There will be an Old Testament ending to this Roman Bacchanalia...

The human race has only one natural enemy: Itself. This species has an extreme aversion to the inconvenient truth. That aversion aka. denial, gets the hairless monkey into all sorts of trouble. For those extended durations when this species is assiduously avoiding the truth and enlightenment, corporations have infinite lethalities to keep the drones shackled to addiction.

"Consumer choice"

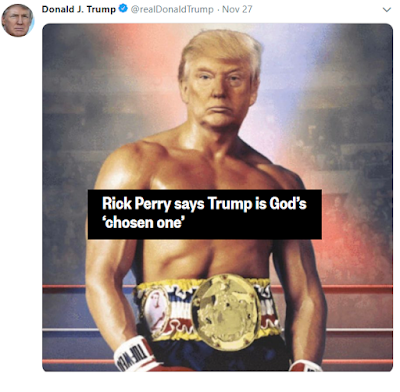

On the topic of denial, it's abundantly clear that the Creator had in mind to humiliate President Ass Clown to the fullest extent possible before exploding his incontinent Circus with biblical dislocation. The plan is exceeding all expectations:

Recall, earlier this year Trump nominated himself Person Of the Year

Next week at Davos, Trump will face off against a 16 year old, in a battle between incontinent arrogance and reality. Another Trump showcase of abject irresponsibility:

Depending upon who you ask, either climate inaction is the biggest risk facing the world, or Donald Trump is the biggest risk facing the world. If you ask Trump supporters, it's Nancy Pelosi.

In other words, the biggest risk facing the world is DENIAL.

"McKinsey said trillions of dollars in economic activity and hundreds of millions lives are at risk from a changing climate"

Adapt, what's that? Unfortunately, that might affect the quarter. Don't these people know we're in self-destruct mode? It's easier to pretend this is all just a hoax invented by people who enjoy riding their bikes to work.

Fortunately, denial is actually the solution. It's this dedication to arrogance and ignorance that has created the chasmic gap between fantasy and reality. We can thank Trump for being the official president of denial.

The U.S. oil industry is literally drilling itself into the ground

The gap between the economy and stocks never wider:

All those attending Davos will be surprised when they learn that this entire decade was one colossal Ponzi scheme, run by an entire generation of Bernie Madoffs. The least dangerous of whom was jailed ten years ago. They put Bernie in jail for running his pissant Ponzi scheme and gave Wall Street a free money bailout for imploding the global financial system, for fun and profit. Fast forward another decade of criminality later, and carbon output is now 100% correlated to mass deception. The biggest source of global warming being rampant bullshit. Especially the b.s. emanating from conferences crowded with rich people who are expert at discussing problems while doing absolutely nothing to fix them.

While today's dedicated denialists were busy staving off the minimalist recommendations from the various climate conferences, they were assiduously ignoring the freight train of reality bearing down on them from the other direction.

I don't know if outright carbon collapse will fix the problem at this late stage. I just know that we are about to find out. And then, all of the idiots who said we couldn't afford climate action will find out that they couldn't afford to be arrogant idiots.

History will say that the Trump carbon tax was totally unaffordable. Nevetheless, due on arrival.

Thursday, January 16, 2020

Wednesday, January 15, 2020

100% Banana Republican Fraud

The Republican Party bears all of the hallmarks of a Third World kleptocracy: Theft, fraud, corruption, authoritarianism, propaganda, and false idolatry. The transformation is complete...

The difference between the last trade truce and this one can be summed up thusly:

The 2018 trade truce came at the end of a 10 month decline in Emerging markets.

This trade truce is coming at the end of a 13 month rally:

"While many of the stocks saw their gains wiped out during the dot-com bubble, Cramer said it is still a worthy exercise to look back to top performers in 1999.

“It’s really pretty astonishing how much of what was working then is also working now”

Good times.

The fact that Joe Biden is the leading Democratic candidate - by a wide margin - speaks to America's void of leadership. Not one of the candidates is willing to call out the Trump economic fraud for what it is - 100% smoke and mirrors.

Rented prosperity. Generational theft on a biblical scale.

Nor are they willing to point out his biggest, fattest, ugliest bubble in human history. Why? Because they are not willing to play the fear card. Trump of course went there over and over again when he was campaigning, but they won't resort to scare tactics. The Democrats are a one legged man in an ass kicking contest.

It's up to markets to impeach Trump before he rigs another election, which is what he is planning to do already:

Speaking of MAGA glue fumes, narco pharma stocks are in blowoff mode:

Despite JP Morgan's blowout earnings on Tuesday, most bank stocks are getting shellacked this week:

Wells Fargo is getting monkey hammered

Remember 2018's trade truce?

