our cases are increasing so rapidly here, we literally today are making plans to put refrigerated trucks for morgue space outside of our hospitals and field hospitals,” said Dr. Forman

"Boeing (NYSE:BA) cut gains after Morgan Stanley warned that bullish sentiment on the stock was getting ahead of fundamentals. The aircraft had been up more than 6% intraday after the Federal Aviation Authority ordered the ungrounding of Boeing's 737 Max, which was involved in two deadly crashes"

Tuesday, November 17, 2020

FOMO: Fear Of Missing Obliteration

It was inevitable that a narcissistic psychopath would one day become president. Trump is the Jim Jones of presidents. His legacy will be measured in astronomical body count...

FOMO on the left shoulder and FOMO on the right:

A combination of events have coalesced to create a lethal winter interregnum at the behest of an intransigent psychopath.

When the COVID crisis hit, Trump's signature response was denial, blame, and incompetence. He first went to great lengths to obscure the lethality of the virus, as described in Bob Woodward's latest book, Rage. And then Trump went to great lengths to ridicule mitigation measures such as masks and social distancing. Instead he placed all of his efforts on developing a vaccine at "Warp Speed". He bet that a vaccine could be created before the winter of COVID hell. He was right, the vaccine has been created. However, it's not the vaccine that matters, it's vaccinations that matter. Fully half of Americans have already decided they won't be getting vaccinated from COVID. In addition, there are the logistics of distributing the vaccine to millions of people, a process that will take several months.

What to do, as COVID cases skyrocket? Trump is now actively blocking the incoming Biden administration from accessing the transition resources they need to plan an effective COVID strategy. Which means that the Biden administration will be several months behind the curve when they take over. In the meantime, Trump's body count will be piling up to record levels.

Trump has ample assistance from his rabid base of denialists. One must wonder if they really don't believe this virus is real or if they have some sort of death wish. These are the least healthy people on the planet. Many of them have marginal access to healthcare. And yet they continue to play along with the theme that this rising death toll is merely a hoax propagated by Democrats to win the election. Or, a "plandemic" to place more economic control in the hands of Jeff Bezos.

No one can stop Trump. The much feared "Deep State" has been wholly incapable of derailing Trump's subversion of democracy. History informs that nothing is as vicious as a Fascist party that refuses to relinquish power. They will use every trick in the book to hold on to the White House.

Only Covid can stop them, the very thing they deny.

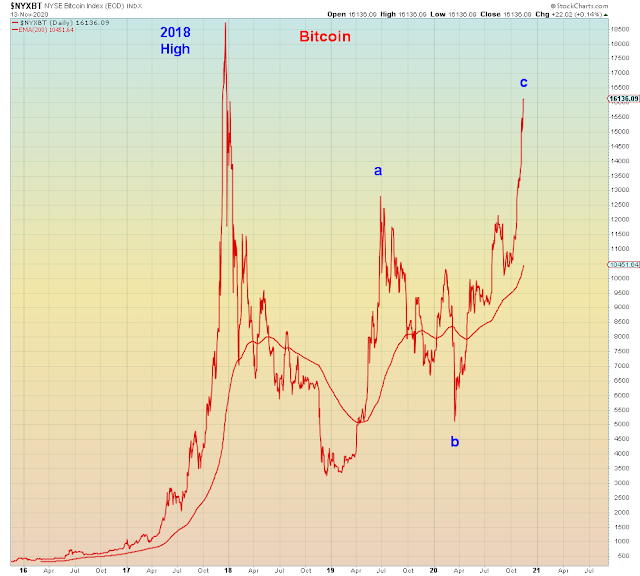

This lethal delusion is driven by manic social mood that attends a monetary asset bubble now reaching new all time highs, while the economy collapses. Global central banks have done their part to administer lethal doses of monetary euthanasia to the Soylent Idiocracy.

This graph below shows that ex-deficit, this is the worst economy since the Great Depression. I call this honest GDP because it adjusts for the ludicrous amounts of borrowing that give this economy the illusion of recovery. Had prior administrations been as profligate as the current one, the U.S. would have been bankrupt decades ago:

The intersection of maximum pain is GOP intransigence on stimulus during a skyrocketing pandemic. States that had ordered lockdowns in the Spring are now reluctant to do so in absence of a Federal safety net of the type offered six months ago:

"Polis said that it’s not fair to impose a stay at home order, especially when the federal government was not offering the same benefits to Americans who would be forced out of work as it had done earlier in the pandemic."

