Sunday, January 8, 2023

THE EVERYTHING RECESSION

Wednesday, January 4, 2023

THE CALM BEFORE THE SHITTING OF BRICKS

2023 is starting off the same as 2022, except this year instead of the all time high into wave one (blue) down, this is a broadening top into third wave (blue) down. The difference will be in how much underwear is soiled this year compared to last year...

The Dow's all time closing high was a year ago today. The all time intra-day high was a year ago Jan. 5th, aka. my birthday. Those early Jan. 2022 highs have stood until now. Which leaves the only question on the table - is this week seeing the highs of the year for 2023?

For the record, now that 2022 is over we know that the post mid-term election "melt-up" never happened AND the annual Santa rally was a total dud. The Goldman Sachs/Zerohedge Q4 stock buyback bonanza also failed to deliver.

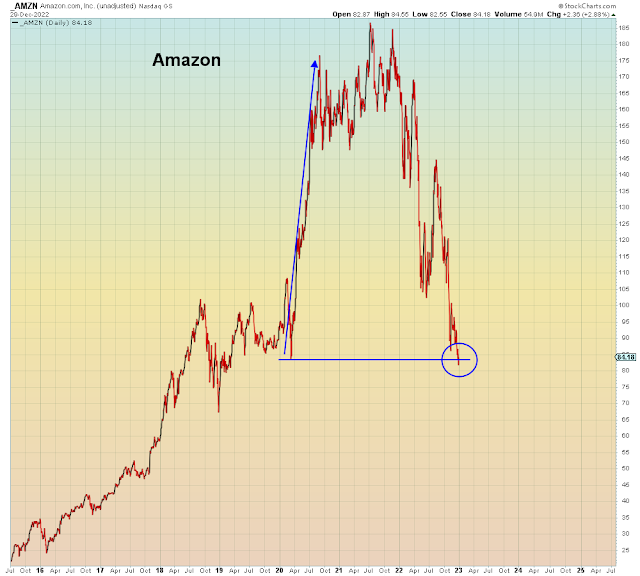

Nevertheless, the Q4 low volume/volatility collapse has carried over into the new year. The only way to keep the market pinned at these levels is to essentially lower liquidity until all trading stops. Case in point, today the Nasdaq VIX flash crashed the most in history. Clearly the algos are having a hard time maintaining this illusion when one by one all of the market cap generals get taken out and shot. Today it was Microsoft's turn to get downgraded due to "rapidly decelerating" cloud (Azure) growth. Meaning, it was a veiled downgrade of Amazon as well. Recall that in the last quarter, analysts valued Amazon's Ecommerce business at $0, and ascribed all market cap to AWS. Which is now "rapidly decelerating".

It's the same low volume in the housing market. Last week we learned that pending homes sales have collapsed to two decade lows.

This chart shows the ratio of U.S. home prices to U.S. incomes, available from the OECD web site. The middle pane shows the months of homes available for sale. And the bottom pane, pending home sales. Note that the monthly inventory of homes for sale only rose AFTER prices began to fall in 2006. Whereas this time it has already shot up. When prices finally begin to collapse, sellers will rush to the market and all try to get out at the same time.

It won't work.

Michael Burry was out this week saying the U.S. is already in a recession and he believes the Fed will make the same mistake Volcker made which is to stop tightening too soon which will allow inflation to reaccelerate. That's a bold call to make and it's quite bullish. However, there are reasons to believe that won't happen this time around.

First off, Burry ignores the fact that financial conditions today are nothing like they were in 1980. Today they remain far too loose for the Fed to pivot. It would have to be one hell of a crash to make them change their mind. Without that, CPI won't be coming down any time soon.

Back in the early 1980s, there were protesters outside the Fed:

"Those were tough times—economically and politically. Interest rates of 20 percent and unemployment rates of 10 percent; rings of tractors around the board building; offices filled with 2x4s mailed in by builders; consumer demonstrations outside the building; talk of his impeachment in the Congress"

Which get us to the the next point: by this time in both 2000 and 2008, the Fed was ALREADY easing. So this idea that they will push the economy deep into recession and push markets lower, THEN bail them out has no basis in reality. They neither bailed out the stock market nor the housing market the last two cycles. Unless you consider SPX -50% a successful bailout.

