Only by extrapolating the past into the indefinite future can today's financial Ponzi schemers ignore this stupid level of risk. Fortunately for them, their job is made easy by the fact that the sheeple only want to be told that the future will be exactly like the past. They are not capable of believing anything else.

Of course when this epic mass deception spontaneously explodes "without warning", that will be a different question.

What follows is a summary of the risks that have been growing to extremes over the past year since the March 2020 low:

First and foremost global markets have been fully "Gamestopped" by central banks. Meaning we are watching a continuously rotating pump and dump from one sector to the next. Last year, the crowded trade was Tech stocks. The narrative at the time is that we were in a secular bull market for the new virtual economy. Gamblers flocked en masse to the "Money Tree" Cathy Wood and her Ark investment ETFs only to realize it was a mirage. Tech is only part way through its bear market. Wall Street deserves a lot of credit for collapsing the Tech bull market, because when Biden was elected they said the deflation trade is over and the re-opening reflation trade is the next bull market. We went from having a massive Tech bubble to now having a massive cyclical bubble. Based on the exact same specious narrative that valuations don't matter. Valuations mattered in Tech, and they are starting to bring down cyclicals.

You know the financial system is fatally weak when a pump and dump scheme in a pissant stock can almost crash the system.

"We have come dangerously close to the collapse of the entire system and the public seems to be completely unaware of that"

The first leg down of the Tech wreck saw record Nasdaq down volume. A minor taste of what is coming.

The next widely ignored risk is Japanification - the use and abuse of stimulus gimmicks as a proxy for a real economy. This is a synthetic recovery currently running on 27% combined fiscal and monetary stimulus. It's the full virtual simulation of prosperity. Today's bulls have no thought or concern for the chasmic and ever-increasing deficit. Worse yet, the fiscal multiplier has collapsed, meaning that fiscal stimulus is having an ever decreasing impact on the economy. In the tradition of Japan, the economy is now dependent upon continuing massive deficits. It's not "stimulus", it's life support.

While fiscal policy is having a lessening impact on the economy, monetary policy is having no effect on the economy. Monetary policy's only use now is to juice markets. At the 0% bound, there is nowhere to go with interest rates, which means there is NO monetary safety net for when this mega bubble explodes. This stimulus dependency has led to stimulus overload in the markets. All global risk assets are now massively overvalued. Another risk is that the Fed has now lost control over Treasury bond yields. They can't rein them in because more QE will cause inflation expectations to rise. This week saw the largest stock to bond rotation in a decade. And yet bond yields STILL rose on the week. Bond yields will continue rising until the stock market explodes, led by Tech stocks.

Speaking of rising bond yields, back in 2018 Trump's tax cut caused U.S. bond yields to rise which monkey hammered Emerging Markets. Now, the same thing is happening due to Biden's stimulus package and the impending Infrastructure program. It's sucking money out of global markets back to the U.S. and driving a massive dollar rally. It will be extreme irony when this next meltdown originates in China, as it did in 2015 with the Yuan devaluation.

No discussion of risk would be complete without the discussion of margin leverage and overall extreme speculative appetite. Global gamblers are under the belief that central banks are invincible and hence there is zero hedging taking place right now. Complacency is rampant, and there is a stupid amount of risk being chased. Nevertheless, the dominoes are already falling in SPACs/IPOs, pot stocks, Chinese stocks, work from home stocks, Biotech, cloud internets, Fintech, and electric vehicles.

Of the three major rallies in the past five years, this rally has been the narrowest in terms of new highs participation. This is a sign of a market that is under constant churn and sector rotation. Each sector getting pumped and dumped until there is nowhere left to hide.

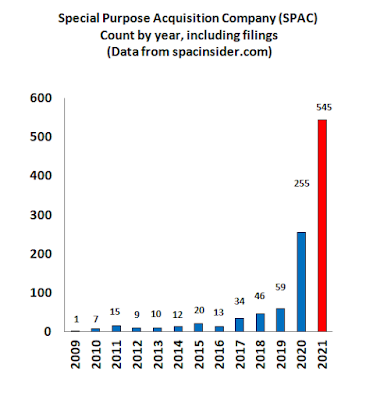

Another risk that Cramer raised earlier this week and then forgot about later in the week, is the MASSIVE amount of stock issuance coming to market via SPACs and IPOs. As he put it, this glut of supply is already overloading the market, and it will keep coming until the market breaks. SPACs are this era's subprime, they are riddled with fraud - and deja vu of 2008 regulators are arriving too late.

"The SEC is looking into potentially illegal activity related to SPACs, according to people with knowledge of the inquiry"

Imagine getting this far down the page without talking about massive unemployment. It speaks to the total alchemization of markets that the economy is always a distant consideration. One year from the pandemic onset and there are still five years worth of jobs missing. Non-farm payrolls are at 2015 levels. Due to Globalization, the U.S. economy is now in a state of structural deflation. Which means that profits are now taking a disproportionately large share of GDP, and wages are taking a record low amount of GDP. Wages can't rise due to the high unemployment and extreme global deflation that is being imported. Neither political party currently has a plan to acknowledge this issue, much less fix it. See stimulus dependency above.

Another risk that is seldom mentioned by today's Madoff-acolyte financial pundits is the fact that corporations have been gorging on debt for the past year. Unlike every other cycle in U.S. history there has been no deleveraging during this recession. We are to believe that this *new* cycle will merely pile on to the debt super bubble from the longest cycle in U.S. history.

Sure.

In summary, getting back to the first topic of fragile markets. In momentum markets such as these, the buyers are above the market, and the sellers are below the market. Central banks have ensured that everyone is on the same side of the boat - they just sponsored human history's biggest short covering rally, led by beaten down retailers which may or may not even be in existence a year from now. One year from the March lows and due to the massive margin leverage that has accumulated in the meantime, the machines can no longer handle a RISK OFF event. They will step aside, and the market will go bidless. The margin clerks will be in charge and stonks will be sold at any price to raise liquidity aka. "cash", which will soon be in very short supply.

Last week we got a preview of what's coming.

Stonks will be dumped by brokers at any price. Why? Because if they don't, another broker will front-run them out the door to avoid the billions in broker losses that were reported this week.

$10 billion from one minor hedge fund.

The biggest risk of all of course is what I call "bailout risk". Which means that when the middle class gets wiped out in stonks again, the amount of rage will be quite unfathomable.