Apparently gamblers have forgotten that global markets crashed immediately afterwards.

The difference between the last trade truce and this one can be summed up thusly:

The 2018 trade truce came at the end of a 10 month decline in Emerging markets.

This trade truce is coming at the end of a 13 month rally:

"While many of the stocks saw their gains wiped out during the dot-com bubble, Cramer said it is still a worthy exercise to look back to top performers in 1999.

“It’s really pretty astonishing how much of what was working then is also working now”

Good times.

Tuesday, January 14, 2020

The Moment Of Truth. Is Not An Option.

This era proves that like-minded fools locked in human history's best lubricated circle jerk, will believe ANYTHING and ANYONE. Except the truth...

Tomorrow, markets find out the full details behind the mystery trade deal, however the high is already wearing off ahead of the Black Swan event. It's starting to sink in that this was just another Trump con job:

Big Donny will explode the mega bubble. Trump being the only risk factor anyone needed to know that this would all end extraordinarily badly. After all, what kind of moron would trust Donald Trump?

"One minute I held the key

Next the walls were closed on me

And I discovered that my castles stand

Upon pillars of salt and pillars of sand

For some reason I can't explain

I know Saint Peter won't call my name

Never an honest word

But that was when I ruled the world"

Tomorrow, markets find out the full details behind the mystery trade deal, however the high is already wearing off ahead of the Black Swan event. It's starting to sink in that this was just another Trump con job:

"Stocks were rattled, when Bloomberg news service Tuesday afternoon reported that tariffs were not expected to be lifted until a phase two deal...The report also said the phase two deal was not expected until after the November election"

Markets are primed to implode:

"Reflation"

Oil

Positioning

Today new multi-year high in the equity call/put ratio ahead of the Black Swan event.

As gamblers reach for MAXIMUM risk:

Today new multi-year high in the equity call/put ratio ahead of the Black Swan event.

As gamblers reach for MAXIMUM risk:

Zerohedge reminded us today that we haven't seen this level of extreme short covering, since...

October 2008:

The "trade deal" isn't even signed and Trump is already agitating to monkey hammer the leading sector, semiconductors:

"The U.S. government is nearing publication of a rule that would vastly expand its powers to block shipments of foreign-made goods to China’s Huawei, as it seeks to squeeze the blacklisted telecoms company"

For those wondering what would "officially" pop the Tech bubble, now you know...

Big Donny will explode the mega bubble. Trump being the only risk factor anyone needed to know that this would all end extraordinarily badly. After all, what kind of moron would trust Donald Trump?

MAGA: License To Implode

I don't understand how so many people can be conned by Trump. He is ENDGAME for the Roman Circus. Euthanasia for America's blue collar working class who view him as their saviour...

Somehow Democrats spend all of their time worrying about the election, when they should be worried about the Financial Weapon of Mass Destruction Trump has created. The largest MMT (Fiscal + Monetary) thermonuclear asset bubble in human history.

Trump has already cost over a million Americans their healthcare coverage. And yet he bragged this week about saving healthcare for the middle class. There is no asinine lie he won't tell and his base won't believe. Which is what makes him so dangerous. To them. He mixes the cyanide Kool-Aid, and they drink it en masse. Without question.

Coming out of the Vietnam war over forty years ago, the blue collar working class was beaten down. National morale was at a low point. Jimmy Carter famously talked about the "malaise" that was afflicting the country. A crisis of confidence. Ronald Reagan had the cure for that problem - punt Carter out of office and make America Great Again. Sound familiar? One decade later, the debt was tripled and America's homeless population had exploded. Sometimes greatness can be expensive. GW Bush, had the exact same plan. Punt the liberals and get America back to kicking ass and taking names. Two failed wars later, the economy imploded. Again, greatness comes at a cost. To the middle class. Trump was elected on the exact same promise - regain America's swagger after suffering almost a decade under liberal "mediocrity". The 5th Avenue fake populist gave the blue collar working class their swagger back, and all he asked for was another pound of flesh in return. More strip mining of the middle class to make the bailout class richer again.

The aftermath of Trumptopia will make 2008 seem like a fun picnic. Trump will cost many people everything. He used up the monetary safety net to create the mega asset bubble to get re-elected. In the process, he has created a like-magnitude bubble in mass complacency.

He has had plenty of assistance. The Faux News set have vociferously defended every single abuse of power, instead casting Democrat impeachment efforts as undermining democracy. When their dictator destroys democracy that's perfectly Ok, but any attempt to check Trump's power undermines "the system". In the process, they have given free reign to a narcissistic demagogue taking his cues from a deranged Twitter mob.