The risk isn't that the Fed restarts inflation, the risk is that they create runaway deflation. In 1980, Volcker had 19% of Fed rate to ease. This Fed has 4.25%. Consider the fact that the 1990, 2000, and 2008 recessions all required 5.5-7% of rate cuts.

In other words, if the Fed woke up to their incipient mistake tomorrow, it would still be too late to bailout markets and the economy.

Thursday, December 29, 2022

2023: DEFLATIONARY COLLAPSE

The biggest risk for gamblers anticipating bailout in 2023 is that we are at the exact opposite end of the Fed policy continuum from bailout...

Rewind to November 10th, 2022:

"There's still a chance we can avoid a hard landing if the Fed pivots in December"

Exactly. But the Fed didn't pivot in December. So now what do bulls expect? They expect a Fed pivot and soft landing to come in 2023 instead. And a pony to go with the horse shit.

Recall that during the first half of 2022, pundits pounded the table saying the Fed was tightening too slowly. Markets had their worst first half since 1970. So then pundits panicked and spent the last six months saying the Fed is tightening too fast.

Which is why the watch word of the year is "Fed Pivot".

What they call "pivot", I call bailout. Have you noticed I'm the only pundit who uses this term? Pivot sounds so official and technical. It's almost like a real economic term. Whereas "bailout" sounds like a trapped bull in desperate need of Fed assistance - the entire market story for the past fourteen years.

This current Fed bailout fantasy has been assiduously cultivated by the financial media desperate to give trapped bulls the illusion of another easy bailout. Just this week, Goldman Sachs put out their latest prediction for 2023 saying it will be an even softer landing than consensus already predicts (re: 4,000 SPX is consensus). Goldman actually sees a soft landing WITHOUT a Fed pivot in 2023, which is on the side of free-basing crack. Bearing in mind that the people writing this were playing Halo in their parents' basement in 2008.

Zerohedge compounds confusion:

"We agree that a divided Congress will be unable to respond to a recession (which will occur), which means that the only support possible in 2023 and 2024 will be from the Fed, and yes: the firehose is coming"

Of course the firehose is coming. But at what level is the question. Will Zerohedge join the NBER in declaring recession with the SPX down -50% as they did so well in 2001 and 2008?

It appears they will.

In early 2023 we will find out what would have happened if the Fed hadn't pivoted in 2018 because the Fed won't pivot until they see market panic and by that time it will be too late. Moral hazard has caused too much underlying technical damage, as we see in the lower pane below.

Recall that in 2008 the Fed didn't have to (1) pause (2) pivot (3) stop QT (4) start QE. We are currently at the exact opposite side of the bailout continuum from 2008 AND from March 2020.

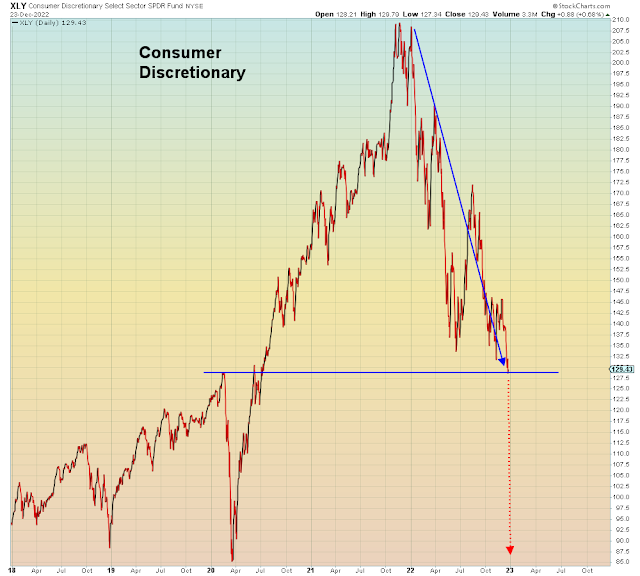

Unlike March 2020, Tech won't support the market this time around.