With its uniquely deficient virus response the U.S. is diverging massively from the rest of the world. While Trump focuses his attention on frivolous lawsuits and his election temper tantrum, the U.S. has become the outlier nation with respect to COVID impact.

As the data comes in over the coming weeks showing wholesale economic collapse, Treasury bond yields will collapse. Which will unwind the STILL record Treasury bond short.

And then the Trump Super Bubble will explode.

Friday, November 13, 2020

The Hardest Crash In History

“And we know the cases reported are an underestimate of what is out there ... we’re missing many cases because people aren’t getting tested. So the true number is much higher than what we’re actually seeing.”

Looking Across The Valley. Of Death

"Two critical unemployment programs are set to expire at the end of the year, potentially leaving millions of Americans vulnerable to eviction and hunger and threatening to short-circuit an economic recovery that has already lost momentum."

Thursday, November 12, 2020

Rule By The Wicked. Is Ending.

In hindsight, biblical scholars will call MAGA the era of false witness. A time when criminals ran rampant and worshipped their modern day Caligula, while the empire imploded in real-time...

It took Mother Nature to put a stop to this farce.

As I said in my prior post, the sheeple are entirely unaware of their descent into squalor. It was gradual and hence it went unnoticed. For amnesiacs it's impossible to remember a time when "news" wasn't 100% circle jerk. A time when non-stop lying was considered abrogation of the Ninth Commandment, and not basis for re-election. And a time when conspiracy theories were not used to explain away facts and reality.

Faux News (Fox) stock just took a pounding, as apparently Trump is planning to start his own "news" network. His true believers are enraged that the network is not aiding and abetting his gambit to steal the election. They now consider Fox News to be a left wing fake news outlet.

"President Donald Trump went on a Twitter tirade against Fox News on Thursday morning, escalating recent attacks against his long preferred cable network."

Therefore, they are going to start a new network. We can probably guess the name. The top contenders will be INN: Idiocracy News Network. Or NJN: Nutjob News. Regardless of what it's called, it will be non-stop bullshit and conspiracy theories catering to the dumbest people on this planet.

Corporations caused this problem, they wanted a dumb and facile populace that they could exploit for maximum profit. From there, the GOP cultivated a base of useful idiots. Now, their frankenmonster is off its leash. Rupert Murdoch's evil empire is only the last casualty. Since McDonald Trump hijacked their party, traditional conservatives have had a choice, leave the party and have no representation whatsoever, or join the league of nutjobs.

Conservatives have lost track of right and wrong. An outcome predicted by The Lonely Crowd over 60 years ago, in which society would get hijacked by sociopathic extroverts. The gullible would come to prefer opinion over facts and data, until they could no longer tell the difference. As their living conditions deteriorated, they would seek out a new lower common denominator in facile buffoonery:

The Lonely Crowd also argues that society dominated by the other-directed faces profound deficiencies in leadership, individual self-knowledge, and human potential"

The Founding Fathers would not recognize McDonald Trump and his cabal of liars. Because they are the antithesis of what the Founders sought to create in their new republic. We live in a society of Disney people not willing to reveal too much of themselves to others lest it reveal the Oz-like production taking place behind the curtain. The ability to work a room with small talk is valued, however, revealing the truth is frowned upon. People who are too honest about themselves are deemed antisocial or perhaps even "on the spectrum". The slick carnival barker is preferred over the genuine individual. Where do the sociopaths learn these skills? College of course. America's black hole of wasted time and money. An industrial factory for pumping out commodified widgets for corporate use. And along with these superficial relationships has come a profound sense of loneliness and disconnection from the rest of society. No one knows who they can trust anymore.

The next thing you know a con man is trying to tear down democracy with the assent of nearly half the country.

We have entered a black hole of leadership between now and the inauguration late January. During this time, Trump will be solely preoccupied with his own future, at the expense of the country. Planning a new talk show network reveals that he is already thinking about his next move. In the meantime, there will be no stimulus, no COVID strategy, and no leadership. This period will reveal the full extent of his incompetence and negligence of duty. To even the most ardent of supporters. And they will come to know fear.

In the biblical tradition.