We are seeing a level of central bank adulation that is beyond the asinine. An entire society convinced that printed money is the secret to effortless wealth. Those who believe this contrivance will find their future is forever stained by the epic fraud that defines this era...

We talk about the financial consequences of this rolling pump and dump scheme all the time. Buy this bubble or that bubble and get out ahead of everyone else or explode in place. Those are the choices.

However, the other major consequence of this era will be measured in lost credibility, damaged reputations, and destroyed careers. Don't worry about Wall Street, I doubt there will be one after this event - their primary line of business pumping junk IPOs/SPACs/subprime mortgages into public markets will be regulated out of existence. This era will separate those who bought and believed the largest fraud in human history versus those who wanted nothing to do with it. Sadly we see that the pressure to capitulate to mandatory optimism is overwhelming. No amount of intellect can prevent those in the financial services industry from succumbing to the primary economic imperative which happens to be blind optimism for the future. Why? Because 90% of the time, optimism is richly rewarded. However, 10% of the time it proves to be lethally fatal. Sadly we are in the sudden death overtime phase of the richly rewarding era. The muscle memory of the past is now guiding the extrapolation of delusion into the indefinite future.

Somehow today's con artists have convinced the public that a massively leveraged post-pandemic re-opening is the strongest recovery in history. Meaning, the exact same businesses that were forced to shut down last year, will now partially re-open and economists will hail that as a record recovery. All because they base ALL of their economic metrics (metricks?) off of year over year comparisons. Last year being dire depression, this year being greatest economy in history. No other profession could get away with this level of incompetence.

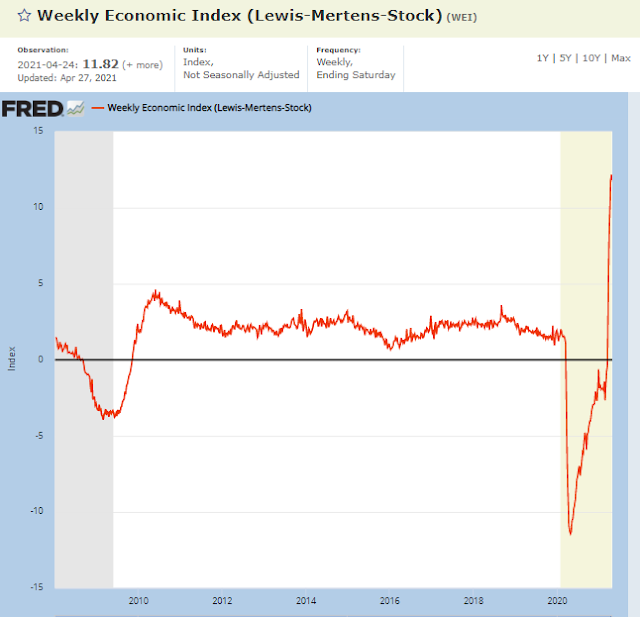

According to the Fed's own economic model, these are the leading indicators based upon one year rate of change relative to a locked down pandemic:

Here we see, the "greatest recovery in history" attends U.S. payrolls at a level first seen five years ago:

The recent passing of Bernie Madoff at the pinnacle of the largest global Ponzi scheme in human history will this weekend be matched by the spectacle of "The greatest investor of all time" holding court at his annual confab.

It's called tempting fate.

With a straight face Buffett will regale his acolytes with tall tales of his legendary success. There is only one problem, it will be all bullshit. Since 2008, Buffett and his billionaire cohort have been bailed out by non-stop monetary intervention. So much so that monetary policy is no longer having ANY effect on the economy. Its sole use is to prop up the wealth of multi-billionaires at public expense. Monetary policy is now the method by which wealth passes from the middle class into the hands of the ultra-wealthy on its way to offshore bank accounts.

From an economic standpoint, the situation we face was last faced in the 1930s - a liquidity trap. A scenario in which interest rates reach a point at which there is no one left to borrow. Looking back, historians will say that the pandemic lockdown concealed a liquidity trap that was deemed to be temporary, but turned out to be a permanent scarring of consumer confidence.

"A liquidity trap is a contradictory economic situation in which interest rates are very low and savings rates are high, rendering monetary policy ineffective"

Here we see that consumer sentiment has in no way recovered back to its pre-pandemic levels, notwithstanding the biggest asset bubble in human history.

As it stands now, central bank alchemy still "works" to the extent that it inflates asset bubbles. However, in the experience of Japan (and China), when these bubbles deflate, even that "super power" will be rendered useless.

And then, the underwear will be mighty stained.

Sorry Warren. Been there, done that.