Wednesday, December 14, 2022

LETHAL INCOMPETENCE

Sunday, December 11, 2022

THE MOST IMPORTANT WEEK OF 2022

All of 2022 risks have been kicked down the road into the end of the year. From Wall Street's perspective, it's money in their bank...

Looking back at the past year we now know that Wall Street's predictions a year ago were total science fiction. Their Fed rate hike predictions were wrong every quarter of the year, by being continuously over-optimistic. And yet, CNBC and Zerohedge dutifully quoted Wall Street’s used car salesmen every step of the way, never once questioning the bullish bias. A premium service that costs twice - once to get the advice and again when you go to use it like a useful idiot.

So it can come as no surprise that Wall Street predictions for 2023 are "looking across the valley" to the better market that lies ahead in the second half of the upcoming year. Hence the average forecast is unchanged to up 5% on the year.

"The range of forecasts is pretty wide this year: Bloomberg surveyed 17 strategists who had an average forecast of 4,009. Reuters’ poll of 41 strategists revealed a median forecast of 4,200."

In other words, despite a Fed target rate that has risen 500% year over year, Wall Street has only reduced their outlook to neutral. Investors can expect somewhere between 0% to 5% return while taking epic - this time KNOWN risk. We all know that monetary policy operates on a lagged basis, and yet the SAME magnitude of rate hikes that collapsed the housing bubble in 2007 are now met with a shrug.

Meaning that Wall Street's 2023 predictions are the same as their 2022 predictions - buffoonishly optimistic.

That's the bad news. The good news is that Wall Street has already closed the books on this year, giving the impression that 2022 risks have gone into hibernation when in fact they have been merely ignored and punted into next year. But why would any (financial) industry that counts one year of P&L at a time, care about that?

So it falls on us to ask the question what could go wrong?

First off, BOTH the Fed and ECB are expected to raise rates by .5% in this coming week.

"The European Central Bank will take its deposit rate up by 50 basis points next week to 2.00%...at its fastest pace on record...despite the euro zone economy almost certainly being in recession"

Europe had already been dealing with the supply shock caused by the pandemic, and now they are struggling with the supply shock caused by the war in Ukraine. So what to do? Raise interest rates on consumers at the fastest rate in history. Consider that the European deposit rate had been negative for the SIX years before the pandemic. And this week it's on the way to 2%. Sound familiar? It's an even bigger policy mistake than the Fed is making. At least the Fed can still pretend the U.S. is not in recession. Not one media stooge has thought to ask the Fed/ECB why they are jacking up rates when rates didn't cause inflation in the first place.

What all of these monetary dunces don't realize is that wages are growing SLOWER than inflation, hence this is NOT demand side inflation. Which is why this policy error will cause the fastest global demand collapse in history. And policy-makers won't be able to resuscitate the middle class when it happens. All because they used their balance sheet to create inflation, and now they're using interest rates to quell inflation. Supply-side idiocy.

Which gets us to the casino. A confluence of factors are coalescing, similar to what happened right before the pandemic meltdown.

For one thing, speculators were very active going into March 2020. One of the risk assets they were bidding up were low quality shipping stocks:

Similarly, in early 2020 Chinese stocks had been shellacked by the early pandemic. However, they suddenly rallied in February due to the excessive amount of stimulus provided by the PBOC.

The same thing is happening now, as we see in the upper pane of the chart below.

Another thing this chart shows is the manic levitation of packaged foods company Campbell Soup company. Which is manifestation of the U.S. recession trade. Another common factor from February 2020.

Another factor many investors seems to forget is that the $USD had a major pullback in February 2020 just before it sky-rocketed. The timing of this dollar pullback lines up with the other risk factors mentioned above. Right before all hell broke loose.

In summary, it's going to be an interesting week.

