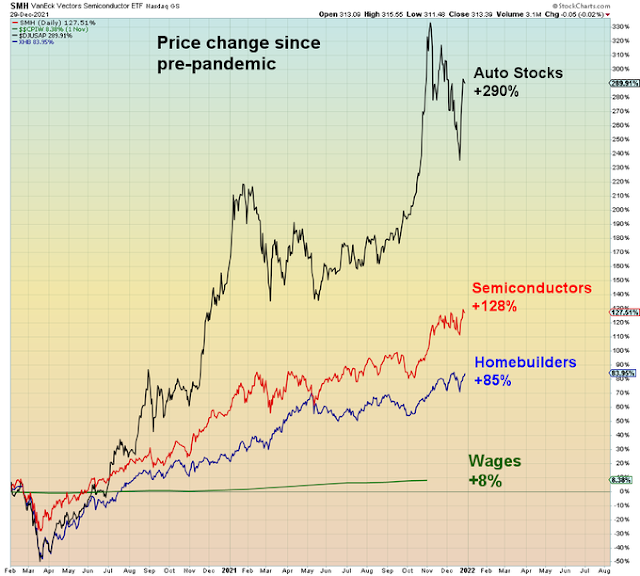

Whereas 2021 was the year of openly welcomed market manipulation: By central banks, Reddit boiler rooms, and Wall Street momentum algos, 2022 will be the year when the record overvalued super asset bubble explodes. All while the investor Idiocracy was worried about baristas earning $15/hour. If you think that a Y2K Tech bubble and 2007 housing bubble both imploding at the exact same time will be "inflationary", you came to the wrong place.

All of the risks I am about to discuss for 2022 have already been previewed in 2021:

SPAC fraud

Reddit pump and dumps

Hedge fund explosion

Ark ETF/Tech implosion

Crypto crash

EM currency implosion

Evergrande meltdown

Central bank hawkish pivot

Omicron pandemonium

ALL of it got bought with both hands.

The epicenter of this explosion doesn't matter nor does the trigger or imminent cause. It could be Omicron, Evergrande, the Turkish Lira, Bitcoin, Millennials waking up bankrupt etc. etc. It doesn't matter, because all risk assets are now highly correlated.

Before I freak anyone out, I happen to believe that t-bills and money market funds are still safe. I could be wrong, but I do not specialize in end of world scenarios.

I envision a major financial dislocation that basically wipes out this era of rampant fraud and speculation and puts an end to the mass consumption lifestyle. A 2008, sans bailout. Is this partly wishful thinking on my part? Maybe. But not nearly on the scale of wishful thinking taking place in financial markets right now. As I pointed out in my prior post, those of us watching this slow motion trainwreck are considered "market timers". However, the REAL market timers are those who assume they can ride out human history's largest asset bubble as if they are surfing a tsunami to a stroll on the beach.

Nassim Taleb coined both terms - "black swan event" and the concept of systemic "fragility". The term "black swan" of course refers to a rare and unforeseeable event that causes major dislocation in financial markets. However, in that same book (Fooled By Randomness), Taleb describes a novice trader who finds early success in trading during a bull market. This trader begins to feel invincible and therefore doubles down on every bet. Until such day as the market turns bearish and the trader implodes spectacularly. Black swan event? Hardly. Call it Millennials circa 2021. If Taleb hadn't invented the term black swan event, Wall Street would have invented it anyways. Why? Because it gives them legal cover from their end of cycle chicanery. Think 2008 when Goldman was selling AAA rated subprime CDOs that were expressly designed to explode. Then they were buying credit default insurance to collect the payoff from the ensuing collapse. And when the system itself exploded, they were bailed out 100% on the dollar by their alumni in the U.S. Treasury. That level of criminality can only take place under the cover of a widely believed black swan event.

Likewise, Taleb believes he "invented" the term anti-fragility. In his book "Antifragile" he describes all kinds of manmade systems that benefit from stressors and shocks. However, Mother Nature invented all of these concepts long before PhDs came along to publish them. Throughout the natural world, organisms are strengthened by facing adversity. When a society as a whole is protected from their bad investment decisions by central banks, then that embeds latent fragility in the form of increasing speculation. When historical volatility is used as the primary variable for determining algorithmic leverage, then that creates a feedback loop by which increased leverage further dampens volatility leading to increased leverage. A compressed spring that explodes in the other direction when the breadth divergence from index manipulation grows to an epic scale, where it is now. All of which fool's errand can be blessed by financial PhDs employing Greek numerology backstopped in case of inevitable failure by a "black swan event" that is always one standard deviation outside the parameters of their idiot model. It helps to have a society of serial morons available as well.

Here we see the Info Tech sector and the 30 day moving average of Nasdaq lows. What we notice is that new lows are approaching a level previously associated with BEAR markets while the index itself is at an all time high.

It's not hard to imagine that following the pandemic and the inflation of the super asset bubble spawned by the global central bank bailout, that there now exist RECORD accumulated fragilities that will not withstand a risk off event. We got a small taste of that earlier this year during the Gamestop debacle. There were more broker outages last January than there were during the March 2020 meltdown. Crypto alone is 2x subprime in magnitude.

Here we see that Nasdaq down volume has been increasing for YEARS as speculators onboard more and more and more leverage.

Therefore, what I envision coming soon is widespread trading system outages. Server failures. Internet connections over-loaded. Help desks non-responsive. Investors panicking, unable to get out. Limit down moves followed by limit up moves which will lock prices and prevent markets from clearing. Margin clerks front-running their clients to liquidate their most prized assets because the junk assets are bidless. Risk asset correlations at 100%.

And then will come the rumours. This or that entity is now in default, followed by massive hedge fund redemptions. Does anyone remember the Archegos Capital Management implosion circa March of this year? Back in February the global Nasdaq reached a peak and imploded. Archegos held several Chinese internet stocks that were imploding. They also held several U.S. media companies. When the prime brokers realized they were ALL exposed to massive margin loan losses they started selling down Archegos assets indiscriminately, leading to MASSIVE losses for Credit Suisse and Nomura two brokers that were laggards in the fire sale.

ViacomCBS was one of the stocks that was affected by this liquidation event. Here we see that it has in no way recovered.

Picture this scenario on a 100x scale. Because that's what is coming.

When the smoke clears will there by buying opportunities? Yes, many. However, these will mostly be relatively short-term trades. Few assets will be safe holding for long periods of time until the full extent of damage is revealed.

TBD.