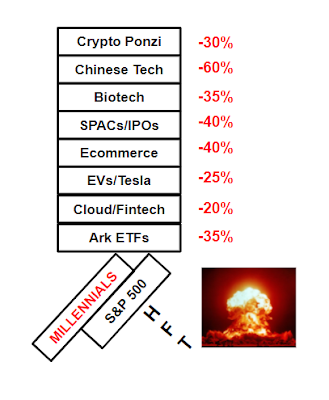

It's that time of year when all pundits make predictions, so I offer mine as a counterpoint to this era's mass delusion and mass deception. 2021 was the year of MAXIMUM pump and dump: The epic transfer of wealth from the working class to the ultra-wealthy under the auspice of "democratization of markets". In other words it was the traditional end of cycle distribution of stock from wealthy insiders to the final bagholder public. Going back a year I never predicted this much criminality would ensue during 2021, starting with the Gamestop debacle. I didn't envision Millennials embracing end of cycle fraud on record margin. Therefore, I don't buy into today's standard view of "good news more people got conned" democratization of deception. I believe that Millennial margin call, along with end-of-cycle inflation-driven panic buying and Fed double taper will combine to create the hardest landing in history, without any comparison...

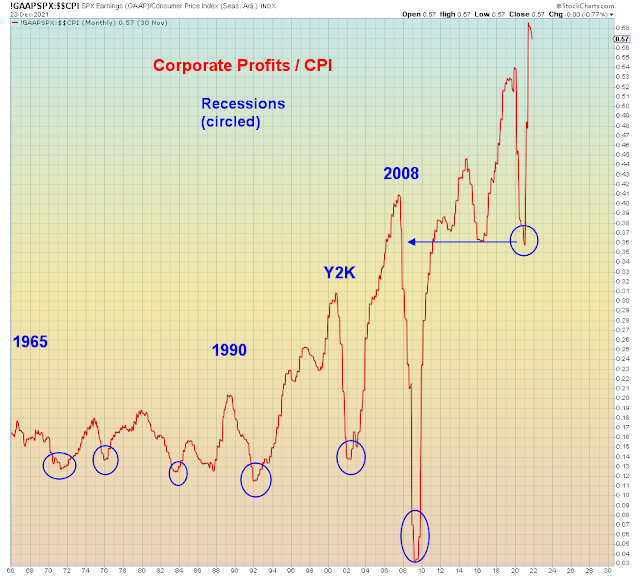

In addition to lethal doses of monetary heroin, this era's excess stock market returns are a function of an aging society reaching peak retirement. Passive "dumb money" inflows have been creating their own Ponzi-like market returns. We are now told that "valuations no longer matter". There has never been an asset class in human history wherein valuations don't matter. When asset valuations are predicated strictly upon inflows they temporarily detach from their intrinsic values and then they ultimately crash back down to reality. The greater the distance back to reality, the harder the fall. At the end of the longest uninterrupted profit cycle in U.S. history, it's a long way down. Therefore it can come as no surprise that I disagree with today's mainstream predictions. I just read this 2022 prediction and I agreed with all of the facts, yet I arrived at the exact opposite conclusion:

"In recent years, traditional valuation metrics like price-to-sales and market- capitalization-to-GDP have rocketed beyond historical highs...Passive strategies are valuation-agnostic and buy whenever new money arrives"

Just like in 2018, when required year-end selling caused an illiquid stock market to plummet over 9% in December, Required Minimum Distributions (RMDs) may not be done wreaking havoc in 2021"

Curve flattening is an indication of a Fed policy mistake, namely, boosting rates into an environment where economic growth is slowing"

Does this mean U.S. stocks will end 2022 in the red? Probably not"

Got that? Valuations no longer matter. Meltdowns are opportunities, and a slowing economy is good reason to buy stocks. Somehow I see those exact same risks as ending horrifically badly.

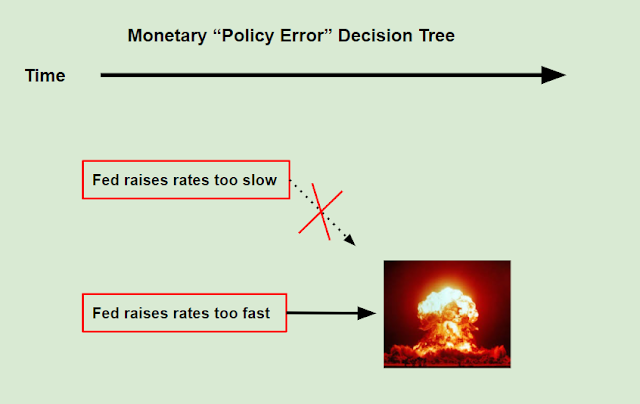

First off, today's inflationists believe that the policy error was keeping rates too low for too long. But what if they're wrong and the bond market is right? It would mean the inflation they fear is cyclical not secular and therefore the panic buying feedback loop and resultant Fed hawkish pivot occurred at the worst time in the cycle. Deja vu of 2008. The author above believes that the Fed can quickly pivot to a dovish stance and bail out all markets at the same time. Picture J. Powell juggling pies while stumbling down the stairs - it's sheer and total fantasy. For one thing, Millennials are ALREADY on the verge of margin call and when that happens the dislocations will spread far faster than subprime in 2008.