Thursday, December 8, 2022

THE INFLATION TRADE IS OVER

What pundits and the Fed all forget is that when Volcker purposely over-tightened in 1980 to bring down inflation, he had 19% Fed rate buffer. In the event, they used 10% of it. This Fed currently has 3.75% of downside buffer. According to Zerohedge/Bloomberg, the Fed will now need to cut rates by 5% in 2023. That will be difficult if the Fed rate is below that level when the Fed pivots as bulls expect will happen any time now. So it is that the best case scenario for markets happens to be the worst case scenario for the economy.

Tuesday, December 6, 2022

FTX MODE

History will say the pandemic was the biggest bull trap in history...

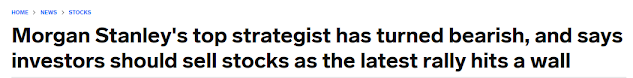

Wall Street's top ranked strategist has now proclaimed "the rally is over":

For those who remember Y2K, this pattern of late cycle Dow outperformance was seen back then as well. It was a very dangerous mirage as the bear market accelerated.

The short-covering bonanza was even bigger for overseas investors, particularly in Europe and China. These have been the most shorted markets of 2022, therefore hedge funds just gave back the majority of their gains for the year.

This chart of the World ex-U.S. compares this Q4 rally to the ones in 2017 and 2019. This one is of the same magnitude in a fraction of the time. It's important to note the 2018 year-end decline due to Fed rate hikes.

Investors are entering December positioned the OPPOSITE of 2018:

Unlike the stock market, the bond market is signaling major Fed policy error. For some reason, only bonds are capable of looking beyond the linear horizon to predict that the Fed is about to break markets.

Here we see the 30 year bond ETF is rising at the fastest pace since February 2020. The arrows show the path of deflation followed in 2020.

What comes next I call "FTX Mode", meaning wholesale liquidation of entire asset classes. Where it will begin and end is anyone's guess, but we can speculate that it will likely take place in ARK ETFs and other Tech funds that only nominally participated in the rally.

Capitulation at this late stage of the game will be interesting to say the least.

In summary, contrary to popular belief, deflation will NOT be good for stocks. That will be the final lesson for those who never learned their lesson from Y2K and the housing crash - when official recession declaration came only AFTER gamblers were already buried.

And it was backdated a year.

Thursday, December 1, 2022

THE BIG BANG THEORY

Gamblers are betting the worst is over. Unfortunately, the worst hasn't even started yet...

The only thing that can bring down inflation quickly is a market crash. Hence the Fed has signaled they will keep it up, until their job is done.

"Good news":

The Dow just closed November with the largest two month Dow rally in history (75+ years). Powell was hawkish, but the market didn't care. Nothing could derail this manic melt-up. This impending December rate hike is not a pivot, it's not a pause, it's merely a "step down" from .75% to .5% with ongoing potential rate hikes in 2023. We've entered the Twilight Zone in which a .5% rate hike went from being unthinkable a year ago to good news now. Per Hendry's Iron Law of Disney markets, bad news is constantly conflated as good news. In addition, what bad news obtains has been magically pushed into 2023. Another important concept that has been forgotten is something called "conflict of interest".