Recall that it was the "work from home" Tech stocks that supported the market in 2020. Now most of those stocks are already below their March 2020 lows.

2022 has done all of the pre-crash preparation. The ensuing global RISK OFF will leave the casino bidless with nowhere to hide.

The Fed's Volcker gambit of shock interest rate hikes will fail catastrophically because global central banks don't have enough rate hike dry powder to prevent mass deleveraging. And as Zerohedge admits, this Congress will be deflationary. When I say deflationary I mean that supply will exceed demand at the macro level. Leaving a glut of EVERYTHING at the same time.

Contrary to popular belief, already-collapsed consumer sentiment will not improve in 2023 when global asset markets explode.

This is nothing like 2018 in terms of consumer sentiment:

In summary, right now 90% of investors and pundits are bullish and 10% are bearish. I mean really bearish not Wall Street bearish.

This bear market doesn't end until it's the other way around. When that happens, we will STILL be in the minority camp, battling the same morons every step of the way.

And on the right side of the trade.

Saturday, December 24, 2022

2023: TERMINAL CRIMINALITY

My prediction for 2023 is that widely ignored fraud will explode spectacularly, amid what will be widely considered an unforeseen Black Swan event. When that happens, all of Wall Street's lethally optimistic predictions for 2023 will be instantly imploded...

My Twitter picture (below) was taken at the Ladner bird sanctuary in 1971. My first encounter with a black swan. I have since migrated south of the border.

Sam Bankman was extradited to the U.S. this week and released on $250 million bail. His partner in crime was released on a mere $250 thousand bail because she threw him under the bus. She admitted they had been knowingly committing rampant fraud, in exchange for a reduced sentence. This is the type of criminal spectacle that keeps this society preoccupied while they are being fleeced by what I call criminality as usual.

The problem with today's markets is the problem with this society - we are dominated by storytellers who ignore all facts. Today's market predictions are science fiction, however this society has an addiction to what I call "soft" fraud.

Which gets us to my 2023 prediction. I predict that the Fed will continue to escalate their campaign of incompetence, and Wall Street will continue to escalate their campaign of fraud until it all explodes with extreme dislocation. Bullish pundits who assert that us skeptics have been wrong this whole time, will be viewed as accomplices to fraud.

Let's recap:

In 2021, exiting the pandemic the Fed made the mistake of staying too loose for too long. In league with global central banks, they inflated the largest bubble in human history. Wall Street took full advantage by "democratizing markets", which meant democratizing fraud. It was exhibited by the Gamestop/ AMC pump and dumps which were conflated as victories for small investors. In addition, a record $1 trillion of junk IPO/SPAC issuance dumped on small investors. Followed by the Ark ETF bonfire of retail money, and mainstream adoption of Crypto Ponzi schemes in 401k retirement plans.

But who knew all of THAT would be small time compared to what was coming in 2022? Not one bullish pundit.

In 2022, the Fed made the mistake of panic raising rates up to a level 3x higher than pre-pandemic while keeping their balance sheet unchanged on the year. Today's bullish pundits STILL have yet to realize that was a colossal mistake, because it has so far only imploded the middle class while leaving the casino class intact. In 2022, Bankman's FTX losses were 1/100th the scale of mega cap Tech losses. Wall Street's consensus 2022 market prediction was off by -30% at the lows of the year and it remains off by a bear market magnitude, as we see in the S&P 500 full year chart below.

I now predict 2023 losses will make 2022 seem like chump change because once again, the Fed and Wall Street have found a way to up the ante:

My prediction for 2023 is that Wall Street's profit and GDP estimates will be off by a minus sign and their market consensus of S&P 4,000 will be catastrophically wrong.

The Fed will be tightening in a bear market/recession. The much anticipated "pivot" will be a total clusterfuck that will accelerate investor risk aversion. I predict the Fed will react very slowly to market meltdown and then they will ultimately panic, causing even more mayhem. Today's bullish pundits just assume that the Fed can easily pivot 180 degrees to rescue markets even though that wasn't the case in 2000 or 2008.