Trump's mega asset and complacency bubble is now totally out of control. It's in melt-up mode at this moment, but when it rolls over into vertical melt-down mode, there will be no way to stop global mass implosion.

Clownius Trump is endgame. He is the last round of false bravado sponsored by recycled failure.

You have to be brain dead to believe anything else. That, or over-invested in criminality. Fully complicit in propagating biblical mass delusion.

Somehow Democrats spend all of their time worrying about the election, when they should be worried about the Financial Weapon of Mass Destruction Trump has created. The largest MMT (Fiscal + Monetary) thermonuclear asset bubble in human history.

Trump has already cost over a million Americans their healthcare coverage. And yet he bragged this week about saving healthcare for the middle class. There is no asinine lie he won't tell and his base won't believe. Which is what makes him so dangerous. To them. He mixes the cyanide Kool-Aid, and they drink it en masse. Without question.

Coming out of the Vietnam war over forty years ago, the blue collar working class was beaten down. National morale was at a low point. Jimmy Carter famously talked about the "malaise" that was afflicting the country. A crisis of confidence. Ronald Reagan had the cure for that problem - punt Carter out of office and make America Great Again. Sound familiar? One decade later, the debt was tripled and America's homeless population had exploded. Sometimes greatness can be expensive. GW Bush, had the exact same plan. Punt the liberals and get America back to kicking ass and taking names. Two failed wars later, the economy imploded. Again, greatness comes at a cost. To the middle class. Trump was elected on the exact same promise - regain America's swagger after suffering almost a decade under liberal "mediocrity". The 5th Avenue fake populist gave the blue collar working class their swagger back, and all he asked for was another pound of flesh in return. More strip mining of the middle class to make the bailout class richer again.

The aftermath of Trumptopia will make 2008 seem like a fun picnic. Trump will cost many people everything. He used up the monetary safety net to create the mega asset bubble to get re-elected. In the process, he has created a like-magnitude bubble in mass complacency.

He has had plenty of assistance. The Faux News set have vociferously defended every single abuse of power, instead casting Democrat impeachment efforts as undermining democracy. When their dictator destroys democracy that's perfectly Ok, but any attempt to check Trump's power undermines "the system". In the process, they have given free reign to a narcissistic demagogue taking his cues from a deranged Twitter mob.

Trump's mega asset and complacency bubble is now totally out of control. It's in melt-up mode at this moment, but when it rolls over into vertical melt-down mode, there will be no way to stop global mass implosion.

Clownius Trump is endgame. He is the last round of false bravado sponsored by recycled failure.

You have to be brain dead to believe anything else. That, or over-invested in criminality. Fully complicit in propagating biblical mass delusion.

Monday, January 13, 2020

Fools And Their Money. Are Soon Parted.

What we are witnessing in real-time is the end of globalized capitalism. A supernova of over-valuation driven by recession, in accordance with the rules of modern financial alchemy, as taught at America's "best" business schools...

Archaeologists will be studying this era for centuries - how the average IQ collapsed down to the level of a dead gopher. And then, how today's "best and brightest" got conned by a known con man. I'll give the historians a hint, it's called misallocation of capital due to the poverty arising from 2008 and the attendant RECORD low interest rates. The fate that met labour in 2008 now awaits capital. Nothing lies more than misallocated capital:

Imagine going down in history knowing that the CFOs warned, the CEOs warned, but true believers instead chose to trust a proven con man on Twitter. Donny is also from Wharton Business School by the way, where apparently they hand out degrees at the bottom of a Cracker Jack box.

In summary, 2018 priced in Trump's tax cut and ended the year down -20%.

In 2019, the Fed stepped in to bailout Trump and his trade war, cutting rates three times and expanding their balance sheet at the fastest pace since 2009. The Fed called it the "Mid-cycle" adjustment, at the end of the longest expansion in U.S. history.

Archaeologists will be studying this era for centuries - how the average IQ collapsed down to the level of a dead gopher. And then, how today's "best and brightest" got conned by a known con man. I'll give the historians a hint, it's called misallocation of capital due to the poverty arising from 2008 and the attendant RECORD low interest rates. The fate that met labour in 2008 now awaits capital. Nothing lies more than misallocated capital:

"What a fool believes, he sees

No wise man has the power

To reason away

What seems to be

Is always better than nothing"

Of the three bubbles, this is by far the most obvious one. Why? Because it has key risk indicators from BOTH of the prior two bubbles - Massive Tech overweight deja vu of Y2K, and credit bubble due to low interest rates deja vu of 2008. In addition, this bubble has currency risk circa 1997. The 1998 collapse of mega hedge fund LTCM (Long-term Management Capital) was caused by the Asian currency crisis. The book that chronicled that event was called "When Genius Failed". Because the fund was run by a group of PhD Nobel Prize retards. The same type of people who are ignoring risk RIGHT NOW.