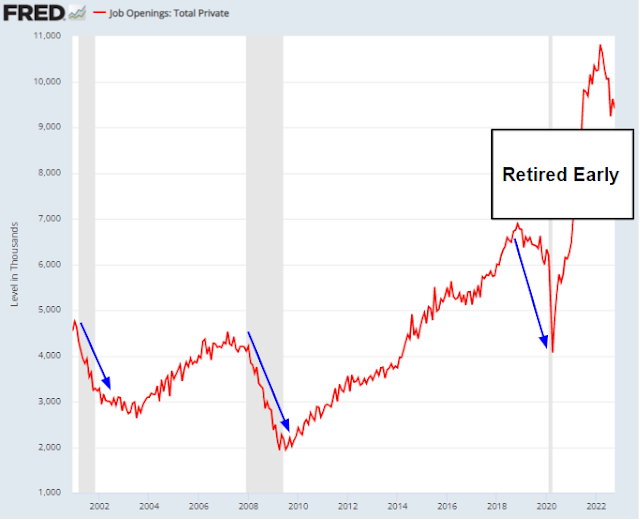

Powell indicated the main source of ongoing inflation is the tight labor market which is not expected to weaken markedly any time soon. The labor market mismatch is primarily due to two million early retirements that occurred during the pandemic. Ironically, due to high stock prices caused by the Fed. Which means that instead of increasing the supply of workers through higher labor participation, the Fed's goal is to reduce the demand for workers. The Fed is of the belief that because job openings are extremely elevated (see below), they can produce a soft landing. However, as we see from the chart, the only way to bring down job openings historically is through recession. Bank of America agrees this is the most likely outcome:

Notably, the Fed never mentioned record corporate profit as a source of inflation. Which I should remind everyone - but mostly the idiots at the Fed - that record corporate profit is AFTER deducting "inflated" employee wages. How could wages be the source of the problem when profits are up 45% in three years?

Here is what BofA has to say about the relationship between jobs, recession, and corporate profits:

"The prospect of negative job growth and a recession probably won’t bode well for the stock market. When the economy contracts, corporate profits usually deteriorate"

Bank of America’s head of U.S. equity and quantitative strategy Savita Subramanian recently said that the S&P 500 is “expensive” and “super crowded.”

Despite all that, BofA sees stocks flat year over year. They predict a mere -10% downside for S&P profits. Below we see how that looks historically. It would be 1/3rd the profit decline of the least worst recessions in 30 years. Despite the fact that the CPI is at the highest level in 40 years. It's all part of the stagflation fantasy now propagated by Wall Street. It's the new permanent plateau of delusion.

Imagine if profits declined a moderate 30% AND stocks declined 30%, that would mean stocks are STILL expensive.

Per the stagflation thesis, stocks are good, bonds are bad, so no surprise we see that retail investor allocation to stocks remains high through November. I am still of the belief that long-term Treasury bonds will substantially outperform stocks on both a relative and absolute basis in 2023.

Per the title of this blog post, I would not be the only unwavering bearish blogger if I did not point out that this will not be a linear process as predicted by Wall Street.

Which is why we must look to the 2015/2018 analogs which were the only two years in the past two decades that featured a December rate hike. And they were both debacles.

I contend that the Santa rally is ALREADY over. It ended a month too soon this year as evidenced by the biggest two month Dow rally in history.

The CNN greed/fear index just flashed its highest reading of 2022. This Dow pattern is similar to last year, except the Dow is peaking a month early. In addition, every spike in the greed/fear index was a rally top in 2022. And of course last December didn't have a rate hike.

Worse yet, we appear to be approaching what Elliott Wave technicians call the "Third wave down". Which means that the decline in the first half of 2022 was the first wave down. The two rallies in the second half were the second wave up. While the waves are not as clear in the S&P 500, the waves are much clearer in this chart of regional banks, which also predicted the 2020 crash. How could banks predict a pandemic? They didn't, the bank chart merely predicted that stocks were about to go down for ANY reason.

In summary, Wall Street doesn't predict black swan events, but they should. Because a market crash is far more likely than stagflation. And when it arrives, the crash will reset all economic and market predictions LOWER for 2023. Which means this market will be STILL over-valued at a lower level and gamblers will be trapped by you know what.

Believe it, or not.

Tuesday, November 29, 2022

MORAL HAZARD DEATH SPIRAL

Sunday, November 27, 2022

COLLAPSE AS USUAL

Archaeologists will have only one question when they dig this failed global empire out of the ruins...what were they thinking?

In this era, disintegration has been normalized. Denial of that fact is democratic self-destruction.

