Looking back, no historian will be able to understand the level of madness taking place right now. Speculators are playing their own corner of the markets while being oblivious to the overall systemic risk accumulating in the background. No one is looking at the big picture as far as how all of this unprecedented risk seeking gets unwound.

Unlike last year, central banks will have far more trouble getting things under control this time around. For several reasons:

First off, interest rate policy is already at the zero bound. which means that the Fed has no policy tools to reinvigorate the economy. Secondly, quantitative easing has already been massively overused and has created extreme over valuations. Which works great on the way up, and is catastrophic on the way down. Contrary to popular belief, there are no "value buyers" below this market. In addition, unlike last year, margin balances are at an all time high, which means that mass margin calls are lurking directly below the market. The rotation to Tech stocks that saved the market last year is already imploding ahead of time. Corporate debt (% of GDP) which was already at a record last year, has grown astronomically year over year. But the biggest risk, is the fact that this year the Fed will be highly constrained on their "special bailout programs" compared to last year. Already Congress has taken away their power to buy corporate bond ETFs in the secondary market. This won't be viewed as a pandemic rescue, this will be viewed as a rich man's bailout and we can be confident it will be extremely unpopular.

A week ago I predicted that cryptos would be the first bubble to burst. And of course that was the story of the week. Since that post, Bitcoin has had two legs down and two weak rally attempts. It's now halfway between the 50 day and 200 day moving average.

The NYSE Composite "Reflation trade" has tagged the upper trend line every month of 2021 so far. Each double tag has sent it back to the lower trend line which is also the 50 day moving average. Each new high has attended greater risk and greater complacency.

If the crypto crash continues, a massive margin call will be waiting at the lower trend-line this time around, 100x the size of Gamestonk in market cap. Also, if the Nasdaq begins its third wave down, then the sum of all risks will coalesce from an all time high, which is my base case scenario:

For most of today's gamblers, price is their sole indicator. So with the Nasdaq at all time highs, they are of the belief that there is no point in de-risking. Of course this is an asinine argument. It implies that the market can't crash from an all time high when it did so just last year, in the most violent high/low crash in history. Featuring five limit down gap opens - more than the entire prior decade combined.

Now, they are making the same mistake all over again. Granted, most of these people were not even investing a year ago, so how would they know?

This is the weakest breadth at a Nasdaq all time high we've ever seen. And it's attended by the largest Rydex bull/bear asset allocation we've ever seen. And of course the highest margin debt:

In summary, this is the most overbought and overbelieved market in history. Bulls can't afford to be wrong. Unfortunately, the irony of markets is that when everyone believes it's the beginning of a new bull market, that means it's the end.

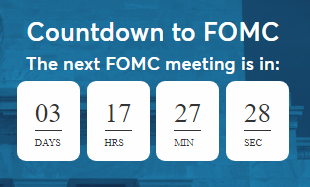

Don't forget, this week is FOMC week aka. "Fear Of Missing Crash". Should be a good one - they will tell us that this Ponzi scheme is 100% under control, with interest rates at 0% and no margin of error. And the sheeple will believe them, right up until the day they realize they got conned. Again.

This meltdown will make last year's gong show seem like a good time.