In what can only be described as human history's biggest mass con job, central banks have systematically desensitized gamblers to all risk. They are now cycle high fat, dumb, and happy. I call it monetary euthanasia...

Compliments of central bank alchemy, the shortest bear market in history yielded the best one year market gain to an all time high in market history. In addition, inflation expectations are the highest since the end of the last cycle, retail investor speculation is cycle high, and now we learn that the market is two decade overbought.

All late cycle indicators peaking at "the beginning of a new cycle".

One of the indicators I haven't shown recently, shows the ratio of mid cap stocks to the large cap Dow. What we see is that mid caps peak relatively early, they underperform for a while and then they burst higher at the end of the cycle due to short covering. In addition, commodity stocks (second pane) outperform at the end of the cycle and of course inflation expectations are highest at the end of the cycle:

This fraudulent recovery which is based solely upon asset inflation has seen some ludicrous moves in asset prices. However, few sectors are as insane as the retail sector which was blighted by the pandemic. And yet, it's the top performing sector over the past year. This entire sector has been "Gamestopped" higher amid record store closures.

Which has fulfilled the circular mirage of "recovery" based upon capital misallocation.

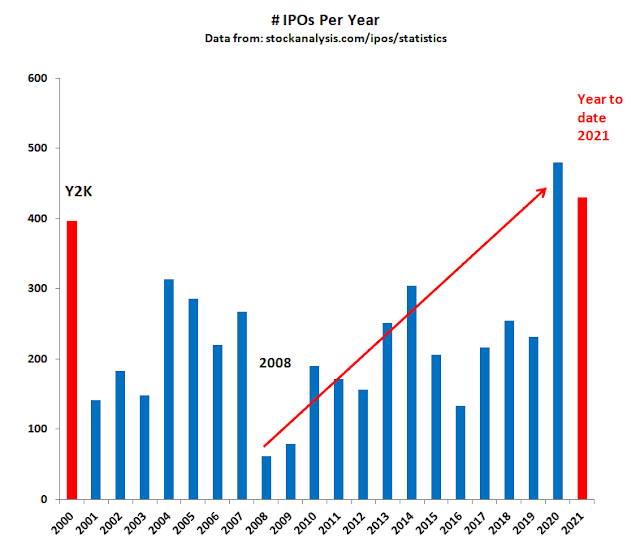

Another thing you don't see at the beginning of a cycle is cycle high IPO/SPAC issuance:

Herein lies the problem:

Over the course of this 12 year continuous monetary bailout cycle, investors have become more and more complacent. I use a ratio of NYSE down volume over up volume to show the degree of panic selling.

Back in 2008 when it was the end of the cycle, panic selling peaked. Subsequently, we have seen lower peaks over the course of the cycle. We are to believe that the lowest level of selling in the entire cycle marks the beginning of a new cycle.

Sure.

What we are about to witness is 12 years of pent up selling, which will make 2008 look like a picnic.

And then everyone will know what we know. It's the end of the cycle.

And this is no time for bullshit from the same proven assholes who lied last time.