It's been a while since my last rant on humanity, so here goes. I am reading two books at the same time right now, but I'm only part way through both of them. One is "Sapiens: A Brief History of Mankind" by Yuval Noah Harari, and the other is "The Myth of Normal" by Gabor Mate. These are clearly totally separate books by different authors and yet they have much in common. The former book "Sapiens" explains how our current constantly reinvented way of life is merely a blink of an eye in the timeline of human civilization. And the second book explains that we have normalized all of modern society's anti-social behaviours as "normal", which is leading to wholesale mental health meltdown. Both books continually highlight the primary theme that our newfound transactional corporate society is nothing like how human beings lived in the past. As predicted over fifty years ago in "Future Shock" by Alvin Toffler:

"Society experiences an increasing number of changes with an increasing rapidity, while people are losing the familiarity that old institutions (religion, family, national identity, profession) once provided"

The post industrial society will be marked by a transient culture where everything ranging from goods to human relationships will be temporary"

So it is that we live in a disintegrating society beset with rampant overdoses aka. suicides, mass shootings, economic and environmental collapse, and political dysfunction. And yet not one media pundit will draw a straight line from all of that disintegration back to the globalized corporate empire which is using people up at an accelerating pace. The term "myth of normal" is exactly how I would describe this entire globalized delusion, not only at the mental health level but at the macro economic level as well. We have normalized the disintegration of the middle class, which has culminated in this pandemic wealth transfer from the middle class to the ultra wealthy. During the pandemic it was the doubling of the Fed balance sheet to $9 trillion that created the colossal asset bubble, driving record wealth inequality. Interest rates were only lowered 1.5%, a mere 1/3rd of the decrease in 2008. And yet we are to believe that 0% for SEVEN years post-2008 caused 1% inflation, and 0% for two years post-2020 caused 9% high inflation. Sure.

Nevertheless, post-pandemic, the Fed has now TRIPLED short-term rates over where they were during the pandemic while leaving the balance sheet unchanged year over year. At the rate the Fed is slowly reducing the balance sheet, it would take FOUR YEARS to get back to the pre-pandemic level. In other words, this post-pandemic tightening strategy has even FURTHER drastically amplified wealth inequality created by their moronic easing strategy.

Which gets us to the casino.

One of the insights from "Sapiens" is that human beings are the only species that are capable of what the author calls "imagined realities". He asserts that imagined realities are what creates and sustains large scale organizations and empires - because they bring together millions of disparate people under a set of shared beliefs, be those real or imagined. Think religions and nation states.

For some long time readers, the term "imagined realities" is very familiar, because it's the EXACT SAME term hedge fund manager Hugh Hendry used in December 2014 to describe the post-2008 monetary Disneyland. He asserted that quantitative easing could temporarily conjure the illusion of economic recovery in markets. But that inevitably the policy would be overused until markets and the economy exploded at the same time:

"The worse the reality of the economy becomes, the more we take on the reflexive belief in further and dramatic monetary expansion and the more attractive the stock market looks"

Hendry went on to say that as a money manager it was not his job to guess when it would all implode and it was his job to maximize return on capital in the meantime. He lost all of his investors soon after posting that. Shocking, I know.

Back in late 2014, Hendry used the term particularly with respect to Chinese markets, which he predicted in 2015 would experience a tremendous imagined reality.

He was right, it soared. And crashed.

Now, their latest imagined reality is crashing, albeit from a much lower level:

"With China reporting record numbers of Covid-19 cases, more than a fifth of the country’s gross domestic product (GDP) is now under lockdown – on par with the economic impact of Shanghai’s shutdown in April, according to a new report."

In summary, we live in a disintegrating society beset by latent mental health meltdown due to an imploding myth of normal, and now clinging to a 100% Ponzified imagined reality. So it is that bullish pundits look to 2023 and can't imagine what could go wrong. How about everything?

I assert that denial is the ultimate weakness, and the Sapien imperative is to survive and realize this is all in the hands of a higher power. Therefore we must see through these imagined realities before they crash and burn as they have for every other empire in history.

Or drink cheap tequila on the linoleum and give in to total fantasy.

As Darwin theorized, it's a personal choice.