There are multiple reasons why today's artificially intelligent pundits are willing to ignore risk right now. First off, they've been conditioned over the past decade to believe that central bank money printing is the secret to effortless wealth. In addition, from a Finance 101 perspective, analysts have been raising their price projections as interest rates fall, in accordance with the discounted cash flow (DCF) model. This fantasy model straight from Disney Wharton, conveniently ignores WHY interest rates are falling. Therefore going into recession, this model predicts rising valuations straight into the end of the cycle. And then collapse in price as Wall Street's extrapolated forward earnings estimates fall off a cliff.

Speaking of which, here we stand at record price and (over)valuation, even as both CEOs and CFOs warn en masse that a downturn is coming THIS YEAR:

Imagine going down in history knowing that the CFOs warned, the CEOs warned, but true believers instead chose to trust a proven con man on Twitter. Donny is also from Wharton Business School by the way, where apparently they hand out degrees at the bottom of a Cracker Jack box.

In summary, 2018 priced in Trump's tax cut and ended the year down -20%.

In 2019, the Fed stepped in to bailout Trump and his trade war, cutting rates three times and expanding their balance sheet at the fastest pace since 2009. The Fed called it the "Mid-cycle" adjustment, at the end of the longest expansion in U.S. history.

All of which has led to the highest valuations of the cycle at a time when corporate insiders are bailing out at decade pace while warning it's the end of the cycle.

Now, the bailout is priced in.

Which means 2020 will be downturn sans bailout.

"Genius" sans intelligence.

When the sheeple finally realize that our leaders are the biggest dunces of all, the underwear will be fully stained. And the rioting will begin post haste.

When the sheeple finally realize that our leaders are the biggest dunces of all, the underwear will be fully stained. And the rioting will begin post haste.

Dual-Listed Rioting

Trump's presidency now hangs on a fake trade deal. Shocking, I know...

The long awaited fake trade deal signing is on Wednesday. Gamblers are super lubed ahead of the Black Swan event. This con job will be measured solely in terms of the record numbers of useful idiots who will believe ANYTHING except the truth. Since the Roman Senate won't impeach Trump, it's up to the markets to finish the job...

Fortunately, there are only five (tech) stocks anyone needs to own

“A ratio like this is unprecedented, including during the tech bubble,” Mike Wilson, the bank’s head of U.S. equity strategy, said in a note on Sunday. “Capital concentration is following corporate inequality like never before.”

Bank of America highlighted the “rising correlation and concentration risks”

The long awaited fake trade deal signing is on Wednesday. Gamblers are super lubed ahead of the Black Swan event. This con job will be measured solely in terms of the record numbers of useful idiots who will believe ANYTHING except the truth. Since the Roman Senate won't impeach Trump, it's up to the markets to finish the job...

Imagine if a long awaited fabricated trade deal was the cause of global meltdown. Zerohedge enumerates all of the ways this market is overbought and overbelieved. Those who propagate this delusion are complicit in human history's biggest fraud. Not just the fake trade deal, but also this fake economy, universally believed to be strong. It's 100% house of cards, held up solely by record combined monetary and fiscal stimulus. With no safety net underneath. An ALL IN gambit on Trump's re-election.

"World stock markets were flat on Monday, hovering just below record levels ahead of the expected signing of a Phase 1 China-U.S. trade deal, although markets have yet to see details of the agreement."

Two years later, global markets ex-U.S. have reached a three wave correction to a lower high:

EMs show the exact same pattern

The U.S. Stock / bond ratio exhibits the exact same three wave pattern as all of the non-U.S. charts above:

U.S. banks, same pattern. Now rolling over:

The largest dual-listed tech stock in the world is up 30% from its Hong Kong dual listing six weeks ago:

Bulls should never want to see Chinese Tech stocks "leading" the rally

Bulls should never want to see Chinese Tech stocks "leading" the rally

Fortunately, there are only five (tech) stocks anyone needs to own

“A ratio like this is unprecedented, including during the tech bubble,” Mike Wilson, the bank’s head of U.S. equity strategy, said in a note on Sunday. “Capital concentration is following corporate inequality like never before.”

Bank of America highlighted the “rising correlation and concentration risks”

In summary, the Hong Kong riots are about to go global, when today's Idiocracy realizes they were conned again.