Granted this fraud has continued at such a manic rate that even Michael Burry of "The Big Short" fame already capitulated earlier this past Fall.

My prediction is that we have now seen peak consumption orgy and the hangover will be BRUTAL. In this late cycle we saw above average retail sales, durable good sales, home sales, and car sales. All far above trend in both price AND quantity. All driven by inflation hysteria and of course the central bank wealth effect. Both of which factors are highly correlated on the upside AND the downside.

Here we see retail sales have been far above trend since the pandemic started:

Whereas 2021 saw the removal of all pandemic supports for the working class, 2022 will see the removal of all pandemic supports for the investor class. What I call welfare for the rich. And my overriding assumption is that they are not going to like it.

Which will bring about MOAC: Mother Of All Crashes. Given the level of current risks, this implosion will very likely set the record for speed and depth of crash from an all time high. Granted, none of my outcome predictions are new. However, what's changed over recent months is the Fed policy stance, record market inflows, record risk positioning, record speculation, AND the beginning of bubble collapse. In other words, the passive-index bubble has hidden all of these burgeoning risks from the masses, leading to mass complacency.

The last two times the Fed tightened in December - 2018 and 2015 they were forced to quickly reverse policy in January. In both those times the market was down -20% before they reversed. My view is that once the crash begins they won't have as easy a time of it as they did the last two times.

In momentum markets such as this one, the buyers are above the market and the sellers are below the market. When there are long periods of time without selling then the sellers all hit the market at the same time on the way down. This creates a bidless market. We have already seen this in many of the speculative asset classes, but we have yet to see it in the major averages.

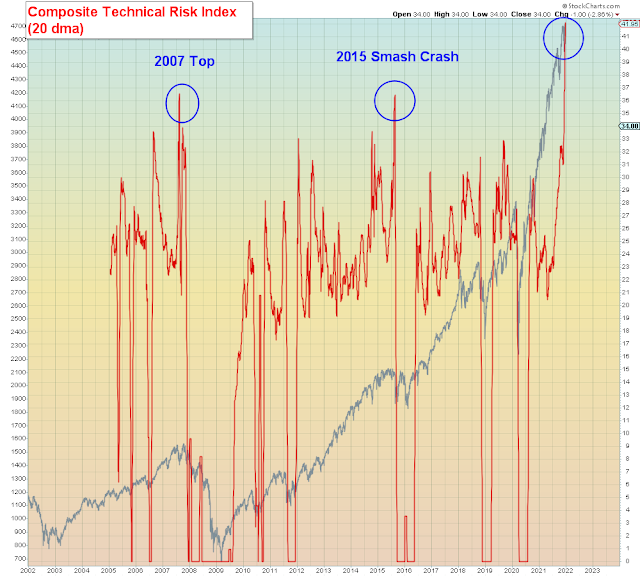

This week I created my own composite technical risk indicator. It combines % bullish S&P 500 stocks, % Nasdaq above 200 dma, % NYSE above 200 dma, NYSE highs-lows, and Nasdaq highs-lows. I converted each indicator into an index between 0-100 for relative comparison across time periods. And then I created a composite index and compared to time periods when the S&P 500 was above the 200 day moving average.

What we find is that this particular indicator hits extremes only on very rare occasions. In this case only three times in 14 years. However, in each of the prior instances, the market rolled over. In 2007 it rolled over from the all time high into a steep bear market. In 2015, the market rolled over and crashed in a matter of a few days.

When we zoom in on the 2015 crash, we see that the indicator peaked only days before the actual crash. We also see in the lower pane that NYSE breadth was in a sideways correction and unable to breakout to the upside. Similar to what we are seeing now.

As another gut check circa 2015/2016 we see that when the Fed raised rates in Dec. 2015, the market imploded. However, Nasdaq highs-lows now are ALREADY at the same level as they were back then with the market down -20%. In addition, RISK ON positioning is far more aggressive this time around.

Which is why I predict far greater dislocation this time around. The market is as bifurcated as the economy.

The bottom line is that the Fed can't bailout everyone from their bad investments at the end of the cycle. Here we see GAAP corporate profit (inflation-adjusted) now compared to prior cycles. Clearly, there has been no "reversion to the mean" for corporate profit for a long time.

Unfortunately, this society only discovers "right" when wrong explodes. Their sanctimonious outrage is stoked by their Ponzi scheme losses. Always looking for someone else to blame. What's coming in 2022 is what the Chinese now call "common prosperity". Meaning, first asset markets must crash and THEN there will be more political consensus about prioritizing people above corporate profit. It all starts with what I call "shared consequences".

After this era explodes, the definition of "retirement" will change from the Suze Ormanesque multi-millionaire retirement to something more basic and realistic given the acknowledgement of zero sum returns implied by 0% interest rates.

Just remember, the Fed's own so-called "RISK" model is constructed in such a way as to view extreme yield seeking and speculation as "low risk".

Why?

For maximization of profit and minimization of legal liability.

At the end of the Ponzi cycle.