As many futurists had predicted, technology has made this society profoundly weak and ignorant, totally incapable of accepting the truth in any direction. In today's Disney culture, sugar coating bullshit is deemed a virtue...

Today's economic pundits feel the overwhelming need to "protect" society from the truth. I heard this specious argument many times throughout my corporate career - we must always sugar coat the truth so we don't create a sense of panic. Fast forward to today and we live in a society in the permanent fetal position, now totally incapable of accepting reality in any direction. Our corporate ordered society is highly trained to focus solely upon the messenger while ignoring the veracity of the message.

In this blue pill Matrix-like environment "perma-bears" are easily ignored, having been thoroughly discredited for wrongly deriding central bank alchemy for the past decade. Therefore, now even as all stimulus is being removed, today's perma-BULLS feel invincible to ignore lethal amounts of risk.

There are many comparisons we can make between now versus past markets. Jeremy Grantham recently stated that this market is more lethal than both 1929 AND Y2K. I would 100% agree with him.

"One by one, we’ve checked off every condition that the glorious bubble needs. And in terms of crazy behavior, this has been crazier, by a substantial margin, than 1929 and 2000”

Add in a global housing bubble, looming Emerging Market currency crisis, and of course record cycle risk. It's a bad time for sniffing glue on a global scale. What I call monetary euthanasia.

I frequently draw market analogs to various recent events such as today the COVID meltdown, or the Dec. 2018 monetary "policy error", the 2015 China crash etc. However while being similar in certain respects, ALL of those will pale in comparison to this banquet of long overdue consequences.

Will it be the end of the world? No.

However, it WILL be the end of the age of DENIAL, which will end in a fiery financial explosion remembered for decades.

And with that event, this current belief system that one can trust people who have ALREADY proven they can't be trusted - will die a hard death. There are times when the consequences of being wrong are of such extraordinary magnitude that they far exceed any solace from having ever been previously "right". This is one of those times when history will not smile on a generation of terminally useful idiots who trusted the EXACT same criminals who lied to them at the end of the last cycle.

Ok, let's discuss the casino. On Twitter today I drew analogy back to Monday February 24th, 2020 which was the day when the global COVID crash began. First, it too was a Monday and it was post-Opex. Secondly, the pandemic had already been raging worldwide, but gamblers had been ignoring the growing risk up until that day when it all of a sudden mattered. Now of course we are hearing Omicron is threatening new lockdowns, two years into a never-ending pandemic. Hardly a Black Swan event. The next commonality was the seven NYSE Hindenburg Omens, which is similar to the recent seven Nasdaq Hindenburg Omens. That Monday was the biggest opening opening gap since Brexit, and today was the biggest opening gap since THAT Monday (leaving aside the ensuing meltdown).

Appropriately, I called that post "Buy The Fucking Crash", because that's what gamblers were doing then, and that's exactly what they are doing again today. No sign of fear whatsoever. And then there is this chart which I haven't shown since that time, which I called the "Crash Ratio". It's the ratio of the Mid cap index to the S&P 500. And as we see it's currently even more dire than it was in February 2020:

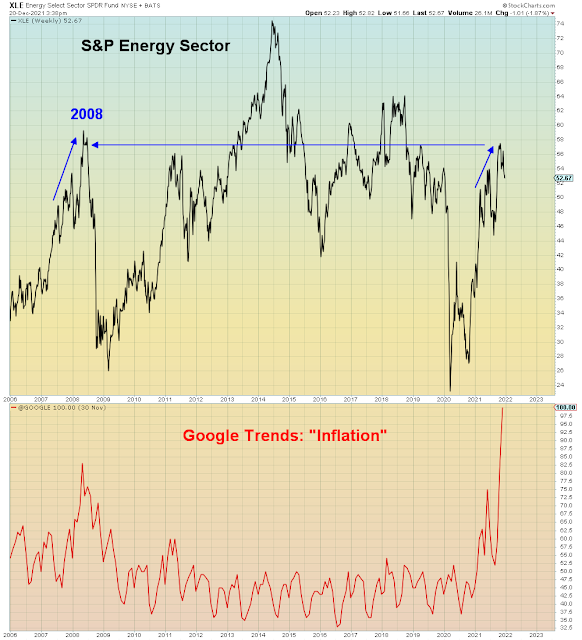

Cycle Risk is something I've been pounding the table about recently, because it's a risk factor that no other pundit wants to discuss. It was the same way in 2008. Back then the cycle never officially ended until many months after the crash. It was only ever acknowledged in hindsight. Today of course the concept of cycle risk is totally at odds with the predominant view of "runaway inflation", which has put gamblers in the RISKIEST assets to own at the end of the cycle. If this current inflation is secular and intractable then commodity/reflation trades make sense. If it's cyclical as I say it is, then those same trades will perform the worst in recession.

In addition, this cycle risk I speak of is ALREADY well advanced. It starts by sucking in record amounts of capital into a cycle top wherein wealthy insiders cash out at public expense. That event is now COMPLETE. As I pointed out in my last post, that was 2021 in a nutshell.

The next phase of course is the meltdown itself, which will be attended by copious amounts of lying, per the theme of my above discussion - sugar coated bullshit.

That is the lethal phase of cycle risk because that locks the sheeple in the casino never ever attempting to get out. All on the belief they can ride out global depression in massively overvalued "stocks".

We have now entered that phase of deception.