Friday, January 10, 2020

Double Down On Super Cycle Fraud

The downside of ignoring 2008 was the conscious decision NOT to see the far bigger crisis yet to come...

The various stimulus gimmicks of this era have steamrolled realists under the crazy train of Disney markets. Meanwhile, Wall Street analysts and today's EconoDunces assure us they can predict the future, even as their asset bubble wholly disconnects from the underlying fundamentals. Put the Casino-Bankrupter-in-Chief in charge of the last Trump (S&P) casino, and just remember one thing: no Alice in Wonderland saw it coming...

As we see above, the real problem is no longer merely the stock bubble. The real problem is the massive disconnect with the underlying fundamentals of the economy. The net effect of the past decade was to cannibalize what remained of the global economy amid non-stop monetary and fiscal stimulus gimmicks. The 2008 bailout and subsequent decade, exchanged a private debt crisis for a much bigger sovereign debt crisis now waiting in the wings of human history's biggest failed bailout.

Deflation has been the common theme for the past decade, and yet the concern for the past decade was the imminent return of inflation. Old habits die hard. The only inflation in this environment is asset inflation. We are told that the collapse of U.S. bond yields is solely due to the collapse of the global economy. Hence not to worry. However, the S&P 500 garners more than half of its profit overseas, which is why CEO confidence is tanking while "consumers" are guzzling Trump Kool-Aid:

"Don't worry, we are decoupled. From reality"

What today's asset managers are telling their clients is that stocks ALWAYS go up in the long-term. They are ignoring the fact that this cycle is entirely unlike any other cycle in our lifetimes. They are ignoring the fact that this time it may take lifetimes to get back to breakeven. In 1929 it took 25 years to breakeven, not a lifetime, but too long for those close to retirement. For young people sure, ride out a -90% dip amid record global dislocation. We don't even know which companies will exist on the other side of this record corporate debt purge.

What is coming is the end of a supercycle. This bubble is wholly disconnected from the underlying fundamentals. As predicted by Hugh Hendry:

"The worse the reality of the economy becomes, the more we take on the reflexive belief in further and dramatic monetary expansion and the more attractive the stock market looks."

Nevertheless, the crazy train must continue.

The role of today's asset manager is to make up reasons for people to ignore risk.

"I feel as though I’m playing a game of Musical Chairs while the music still plays"

Deja vu circa July 2007:

“When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing,”

The various stimulus gimmicks of this era have steamrolled realists under the crazy train of Disney markets. Meanwhile, Wall Street analysts and today's EconoDunces assure us they can predict the future, even as their asset bubble wholly disconnects from the underlying fundamentals. Put the Casino-Bankrupter-in-Chief in charge of the last Trump (S&P) casino, and just remember one thing: no Alice in Wonderland saw it coming...

As we see above, the real problem is no longer merely the stock bubble. The real problem is the massive disconnect with the underlying fundamentals of the economy. The net effect of the past decade was to cannibalize what remained of the global economy amid non-stop monetary and fiscal stimulus gimmicks. The 2008 bailout and subsequent decade, exchanged a private debt crisis for a much bigger sovereign debt crisis now waiting in the wings of human history's biggest failed bailout.

Deflation has been the common theme for the past decade, and yet the concern for the past decade was the imminent return of inflation. Old habits die hard. The only inflation in this environment is asset inflation. We are told that the collapse of U.S. bond yields is solely due to the collapse of the global economy. Hence not to worry. However, the S&P 500 garners more than half of its profit overseas, which is why CEO confidence is tanking while "consumers" are guzzling Trump Kool-Aid:

"Don't worry, we are decoupled. From reality"

What today's asset managers are telling their clients is that stocks ALWAYS go up in the long-term. They are ignoring the fact that this cycle is entirely unlike any other cycle in our lifetimes. They are ignoring the fact that this time it may take lifetimes to get back to breakeven. In 1929 it took 25 years to breakeven, not a lifetime, but too long for those close to retirement. For young people sure, ride out a -90% dip amid record global dislocation. We don't even know which companies will exist on the other side of this record corporate debt purge.

What is coming is the end of a supercycle. This bubble is wholly disconnected from the underlying fundamentals. As predicted by Hugh Hendry:

"The worse the reality of the economy becomes, the more we take on the reflexive belief in further and dramatic monetary expansion and the more attractive the stock market looks."

Nevertheless, the crazy train must continue.

The role of today's asset manager is to make up reasons for people to ignore risk.

"I feel as though I’m playing a game of Musical Chairs while the music still plays"

Deja vu circa July 2007:

“When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing,”

Subscribe to:

Posts (Atom)