It will be like March 2020 without the central bank bailout. When that happens, the simmering global housing bubble will final explode, rendering all of Wall Street's 2023 predictions instantly buffoonishly optimistic.

In summary, "hard" fraud accounts for a de minimis amount of society's wealth losses. Whereas soft fraud accounts for the overwhelming amount of societal losses. Casually destroying people's financial lives is now the primary business model.

And it's going out of business in 2023.

The SEC will finally be seen for what it is - an enabler of mainstream fraud, while focusing solely on small time spectacle.

As always, the burden of truth is on the minority who believe it exists.

Thursday, December 22, 2022

THE GREATEST FOOL'S MARKET

Sunday, December 18, 2022

2022: RECORD BULL CRAP

2022 has been a great year for traders who bought and sold false hope over and again, all while Wall Street's usual bagholders rode the slope of hope all the way down. 2023 will be about the same, only a lot steeper...

2022 had three declines and three rallies. The CNN Greed/Fear Index did a great job of predicting each top and bottom. However, as we see the upper trendline worked great as well.

Technical Analysis 101.

A Santa Rally is a tall order considering the Dow is coming off its best two month rally since 1975.

Still, false hope abounds.

So far, I have avoided making any predictions for 2023 because I am still focused on 2022 even though there are now only two weeks left. This is the timeframe when the wheels came off the bus in December 2018 and I am still of the belief that is the most analogous scenario.

In addition, once the REAL crash begins I believe full year predictions will be a fool's errand of the highest order. Suffice to say the first thing that will happen is that all of Wall Street's full year 2023 predictions will be instantly voided. Now imagine if that were to happen BEFORE the year even began. Biblical.

This year, the Nasdaq has fared far worse than the broader market. To date, this is the worst year for the Nasdaq since 2008 and before that 2000. Nevertheless, bulls are doing a great job putting lipstick on this pig.

I would point out to bulls that the Fed was already easing at the end of 2000 AND 2008. And as we see from Y2K, the Nasdaq continued falling for another two years AFTER the Fed started easing in 2000.

Which gets us to the housing market. So far, the bubble has remained mostly intact with some regional deviations. Few if any pundits are sounding the alarm on another full scale 2008 style meltdown. Except for Michael Burry who predicted the last housing meltdown.

He has been warning all year.

September, 2022:

Imagine ignoring the guy who became famous predicting (and profiting) from the last housing meltdown, because the morons at large were too busy listening to the same criminals as last time. Clearly, this is all repeating for a reason, to show how dumb this society has become.

Which gets us to the Automobile market and the meltdown of Elon Musk, a bubble unto himself, imploding in real-time. Recall that his net worth increased some 10x during the pandemic. And so he squandered the money buying Twitter.

Meanwhile, Tesla true believers are of the mind that Electric Vehicles (EVs) are somehow immune from the laws of economics. Unfortunately, nothing could be further from the truth. They are at the intersection of overvalued Tech stocks and over-priced luxury vehicles.

Up until now there has been a long waiting line to buy a Tesla.

That is about to change in 2023.

In summary, Tech stocks, housing, autos, cryptos, and the Elon Musk super bubble are all imploding at the same time. However, bullish pundits have done a fantastic job of making sure the sheeple remain clueless as to what is coming, which will serve to make the impending dislocation far worse.

The Fed's big mistake in 2021 was being too loose for too long. Their big mistake in 2022 is being too tight for too long. According to Forbes, they will realize their mistake by the second quarter:

"Given the emerging weakness in the economy, we see a continuation of disinflation over the next few months, turning to outright deflation when BLS’s methodology recognizes the downtrend in rents; that should begin in Q2 2023"

All of which means that 2023 will be like 2022 - a roller coaster ride. Only, this one will be for adults only. Because we all know that the first drop is the largest and scariest.

Especially when "no one" sees it coming. Except the guy who saw it coming the last time.